Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Nexus Natural Gas Pipeline 80% Completed, Says DTE

Construction of Nexus Gas Transmission LLC’s 1.5 million Dth/d Appalachian takeaway pipeline is 80% complete, with mainline welding 100% complete, according to the company.

“It is a long-term project that will help grow this business segment for many years to come, and we are very encouraged by forecasts of future production in the basin served by Nexus,” CFO Peter Oleksiak said during a recent conference call with analysts.

“The pipe is located in one of the most prolific dry gas basins in the country. Basin production capacity is expected to grow significantly from 28 Bcf/d to 40 Bcf/d by the end of the next decade. Forecasters are also predicting that the basin will be short takeaway capacity in the very near future…We have enough volume under discussion to fill the pipe, so this pipe is clearly needed and well-positioned.”

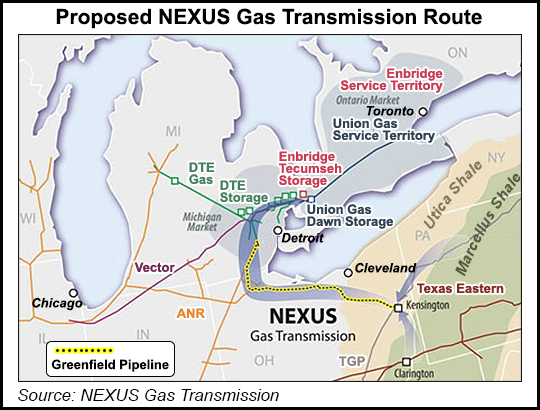

FERC issued a certificate last August authorizing Nexus to proceed with the 255-mile pipeline, which is designed to connect Marcellus and Utica shale production to markets in the Midwest and Canada. In the same order, FERC issued certificates for several related project applications, including Texas Eastern Transmission LP’s (Tetco) 950,155 Dth/d Texas Eastern Appalachian Lease (TEAL) Project, designed to interconnect with Nexus in Columbiana County, OH. FERC also authorized Nexus-related capacity agreements proposed by DTE Gas Co. and Vector Pipeline LP.

Nexus, like Rover, represents a major source of takeaway capacity for Appalachian gas to move east-to-west out of the basin. The $2.1 billion project proposes constructing around 209.8 miles of 36-inch diameter pipeline through 13 counties in Ohio and 46.8 miles of 36-inch diameter pipeline through four counties in Michigan.

The project would also involve four new compressor stations in Ohio’s Columbiana, Medina, Sandusky and Lucas counties.

Last month, the Federal Energy Regulatory Commission cleared Tetco to start construction on the second and final phase of TEAL, a Northeast expansion designed to connect with the Nexus Gas Transmission pipeline.

Nexus and TEAL are both slated for service in the third quarter of this year.

Nexus’ board recently approved a $250 million expansion of its Link Lateral and Gathering system in northern West Virginia and southwestern Pennsylvania, and the company is evaluating acquisition opportunities “roughly the size of Link,” Oleksiak said.

“We have multiple assets under consideration and we are in detail evaluation phase of one asset in particular. As I’ve said before, when talking to investors about potential acquisitions, we are very disciplined in our approach. We’re focused on assets that fits strategically in our GSP [gas storage pipeline] portfolio, and keep our business mix where we like it.”

Nexus parent DTE Energy Co. recently received approval from the Michigan Public Service Commission on the certificate of necessity filed last year for a $1 billion natural gas-fired power plant it wants to build in St. Clair County.

DTE reported 2Q2018 operating earnings of $247 million ($1.36/share), compared with 2Q2017 operating earnings of $191 million ($1.07/share).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |