Hess Loyalty to Bakken Remaining Steadfast

Even in the midst of increased prospects for profit growth overseas, New York City-based Hess Corp.’s narrowing U.S. onshore portfolio remains firmly tied to its assets in the Bakken Shale in North Dakota, senior executives said Wednesday.

Proceeds from a sale in the Utica Shale are to be ploughed back into the highest-return assets, which are split between offshore Guyana and the Bakken, CEO John Hess said during a conference call to discuss second quarter results.

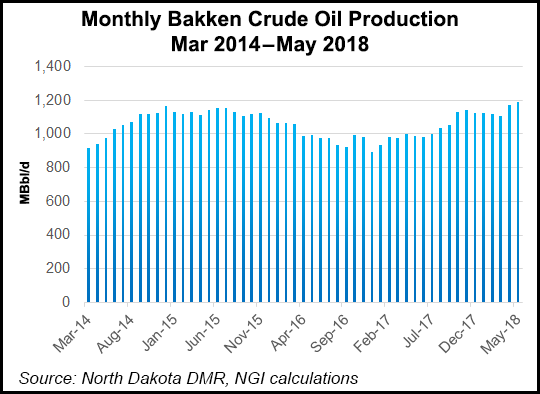

Global production in 2Q2018, excluding Libya, totaled 247,000 boe/d, including 114,000 boe/d in the Bakken, compared to year-ago production of 237,000 boe/d.

North Dakota continues to be the producer’s largest holding at more than 500,000 net acres, the CEO said. As reported earlier this year, the company plans to deploy a fifth rig in the Bakken by the end of September and a sixth one by the end of the year. A third hydraulic fracturing crew is soon to be added.

A comprehensive Bakken study this year also should be completed to determine the best drilling methods moving forward, including its heavily touted plug-and-perforation (perf) technology.

“We continue to see encouraging results from our pilot of limited-entry plug-and-perf completions,” COO Gregory Hill said.

Regarding the reported 24-40% initial performance improvement on the plug-and-perf wells, the company does not plan to raise its production guidance volumes in the Bakken until it has more data.

“With the improved completion techniques, we’re doing our completion study to optimize our investment in the Bakken,” Hess said. “We’ll be ready to share the results of that study around the end of this year. We hope we can give more specificity and clarity to what our future production rates might be in the Bakken.”

The company plans to have up to 40 plug-and-perf wells completed this year, with 25 online. Hess plans to have 40 wells online in Keene, ND, but only seven would be plug-and-perf wells.

In the second quarter, Hess drilled eight wells and brought 27 online. For the full year, the company expects to drill about 120 wells and bring 95 online, assuming a sixth rig is in operation by the end of the year.

For 2Q2018, Hess recorded a net loss of $130 million (minus 48 cents/share), compared with a net loss in the year-ago period of $449 million (minus $1.46). Exploration and production capital was $525 million for 2Q2018, nearly flat from a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |