Newfield Raises Full-Year Guidance on Strong Domestic, Anadarko Basin Production in 2Q

Stronger-than-expected domestic production during the second quarter, including from the Anadarko Basin, prompted Newfield Exploration Co. to raise its full-year production guidance for both and announce plans to spend an additional $50 million on capital expenditures (capex) in 2018.

The Woodlands, TX-based company reported domestic production of 186,700 boe/d in 2Q2018, a 32.4% increase from the year-ago quarter (141,000 boe/d) and above the company’s guidance of 172,000-180,000 boe/d. Newfield’s domestic production of crude oil (74,000 b/d), natural gas (422 MMcf/d) and natural gas liquids (NGL) (43,000 b/d) all beat their respective guidance.

Similar results were seen in the Anadarko Basin, where total production was 131,100 boe/d in 2Q2018, a 48% increase over the year-ago quarter and a 12% increase sequentially (117,000 boe/d). Crude oil production in the Anadarko met guidance for the quarter (42,000 b/d), but natural gas (304 MMcf/d) and NGL (38,000 b/d) production eclipsed their estimates.

In response, Newfield raised its full-year domestic production guidance to 180,000-190,000 boe/d, up from 175,000-185,000 boe/d. The company also raised its full-year production guidance in the Anadarko to 125,000-135,000 boe/d, up from 120,000-130,000 boe/d. Newfield estimates that it will exit 2018 producing 42,000 b/d of crude oil from the Anadarko Basin.

“In the Anadarko Basin, we expect that our net oil production will average 42,000-44,000 b/d in the second half of the year,” CEO Lee Boothby said during an earnings call to discuss 2Q2018 on Wednesday. “The range encompasses the inherent drilling completion and production timing uncertainties that exist with our large multi-well development patch.”

The company reported 21,000 boe/d of production in the Williston Basin in 2Q2018, followed by 20,700 boe/d in the Uinta Basin and 13,900 boe/d in the Arkoma Basin.

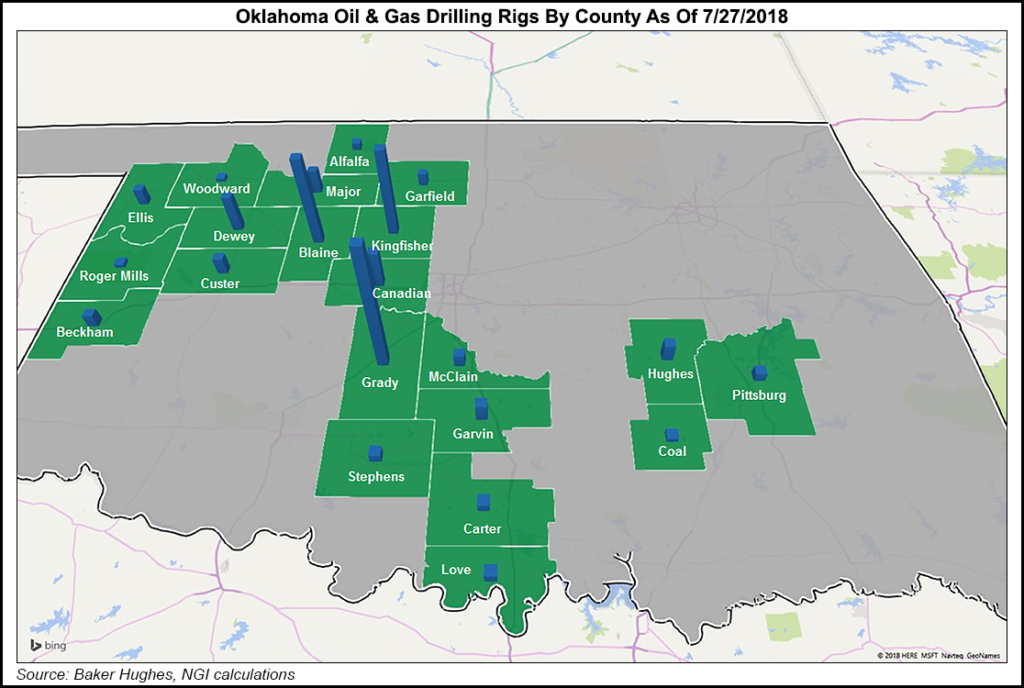

Newfield highlighted progress with its Sycamore, Caney, Osage, Resource Expansion (SCORE) initiative in the northwest part of the STACK (aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) play in Oklahoma, where it holds about 24,000 net acres.

Specifically, the company reported that two wells drilled in northeast Dewey County, OK, in the northwest part of the STACK — Jake 1H-21X and Hyden 1H-17X — had initial 30-day production rates of more than 1,500 boe/d. Newfield had 13 operated rigs deployed during 2Q2018 — 11 in the Anadarko, one in the Uinta and one in the Williston.

In the northwest STACK, Boothby said Newfield is “producing well above the type curve that we’ve historically generated.

“Right now we’re drilling unbounded held by production wells. That program will be completed in the first half 2019, and then we’ll make some decisions about how we progress in the infield development. I suspect we’ll see that in 2019. And at that time, we will see some adjustments in that type curve, as they will come down as we’ve seen in several of the other plays.”

‘Very Little Impact’ on Drilling From OK County Ban

Boothby and COO Gary Packer used the earnings call as an opportunity to weigh in on a dispute over produced water in Kingfisher County. Last month, the county’s commissioners enacted a ban on temporary pipelines in existing rights-of-way to take produced water from oil and gas drilling sites.

“The Kingfisher County Commissioners do not have the legal authority to regulate produced water,” Boothby said. “Oklahoma law is pretty clear: Regulatory oversight of those activities in Oklahoma rests with the Oklahoma Corporation Commission. As a result, we are optimistic the Oklahoma courts will strike down the ban.

“We believe the produced water recycling that we’ve invested in, the infrastructure to move more around, makes a lot of sense for the industry, our company, the state and local citizens.”

Packer said Newfield has so far invested about $80 million in infrastructure to handle produced water.

“We see this as a big issue for the local community. It’s less of a big issue for Newfield because of the investments we’ve made,” Packer said, adding that promoting recycling and minimizing truck traffic “we think is the right thing for the community and the environment. It’s really going to have very little impact, if any at all, on our drilling programs.”

The company bumped its full-year capex budget to $1.35 billion, up from $1.3 billion, on increased working interest and non-operated activity in high-return projects.

Newfield reported net income of $119 million (59 cents/share) in 2Q2018, compared to net income of $98 million (49 cents) in the year-ago quarter. The company said earnings were affected by an unrealized derivative loss of $78 million, coupled with an $8 million legal settlement. With those adjustments, net income for 2Q2018 would have been $189 million (94 cents).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |