Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Alberta, BC Producers Demand TransCanada Mainline Toll Cut

After nearly a year of depressed natural gas prices, producers in Alberta and British Columbia (BC) are demanding a C$1.14 billion ($910 million) toll cut on TransCanada Corp.’s Mainline.

Rates would drop 17-36% on segments of the cross-country pipeline over a three-year period, from 2018 to 2020, if TransCanada refunds a windfall in over-collections since 2014, according to the Canadian Association of Petroleum Producers (CAPP).

“This case is a good news story,” distributor Centra Gas Manitoba Inc. told the National Energy Board (NEB) in support of the CAPP request. “TransCanada has more than C$1.1 billion of shippers’ money in the bank, and the board need only decide how it should be fairly returned.”

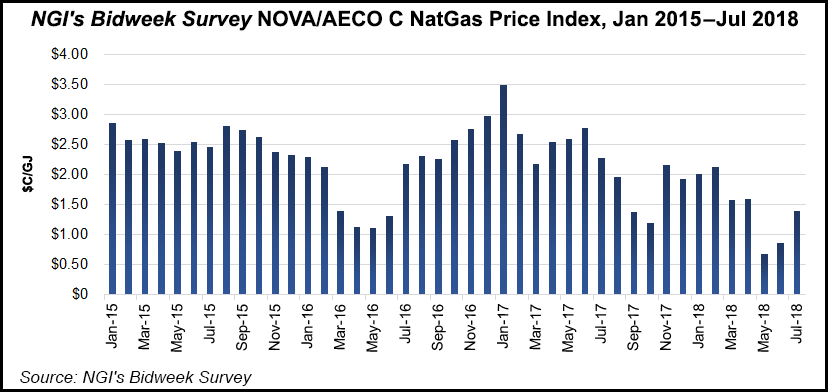

The action counters a price slump that began early last autumn because of maintenance and construction that interrupted traffic on TransCanada’s Alberta and BC supply collection grid, Nova Gas Transmission Ltd. (NGTL).

Although traffic resumed at increased volumes last winter after completion of NGTL’s work, production growth overtook facilities additions. Average prices continue to be undermined by a persistent supply glut, market records kept by the NEB indicate.

Alberta’s Nova Inventory Transfer benchmark fell by 24% to C$1.56/gigajoule (GJ) ($1.31/MMBtu) in the first six months of 2018, down from C$2.06/GJ ($1.73/MMBtu) over the same period in 2017, according to the NEB.

The cash that CAPP and Centra want refunded sits in the Long Term Adjustment Account (LTAA), a self-insurance device created following a 2013 toll settlement between TransCanada and its Mainline shippers. CAPP said the deal miscalculated toll effects of sales competition between Western Canadian production and gas supplies from the eastern United States. The mistake resulted from worst-case scenarios for cross-country deliveries of Alberta and BC gas to Ontario, Quebec and export connections into the United States.

While market shares have evolved, combined traffic from both countries stayed higher than expected across the TransCanada system. “The actual revenues for the 2015-2017 period have proved dramatically different, with the Mainline collecting materially greater revenues than had been forecast,” CAPP said.

For the Western Canadian Sedimentary Basin “to continue to compete for its historically traditional Canadian and U.S. markets, tolls must be as competitive as possible. The continued long-term deferral of over C$1 billion of over-collected revenues for the 2018-2020 period decreases the competitiveness of the WSCB in these markets.”

TransCanada has to date resisted calls to part with the LTAA, which acts as a shield against rapid and unpredictable market changes liable to affect tolls and services.

U.S. natural gas exports to Canada, about 2.4 Bcf/d to date this year, are the same as in first-half 2017, NEB records show. A recent survey by the Canadian Energy Research Institute estimated continuing modifications to cross-border pipeline links could enable U.S. exports to grow to 5 Bcf/d.

Centra pointed out that TransCanada forecasts, drawn from demand for NGTL and Mainline services, show the pipeline and shippers expect Alberta and BC supplies to stay competitive with U.S. gas producers. The distributor cited the forecast driving a multi-year, C$7.4 billion ($5.9 billion) NGTL facilities addition program. The projections foresee Alberta and BC production rising steadily by 40% to 17.3 Bcf/d as of 2030, up from 12.4 Bcf/d today.

“This bodes well for Mainline contracting and revenue, as the Mainline has the most available capacity on which WCSB export volumes can flow,” Centra said. The NEB review of TransCanada’s tolls and shipper demands for a deep cut continues.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |