E&P | NGI All News Access | NGI The Weekly Gas Market Report

President-Elect López Obrador to Shut Down Fracking in Mexico

Mexico’s incoming president, Andrés Manuel López Obrador, said his administration will put an end to hydraulic fracturing, or fracking, in the country.

“We are no longer going to use this method to extract oil,” López Obrador, known by his initials AMLO, told local reporters in response to a question about possible risks of the unconventional oil and gas drilling practice.

The declaration exacerbated already-growing uncertainty over López Obrador’s energy sector plans, and cast further doubt over an oil and gas bid round that authorities recently postponed for a second time, to February 2019 from September 2018.

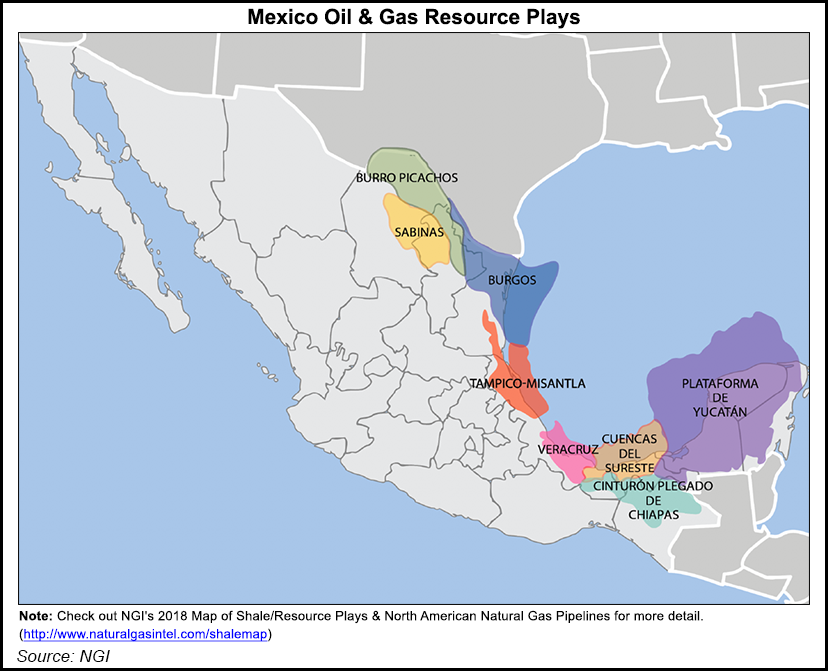

The tender, known as Round 3.3, aims to award nine blocks targeting unconventional resources in the prolific Burgos Basin, the largest source of non-associated gas in Mexico, whose shale potential is thought to rival or exceed that of the Eagle Ford shale play across the border in Southeast Texas.

Although national oil company Petróleos Mexicanos (Pemex) has experimented with horizontal drilling and fracking in the past, shale production is not yet a reality in Mexico, and faces challenges on multiple fronts.

Round 3.3 is part of a series of auctions conducted by the Comisión Nacional de Hidrocarburos (CNH) under the framework of a constitutional energy reform passed in 2013 that liberalized the formerly state-dominated hydrocarbon and electric power industries.

López Obrador, who will take office December 1, last Friday announced his picks for energy secretary and undersecretary, as well as for the chief executive positions at national oil company Petróleos Mexicanos (Pemex) and state electric utility Comisión Federal de Electricidad (CFE).

All four would-be appointees have criticized the reform and expressed support of Pemex and CFE being the central players in the energy sector, as has historically been the case.

Pemex, meanwhile, is the only firm that has signed up so far to participate in Round 3.3.

At a CNH meeting on Tuesday, the same day as AMLO’s anti-fracking comments, officials presented an update on Round 3.3, for which eight firms have formally expressed interest, four have accessed the data room, and five have been authorized to pay the sign-up fee.

Commissioners made no mention of any plans by the incoming government to restrict unconventional drilling. Pemex did not immediately respond to an emailed request for comment.

Exploitation of Mexico’s shale resources is seen as a vital component to reducing the country’s dependence on natural gas imports over the long-term. The country currently relies on imports for about 70% of its gas consumption needs, according to CNH.

López Obrador said last Friday that his government will aim to boost nationwide oil production to 2.5 million b/d from 1.9 million b/d currently by increasing Pemex’s exploration and production budget.

López Obrador’s comments follow the approval by CNH of a development plan submitted by Italian oil company Eni for three shallow water discoveries in Mexico’s Campeche bay.

Development capital expenditure for the Amoca, Miztón and Tecoalli discoveries will total an estimated $1.9 billion, Eni said in a statement, adding that from 2021, it expects a production plateau of 90,000 b/d oil from a floating storage, production and offloading (FSPO) vessel.

Eni said it expects to take a final investment decision in 4Q2018 for Area 1, which holds an estimated 2.1 billion boe in place (90% oil).

Eni won operatorship of Area 1 by way of a production-sharing contract with Pemex through the Round 1.2 bidding process in 2015.

In addition to Area 1, Eni holds operating interests in Area 7, Area 10, Area 14, Area 24 and Area 28. All of this acreage is located in the Sureste Basin, where Eni said it plans to drill two exploration wells in 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |