Infrastructure | E&P | NGI All News Access

A Tale of Two Fleets: U.S. Adds 13 Rigs, Canada Loses 14

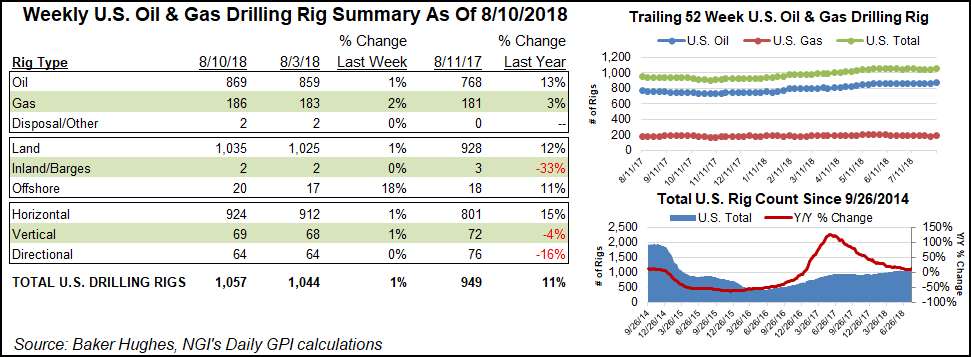

The United States added 13 rigs in the week ended Friday, 10 of them oil and three natural gas, according to data from Baker Hughes, a GE company (BHGE).

The United States ended the week at 1,057 rigs, compared with 1,044 rigs a week earlier. That total included 869 oil rigs, 186 gas rigs and two “miscellaneous” rigs, according to BHGE. Last year, the number of active U.S. rigs stood at 949.

Ten land rigs were added for the week, while three went to work in the Gulf of Mexico. A dozen horizontal units and one vertical were added to the fleet, according to BHGE.

At the same time, Canada’s number were moving in the opposite direction, falling 14 rigs week/week (w/w) to 209 rigs. The combined North American count fell by one w/w to 1,266, but still up significantly from 1,169 at this time last year.

Among plays, the largest increase for the week occurred in the Permian Basin, which added five rigs to finish at 485, compared with 377 a year ago. One rig each was added to the Granite Wash, Haynesville and Utica formations.

Meanwhile, single rig declines were reported in the Arkoma Woodford formation and the Barnett, Eagle Ford and Marcellus shales.

Among states, the biggest increases were seen in Louisiana (six) and New Mexico (five). Alaska and Oklahoma each picked up two rigs, while single rigs were added in California and Ohio. Three states — Arkansas, Kansas and Pennsylvania — each lost one rig.

The rig report came during a week where both natural gas and crude prices enjoyed gains. With help from some late-session buying, September natural gas rallied for a sixth straight day on Thursday to close at $2.955. Meanwhile, September crude futures are still comfortably above the $60/bbl mark. The contract opened Friday morning approximately 41 cents higher than Thursday’s close at $67.22/bbl.

The industry continues to face uncertainty from an escalating trade war. On Thursday, China was preparing to impose a 25% tariff on $16 billion worth of domestic imports, but not on crude oil or liquefied natural gas (LNG). The announcement came one day after the Trump administration unveiled a similar tariff on a range of Chinese goods.

U.S. Trade Representative Robert Lighthizer’s office last Tuesday released a list of 279 Chinese products that would be subject to a 25% tariff beginning on Aug. 23. USTR had originally proposed in June levying the tariff on 284 products, including “gas supply or production meters,” which could impact oil and gas producers. The meters were on the final list.

China’s list of 333 American-made goods subject to the retaliatory tariff includes a variety of energy products including liquefied petroleum gas, oil shale, propane, butane, diesel and fuel oils, but it excluded crude oil. Also noticeably absent was LNG, which appeared on a list the Commerce Ministry recently released in response to the Trump administration’s threat to slap a 25% tariff on $200 billion worth of Chinese goods.

Since May 1, the United States has imposed a 25% tariff on steel and a 10% tariff on aluminum imported from China. The trade war widened in mid-June after the White House enacted a 25% tariff on a host of other Chinese goods, including parts for offshore oil and natural gas drilling and production platforms. After Beijing vowed to retaliate in July against a 10% tariff on $200 billion worth of Chinese goods, the White House increased the tariff to 25%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |