Rising Natural Gas Demand Drives Wisconsin Utilities Results

Milwaukee-based utility holding company WEC Energy Group Inc. cited stronger natural gas sales among the major factors driving its net income in the second quarter.

During a earnings call last week to discuss second quarter results, CEO Gale Klappa said “a stronger economy across the region” has resulted in slightly higher demand for energy from industrial customers. He also cited the start of construction of a $10 billion manufacturing campus in Wisconsin by Foxconn Technology Group, which WEC is involved in, considered a poster child for the success of the the Trump administration’s economic policies.

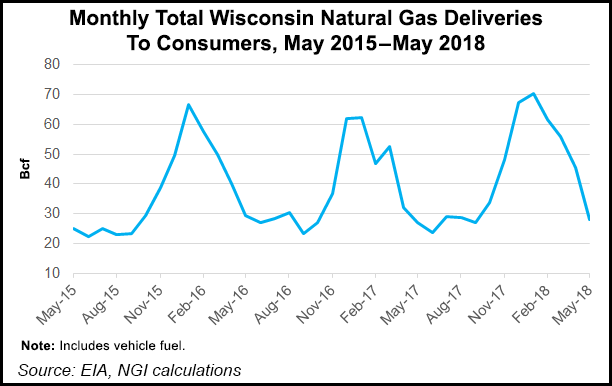

Klappa told analysts that the surge in natural gas demand in recent years is related “to some other trend that we have not seen before.” Over the last three years, WEC’s weather normalization data is showing some interesting statistics, he said.

“Our two-and-a-half years of weather normalized data are showing real continued growth in gas deliveries and customer use of natural gas,” Klappa said. “The next quarter, we were up another 3.7% and then another 3.7%. So 2016 and 2017 turned out to have 3.7% growth on a weather-normalized basis.”

Klappa said it is difficult to determine whether the trend will continue, but “clearly the trend has exceeded our expectations. When you look for a main focal point, it is not just one sector driving the added demand for gas; every sector we looked at was green, and everyone was showing significant increases.”

The demand growth comes at a time when WEC’s utilities are experiencing substantial customer growth, with 15,000 more natural gas customers than a year ago. In the long-term, this might influence capital spending, Klappa said, noting the utilities have requested strengthening the gas network in the Racine, WI, area.

“We’re beginning other work in areas where we don’t have a strong enough gas network to handle demand,” Klappa said. “That’s another $140 million of capital investments that wasn’t in our previous forecast.”

WEC reported net income of $231 million (73 cents/share) in 2Q2018, compared with $199.1 million (63 cents) in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |