E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon’s Volumes Top Guidance, Drive by Permian, STACK

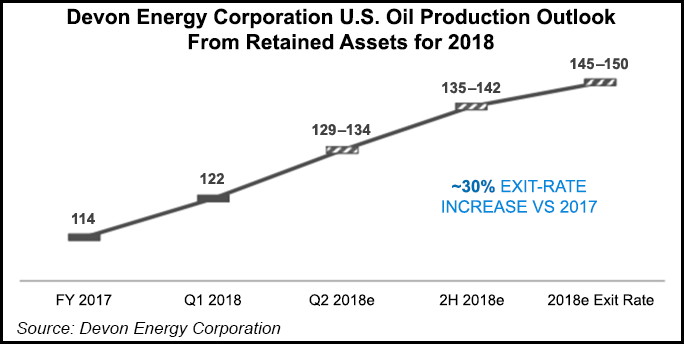

Devon Energy Corp.’s light oil production surpassed the high end of guidance in the second quarter, nearly all attributed to the Permian and Anadarko basins.

The Oklahoma City-based independent today focuses on the Permian Delaware sub-basin and Oklahoma’s STACK, aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties. Light-oil production in the United States averaged 136,000 b/d, a 12% sequential increase and 2,000 b/d above the top end of guidance.

“With the strong well productivity we’ve achieved year to date in the U.S., light-oil production growth is on track to advance 16% in 2018, which is 200 basis points above our original budget expectations. We expect to deliver this improved outlook without any increase to our planned activity, and this disciplined investment program positions us to generate substantial amounts of free cash flow at today’s market prices.”

Devon in early June also monetized its majority stake in the EnLink midstream business, allowing the producer to begin a share repurchase program for up to $4 billion.

The strongest asset-level performance during the quarter was from the Delaware, where oil production increased 54% year/year and which drove total volumes in the play to 79,000 boe/d. Devon’s top 10 wells in the quarter averaged initial 30-day rates of about 3,000 boe/d.

In the STACK, total output was up 26% year/year, with oil production jumping 41%. Net oil output from Canada, where Devon is developing some oilsands projects, averaged 109,000 b/d. Overall, company wide production averaged 541,000 boe/d.

One area Devon is keying on is the marketing and “flow assurance” to move most of its U.S. production to Gulf Coast markets, said COO Tony Vaughn.

“Specifically, in the Delaware Basin, we have been able to price protect 90% oil volumes through firm transportation and attractive regional basis swaps,” he said. “From a flow assurance perspective…we have contractual guarantees to flow 100,000 b/d through our legacy firm sales agreements that extend well into the next decade.

“All in all, these physical and financial swaps in the Delaware will allow us to maintain price realizations near that of West Texas Intermediate pricing.” Flow assurance also is well positioned in the STACK, he said.

“Through firm transportation on the market length pipeline, approximately 75% of our oil volumes have direct access to premium Gulf Coast pricing. Also, we have firm transport agreements covering the vast majority of our gas production in the STACK. Coupled with basis swaps, we have effectively protected the price on the majority of our gas volumes.”

With the completion of the EnLink sale, combined with other minor asset sales to date, total proceeds have reached $4.2 billion. Devon expects to monetize an additional $1 billion of “minor, noncore assets” across the United States by year’s end. Packages to be marketed include undeveloped leasehold in the southern Delaware sub-basin, enhanced oil recovery projects in the Permian’s Midland sub-basin and in the Rockies, along with Wise County, TX, acreage in the Barnett Shale. Data rooms are open for most of the packages.

Upstream revenue, excluding commodity derivatives, totaled $1.6 billion in 2Q2018, a 15% improvement from the first quarter on improved price realizations. Also contributing to the improving price realizations were firm transport and marketing agreements of which the majority provide direct access to Gulf Coast markets.

“Combined with the price protection provided by regional basis swaps, second quarter oil realizations in the U.S. averaged approximately 98% of the West Texas Intermediate (WTI) benchmark,” management noted. “Importantly, the company is positioned to maintain these strong U.S. oil price realizations through the end of the decade.”

In Canada, Devon alo continues to benefit from Western Canadian Select (WCS) basis swaps on about 50% of its estimated oil production in 2018. The WCS basis swaps are locked in at $15 off the WTI benchmark price and have generated cash settlements of $109 million year to date.

Devon also demonstrated its efficiency at managing operating costs in the second quarter.

Production expense, which represents field-level operating costs, totaled $572 million, with lease operating expense (LOE) and transportation, at $493 million. Taxes contributed $79 million to production expense.

The U.S. resource plays delivered the strongest cost performance, where LOE and transportation costs declined 3% on a per-unit basis from the first quarter. In Canada, production expense was impacted by $21 million costs associated with maintenance work at the Jackfish complex.

“Overall, the benefits of higher-margin oil production, improved price realizations and a lower cost structure resulted in expanded margins for Devon,” said management. “Field-level cash margin reached $20.19/boe in the second quarter, a 31% increase compared to the year-ago period.”

Field-level cash margin is computed as upstream revenues, excluding commodity derivatives, less production expenses with the result divided by boe production volumes.

Further expanding profitability is an improving general and administrative (G&A) cost structure. Upstream-related G&A expenses totaled $153 million, a 22% sequential improvement, which was driven by reduced personnel expenses.

The company reported a net loss in 2Q2018 of $425 million (minus 83 cents/share), versus year-ago profits of $219 million (40 cents). Excluding adjusted one-time items, core earnings in 2Q2018 totaled $177 million (34 cents/share). Upstream revenue fell to $1.069 billion from $1.332 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |