Nymex September Gas Contract Eases as Traders Eye Cooler Weather Outlooks; Northeast Spot Gas Surges

September natural gas prices softened Wednesday as traders gave more weight to cooler weather in the weeks ahead than low storage inventories and the possibility of the lowest injection of the season on Thursday. The Nymex September futures contract settled 1.9 cents lower at $2.94 after spending the day waffling in a tight 3.3-cent band.

Spot gas prices were mixed as a weather system with showers and comfortable daytime temperatures in the 70s and 80s was expected to impact the southern Great Lakes and Ohio Valley during the next few days, while high pressure was forecast to start building into the East Coast, sending daytime highs back into the 90s for the rest of the week and lifting prices there. The NGI National Spot Gas Avg. picked up 2 cents to reach $2.99.

As for futures action, the prompt month held in a tight trading range throughout the day, and only briefly moved into positive territory as low storage stocks remain a concern for the market. Still, weather models began hinting of cooler trends on Tuesday, and those were held in Wednesday guidance, helping to ease traders’ minds that the end of summer — and likely larger storage injections — were just around the corner.

“The weather models after next week still favor very warm to hot high pressure returning over most of the country, just stalling in its arrival by a few days,” NatGasWeather said.

It’s quite possible, however, that additional weather systems continue to find flaws in the upper ridge in time for additional cooler trends over the northern and east-central United States to close out August, it said. Overall, the weather pattern was considered to be neutral, with cooling degree days (CDD) running slightly stronger than normal most days, “just not as impressive as what the data advertised early in the week for the loss of several Bcf in demand.”

Bespoke Weather Services said that it now feels that weather models have mostly picked up on the cool risks it has seen into the end of August, but noted that the long range still may cool more as some weather patterns favor less heat than it did previously. As such, additional CDD losses remain possible.

The Harrison, NY-based weather forecaster said that selling is by far the most intense at the front of the futures strip, “which makes sense given burn loosening and cooler weather, but we would need to see both cash and the winter strip fall back more to expect support to be convincingly broken.”

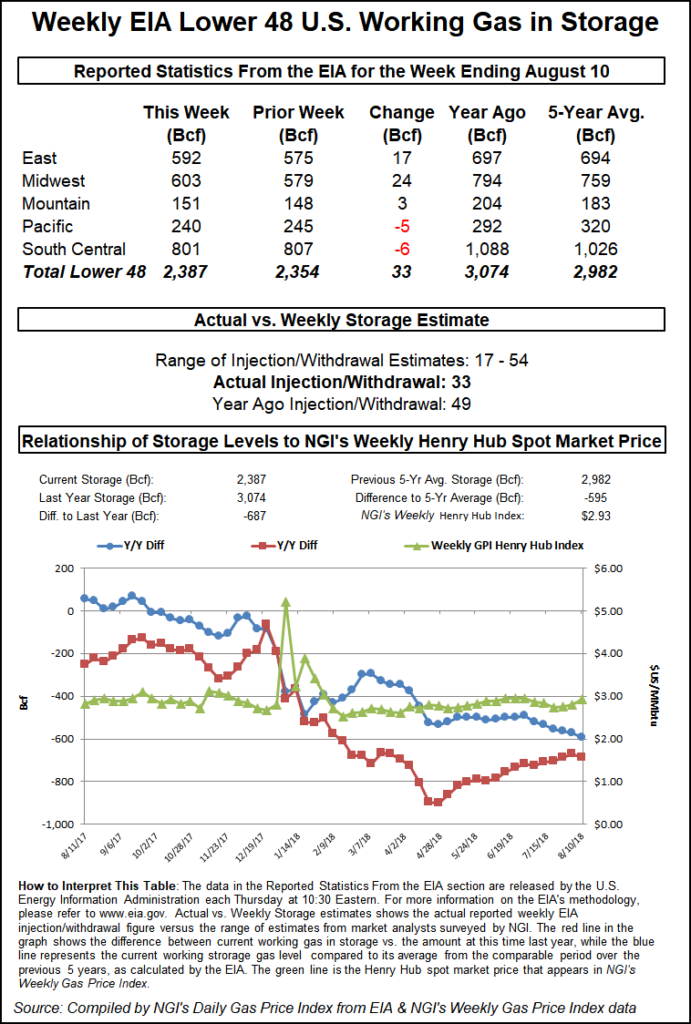

Rather, it sees prices likely to hold around $2.90-$2.92 into Thursday’s Energy Information Administration storage inventory report. Early estimates for this week’s storage report from The Desk ranged widely from 17 Bcf to 42 Bcf, with an average near 31 Bcf and a median of 32 Bcf.

A Bloomberg survey of 17 market participants had a range of 17 to 54 Bcf, with both the average and median pointing to a 29 Bcf injection. A Reuters poll of 20 market participants pointed to an average build of 31 Bcf, with estimates ranging from 24 Bcf to 38 Bcf.

Bespoke projected a 31 Bcf build, while Kyle Cooper of IAF Advisors estimated a build of 29 Bcf, as did EBW Analytics. Intercontinental Exchange settled at 28 Bcf.

A 29 Bcf print would expand the year-over-year deficit to 691 Bcf and increase the deficit to the five-year average to 605 Bcf.

During the similar period last year, 49 Bcf was injected into storage, while the five-year average injection stands at 56 Bcf. As of Aug. 3, Lower 48 gas stocks stood at 2,354 Bcf, 22% below year-ago levels and 19.5% below the five-year average.

The EIA is set to release its weekly storage report at 10:30 a.m. ET on Thursday.

Bespoke said that a print above its expected 31 Bcf build would put $2.85 in play. “Until then, a bounce back towards $2.95-$2.96 short term is a possibility with a firmer strip and weak long-term heat, but risk overall is still a bit lower,” Bespoke chief meteorologist Jacob Meisel said.

On the other hand, technical momentum could propel the September contract higher, particularly if Thursday’s storage injection is below consensus, EBW Analytics said. If this were to occur, “the low $3.00/MMBtu level remains in play,” EBW CEO Andy Weissman said.

If a bullish weather shift or unexpected production dip occurs, prices may even run higher to test resistance as high as $3.12 in a very constructive scenario, he said.

“More likely, however, is that over the next two weeks, upward momentum will fizzle as hot weather fades and market focus recenters on production growth. In this scenario, prices could fall to retest support at $2.85/MMBtu near term as bulls take profits and bears reestablish short positions,” Weissman said.

Looking ahead, EBW said that projections for the next two EIA storage weeks are noticeably missing above-normal demand in Texas, or most of the gas-heavy Gulf Coast. “If forecasts hold, weakening power sector demand in these key demand-driving regions may lessen upward pressure” on Nymex gas prices.

In addition, declining temperatures that are normal with the end of summer are likely to erode power sector demand. Although the end of summer is clearly known, the extent of declines coming off last week’s heat surge is steepened. “Further, by one month from now in mid-September, daily national cooling demand is forecast to fall to below 4 CDDs/day,” Weissman said.

Northeast Gas Spikes on Heat, Pipe Work

A ridge of high pressure was forecast to return to the East Coast, sending temperatures soaring back into the 90s for the next several days in major Northeast cities stretching up the Atlantic Seaboard and past New York City. The heat wave is expected to bring a swing back to strong national demand, with the West and southern United States also remaining hot with daytime temperatures forecast to reach the 90s and 100s, according to NatGasWeather.

The most dramatic increases in the Northeast were seen at New England’s Algonquin City-gate, where next-day gas shot up 79 cents to $4.14 as two concurrent maintenance events were expected to begin Thursday on the Algonquin Gas Transmission (AGT) mainline.

AGT is scheduled to conduct an outage between the Stony Point and Southeast compressor stations (CS) at the same time it plans to conduct pigging operations from the Lambertville meter to the Hudson River, just past the Stony Point compressor, according to Genscape Inc. For both events, capacity through the Stony Point CS will be limited to 810 MMcf/d for Thursday and Friday.

Stony Point implied flows (including no-notice) have averaged 1,242 MMcf/d and maxed at 1,346 MMcf/d during the last 30 days, meaning this event could impact up to 536 MMcf/d of mainline flows, Genscape said. “As Stony Point is the main constraint point for the AGT mainline, this event presents significant upside risk to Algonquin Citygate prices and downstream demand,” Genscape natural gas analyst Josh Garcia said.

Meanwhile, there are also several meter specific supply limitations affecting interconnects with Tennessee Gas Pipeline (TGP), Millennium Pipeline, Columbia Gas Transmission, Iroquois Gas Transmission System and Texas Eastern Transmission, all of which are upstream or near the Stony Point CS. Supply points downstream of Stony Point, including the Everett liquefied natural gas facility, the Salem Essex interconnect with Maritimes and the Lincoln and Mendon interconnects with TGP, will be relied on heavily, Garcia said.

AGT also declared an operational flow order (OFO) on Tuesday, and compounding the issue on the power side is the loss of a transmission line from Hydro Quebec on Aug. 10, which caused a loss of 500 MW of imports to Independent System Operator New England (ISONE), and the loss of about 400 MW of generation from the Pilgrim Nuclear Power Station in Southeast Massachusetts as of Tuesday, Genscape said.

According to Genscape, ISONE hit its price cap the last time a line from Hydro Quebec went down. Hot weather forecast for the region was adding even more upside risk. As of Wednesday, ISONE forecast 23.1 GW of peak demand on Thursday, which is essentially 23.6 GW with the loss in imports, Genscape said.

“This would be a top-5 demand day” year to date, although ISONE’s peak demand forecasts have not materialized recently, Garcia said.

Meanwhile, Algonquin prices have not blown during past events, but those had mitigating circumstances. Algonquin conducted similar outages in April 2017 but Algonquin traded at $3.67 and $3.16 respectively, compared to an average of $3.17 for that month. During those events, however, there was a steep drop off in heating demand that muted demand, Genscape said.

This past June, Algonquin conducted a similar mainline outage on its Southeast CS that would have impacted around 300 MMcf/d of implied flows, but it was rescheduled from June 19 to June 21 to avoid a heat wave and a simultaneous OFO, and the event was completed early. Algonquin Citygate cash basis spiked 50 cents in anticipation for the June event, “but that hardly constitutes a blowout,” Garcia said.

With Algonquin Citygate trading above $4, generation on the pricier Portland and Maritimes pipelines might clear, as well as coal plants that have been offline since early July, Genscape said.

Algonquin has a history of rescheduling events at the last minute, but this event has already been rescheduled from April 2018. Should this event go forward, it will serve as a small sample to predict the larger Stony Point to Oxford outage currently scheduled for late September. “That outage is expected to have greater impact on flows, a much longer duration and concurrent scheduled nuclear outages at the tail end of the event,” Garcia said.

Other notable gains in the Northeast occurred at Tennessee zone 6 200L, where spot gas jumped 74 cents to $4.03.

Regional prices in Appalachia barely budged day to day, and the same story played out across the Midwest and Louisiana as well. Benchmark Henry Hub rose 3 cents to $3.01.

Despite lingering hot weather in California, SoCal City-gate next-day gas dropped nearly 90 cents to $7.89. Malin was down 8 cents to $2.75, while Northwest Sumas in the Rockies was down 2 cents to $2.70.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |