September Natural Gas Futures Slide on Production, Cooler Weather

September natural gas prices retreated for a second day Wednesday as cooler-trending weather fanned out any remaining flames left after bearish production data was reported Tuesday by the Energy Information Administration (EIA). Spot gas prices were mixed amid mostly comfortable weather on tap in the near term, save for parts of the West. The NGI National Spot Gas Average was $2.85, up 7 cents on the day.

It was a slow trading day Wednesday as prompt-month futures briefly reached a $2.788 high and then fell to a $2.7521 intraday low before ultimately settling at $2.758, down 2.4 cents on the day.

The latest weather data held cooler trends from Tuesday with a weather system tracking across the U.S. Midwest and Northeast Aug. 8-10, and was also a touch cooler going into mid-August, thus seen cooler trending overall as it shed several cooling degree days (CDD), NatGasWeather said.

More specifically, a weather system with showers and cooling is forecast to sweep across the Midwest and east-central United States during the next few days, but then is expected to fizzle out late in the week as it runs into upper high pressure building across the East Coast off the Atlantic Ocean. Meanwhile, it is expected to remain very hot over the West with highs reaching the 90s to as much as 115 degrees, making for strong regional demand, the forecaster said.

Hot high pressure is expected to expand across most of the country this coming weekend into next week, aside from the northwestern United States, resulting in a return to strong national demand as highs reach the upper 80s to 100s.

Beyond next week, a weather system is expected to weaken the ridge over the Midwest and Northeast Aug. 8-10, dropping highs into the 70s and 80s as showers sweep through for lighter demand; this is where the latest weather data during the last 24 hours has shown cooler trends, NatGasWeather said.

“The weather data had been bouncing between warmer and cooler trends Aug. 11-15, but has been a little cooler more recently. It’s still expected to be a very warm pattern Aug. 11-15 as upper high pressure rebounds to dominate most of the country with highs of 80s to 100s, just slightly less impressive compared to what the data was showing early in the week,” the forecaster said.

In addition to the cooler weather outlooks, the market appears to still be digesting Tuesday’s EIA monthly production report, which was a third straight bearish report from the agency. The EIA reported that in May, dry natural gas production increased year over year, the 12th consecutive month it has done so.

The preliminary level for dry natural gas production in May was 2,491 Bcf, or 80.4 Bcf/d, which was 8.6 Bcf/d (12.0%) higher than the May 2017 level of 71.8 Bcf/d. The average daily rate of dry natural gas production for May was the highest for any month since EIA began tracking monthly dry production in 1973.

Meanwhile, Genscape Inc. said Lower 48 production closed July with a “solid recovery” from some late-month disruptions to lift the month’s final average to record highs. Its daily pipeline production estimate has July closing out at a daily average 80.27 Bcf/d. The month’s single-day high of 80.97 on July 4 established the all-time record.

The monthly average was nearly 1.18 Bcf/d greater than June’s average, driven primarily by about 0.5 Bcf/d of gains out of the Northeast and the Gulf of Mexico, “the latter being a product of restoration of volumes from a handful of offshore platforms,” Genscape senior natural gas analyst Rick Margolin said.

At this point, production this summer-to-date is averaging 79.15 Bcf/d, almost exactly 7 Bcf/d greater than last year’s summer-to-date average. On a regional basis, the largest summer-on-summer gains are led by more than 3.85 Bcf/d of summer-on-summer growth in the Northeast, followed by 1.44 Bcf/d of growth in the Gulf Coast region and more than 1.1 Bcf/d of growth in the Permian.

“Add to this volumes produced in Western Canada, which are running more than 15.42 Bcf/d, a 0.73 Bcf/d increase on last summer to date,” Genscape said.

The only areas to report a summer-on-summer decline have been the Midcontinent, San Juan and the West (excluding Rockies), Genscape said. Its latest production forecast expects sustained growth through the summer and the rest of year, with the summer-on-summer surplus expected to further widen, “driven by completion of maintenance events and gas and oil forward curves continuing to indicate additional deployment of rigs,” Margolin said.

As for pricing action in the near term, NatGasWeather continues to “view $2.70 as strong support bears would like to take out, while bulls need to clear $2.80 to convincingly regain momentum,” NatGasWeather said.

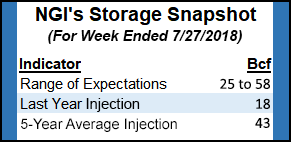

Which end of the recent trading range gets tested might not be known until the results of Thursday’s EIA weekly storage report, “where expectations are for a build near the five-year average of 43 Bcf, keeping deficits stalled around 557 Bcf.”

Kyle Cooper of IAF Advisors is projecting a 40 Bcf build, while a Bloomberg survey had a range between 25 Bcf and 58 Bcf, with the median response of survey participants coming in at 43 Bcf. Intercontinental Exchange settled at 43 Bcf.

Some 18 Bcf was injected into storage inventories for the similar week in 2017, and the five-year average stands at 42 Bcf.

California Prices Hit $10 as Region Bakes

Turning to the spot gas market, California markets continued to strengthen as weather forecasts show temperatures in much of the state remaining well above average for most of the month. Highs in Los Angeles are expected to remain in the upper 80s to low 90s on most days throughout August; this compares to a seasonal average in the mid-80s.

Given the pipeline import restrictions, as well as limitations on storage, gas prices have been volatile for much of the summer, and Wednesday was no exception. SoCal Citygate next-day gas averaged $9.74 after trading in a range between $8.90 and $10.

Meanwhile, AccuWeather’s fall outlook shows the hot and dry conditions lingering across the greater Southwest early in the season.

“There could be some extreme temperatures in September for the Desert Southwest from Phoenix on westward,” said AccuWeather’s Paul Pastelok, expert long-range weather forecaster.

These conditions will keep the threat for fires high before October brings a turnaround to cooler weather. Meanwhile, dryness and dangerous fire conditions will continue for California.

“It looks like a really bad year for them,” Pastelok said.

Rockies prices were mixed as Northwest Sumas dropped 7 cents to $2.32 and Northwest Wyoming Pool climbed 6 cents to $2.49. Opal jumped jumped 12 cents to $2.58.

In the Midcontinent, receipts from production-related facilities in Enable Gas Transmission’s West 1 and 2 pooling areas posted a dramatic 717 MMcf/d day/day plunge, to 157 MMcf/d on Wednesday (Aug. 1) from 874 MMcf/d on Tuesday (July 31), Genscape said. The last seven-day average was 845 MMc/d.

“While some of the reported declines may be getting exaggerated by typical first-of-month production nomination peculiarities, the drop on Enable was somewhat expected,” Genscape said.

Enable’s aggregated West 1 and 2 pooling areas imbalance is typically positive (indicating a surplus of receipts) and has recently averaged 671 MMcf/d, which represents eastbound flows along Line AD which then enter into the Neutral Pooling area, Genscape natural gas analyst Allison Hurley explained.

Imbalance for Aug. 1 is currently negative, at 8 MMcf moving westbound. Estimated eastbound flows through the Chandler compressor station are at 210.6 MMcf/d for Aug. 1, which is down around 660 MMcf/d compared to the previous seven-day average of 870.8 MMcf/d, according to Genscape.

Line AD, west of the Allen compressor station, is expected to remain isolated until the planned maintenance is completed on Thursday, Hurley said.

Enable East next-day gas rose a penny to $2.70.

Over in West Texas and southeastern New Mexico, Waha spot gas prices shot up 14 cents to $2.23, while El Paso-Permian spot gas tacked on 6 cents to $2.16. The stark increases were likely due to a reported explosion midday Wednesday on Kinder Morgan Inc.’s El Paso Natural Gas System, outside Midland, TX. The company issued a force majeure on its line 3130 shortly thereafter, citing a “third-party incident.”

Benchmark Henry Hub lost a couple of cents to hit $2.80.

Meanwhile, some parts of the Northeast posted stout day/day gains despite comfortable conditions in the region as weather systems with showers and thunderstorms were forecast to track across the Midwest and east-central United States during the next few days.

Algonquin Citygate next-day gas rose 18 cents to $3.08, while Transco Zone 6-NY next-day gas climbed just a penny to $2.92.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |