Markets | Mexico | NGI All News Access | NGI The Weekly Gas Market Report

June Mexico Natural Gas Prices Steady; Trade Volumes Rise

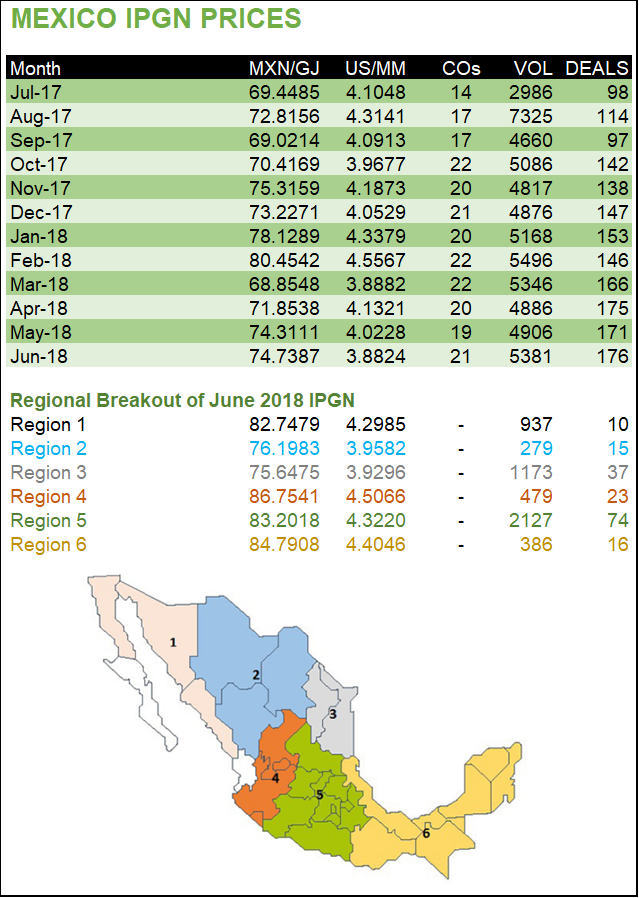

Natural gas prices in Mexico held steady during June, averaging 74.739 pesos/gigajoule (GJ) or $3.882/MMBtu, versus 74.311 pesos/GJ in May, authorities said.

The total volume of natural gas traded rose to 5.38 Bcf/d from 4.91 Bcf/d, according to the government’s July natural gas price index, i.e. IPGN.

In dollar terms, prices rose in trading regions 2, 3, 4 and 6, while falling in regions 1 and 5. Region 1 includes the northwestern states of Baja California, Sonora and Sinaloa, while region 5 covers the country’s densely populated central region, including Mexico City.

The IPGN, published by the Comisión Reguladora de EnergÃa (CRE), is a compilation of regional indexes derived from monthly post-transaction reports that all gas traders must file. Gas transactions in Mexico are typically priced using U.S. benchmarks Henry Hub, Houston Ship Channel or Waha, plus transport costs.

In peso terms, prices rose in all regions except region 1. This region also saw the largest increase in volume traded, to 937 MMcf/d from 738 MMcf/d.

June saw the entrance into operation of TransCanada Corp.’s $1.2 billion, 348-mile El Encino-Topolobambo pipeline, a vital link for supplying gas from the Permian Basin in West Texas and southeastern New Mexico to Sinaloa on Mexico’s Pacific coast.

A June analysis by consultancy RBN Energy highlighted that Mexico’s state electric utility CFE has converted to natural gas-fired units two formerly diesel-fired power plants in Sinaloa with capacities of 300 MW and 320 MW. CFE currently is building two combined-cycle gas turbine plants in the state with 700 MW of capacity each.

The entrance into operation of the TransCanada pipeline and the Sinaloa power plants could ease downward pressure on gas priced at the Waha hub in West Texas, RBN analysts said. Waha has been trading at nearly a $1/MMBtu discount to gas priced at the Henry Hub in Louisiana.

The widening spread between Waha and Henry Hub has followed looming constraints on Permian takeaway capacity amid ballooning onshore gas production, the U.S. Energy Information Agency (EIA) said recently.

“Two pipelines — Comanche Trail and Trans-Pecos — were completed in 2017 to export Permian natural gas to Mexico,” EIA said. “Although these pipelines have a combined takeaway capacity of 2.6 Bcf/d, they are not expected to see significant flows until late 2018 or early 2019 when downstream pipeline infrastructure in Mexico enters service.”

Mexico has 3,152 kilometers (1,959 miles) of pipeline projects under construction that all together total an estimated $7.37 billion of investment. All of the projects are officially slated to come online this year, the SecretarÃa de EnergÃa (Sener) said in a gas pipeline status report published Thursday.

Trade volumes rose in four of the six regions in June, while falling in regions 4 and 6. Region 4 includes the states of Zacatecas, Jalisco, Colima and Aguascalientes in the central-southwest, while region 6 covers the Yucatán peninsula in the southeast, an area that has suffered from gas supply shortages.

Marketers reported 183 total transactions, versus 179 in May. The CRE screened out seven atypical transactions before calculating the indexes.

Regions 5, 3 and 1 accounted for a combined 78.7% of total volume traded. Region 3, which covers the northeastern states of Nuevo León and Tamaulipas, is adjacent to the Eagle Ford Shale, which runs from South Texas into Mexico.

In addition to the TransCanada pipeline, the $609 million Nueva Era pipeline system, a joint venture between Howard Energy Partners and Grupo Clisa, entered operation in June. The system transports gas from the Eagle Ford to Nuevo León state in trading region 3.

The highest average gas price for June, at $4.507/MMBtu, was reported in region 4. The lowest average price, at $3.93/MMBtu, was in region 3.

Since the current government took power in 2012, Mexico has added 4,639 kilometers (2,883 miles) of gas pipelines to the national network, the Sener report said, up from 3,392 kilometers (2,107 miles) reported in the May report. The report said pipelines in operation currently traverse just under 16,000 kilometers (9,941 miles).

Sener had previously forecast that the national pipeline network would be approaching 20,000 kilometers (12,427 miles) by 2018, but social opposition and technical challenges have delayed or scuttled some pipeline proposals.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |