E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | Permian Basin

Dallas Fed Sees Mixed Energy Signals as Drilling, Permit Applications, Output Plateau

Energy indicators are mixed, but there’s a positive overall picture for the industry, the Dallas office of the Federal Reserve Board (Fed) said in its monthly report.

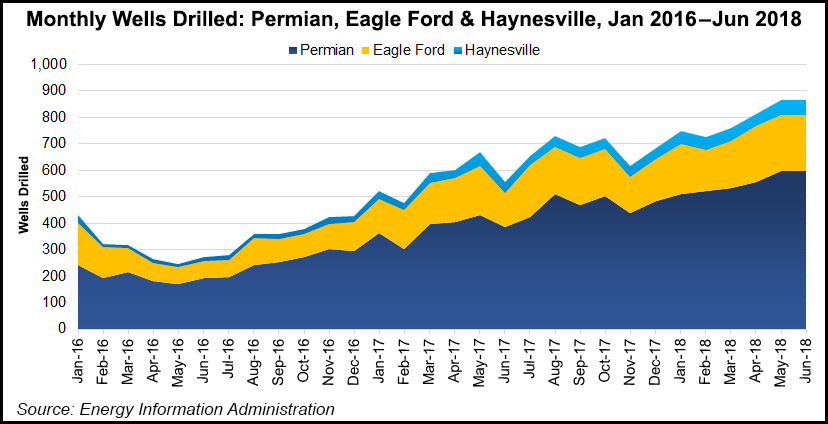

The Dallas Fed, which issues Energy Indicators every month, covers economic activity in Texas, northern Louisiana and southern New Mexico, which translates into the Permian Basin, Eagle Ford and Haynesville shales.

“Drilling, well permit applications and production numbers have all plateaued in recent weeks,” economists said. “However, mining jobs are still growing in Texas despite steep discounts on crude priced in West Texas, and exports of crude, petroleum products and liquefied natural gas (LNG) are rising.”

Drilling in Texas basins leveled off in June and July, driven in part by the impact of pipeline constraints, economists said.

“The rig count was essentially flat from June to July in the Permian Basin at 477 rigs, as it was in the Eagle Ford at 81 rigs. Texas overall saw a modest dip of nine rigs (seven oil and two natural gas) from June to July as drilling outside the state’s two main shale plays softened.”

Seasonally adjusted permit applications, which tend to lead changes in the rig count, leveled off over the first quarter before declining slightly over the second.

“This suggests that drilling activity will remain cool in the coming months,” according to the Dallas Fed.

Henry Hub natural gas prices, which the Dallas Fed said are “increasingly a global benchmark” because of rising LNG exports from Texas and Louisiana, dropped slightly to $2.79/Mcf in July.

“Summer power demand is unlikely to move benchmark pricing, with gas production rising in the Haynesville and with associated gas…pouring out of Texas shale,” economists said. “However, West Texas Waha hub gas prices did inch up to $2.17 in July, narrowing the spread with Henry Hub from its 2018 high in June of nearly $1 to an average of 62 cents in July.”

The Nueva Era and El Encino-Topolobampo natural gas pipelines in Mexico went online in June with a combined capacity of 1.2 Bcf/d, which “grants Texas improved access to Mexican consumers and may be partly responsible for the increase in Waha gas prices relative to Henry Hub,” economists said.

Meanwhile, a production outage in Canada reduced flows to the oil hub at Cushing, OK, lifting West Texas Intermediate (WTI) crude prices there, “but the price rise did not pass through to barrels priced in the Permian Basin due to ongoing pipeline constraints.”

WTI priced in Midland declined to $57 in July. The average spread between Midland and global benchmark Brent rose by about $2, to $17.52.

“After U.S. crude oil production growth paused in April, output fell slightly from 10.5 million b/d in April to 10.4 million b/d in May,” economists noted. “That’s the first month-over-month decline since January 2018, and it was largely due to seasonal factors. Monthly Texas crude oil production has also been essentially flat, with a very slight increase to 4.2 million b/d in May. Texas now produces 40.6% of U.S. crude oil.”

Jobs-wise, Texas mining employment, which includes oil and natural gas, logged gains over the second quarter, but it was mostly in the oilfield services sector. Support activities for mining grew by 11,100 jobs, an annual rate of 33.2% from March to June. The extraction sector overall saw more modest growth of 940 jobs, or 4.9% over that time period.

Oil and natural gas jobs outside of Texas have grown more slowly, with extraction employment nationwide rising at an annual rate of nearly 2.6% (460 jobs) between April and June, while U.S. support activities employment excluding Texas grew an annualized 19.8% rate in February to May.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |