Markets | NGI All News Access | NGI Data

SoCal Swings Higher on Heat as Weekly Natural Gas Spot Market Mixed

Price blowouts in Southern California headlined natural gas spot trading for the week ended Friday, while more comfortable temperatures helped send prices lower throughout the Midwest and East; the NGI Weekly National Spot Gas Average added 2 cents to $2.72.

It was pandemonium in SoCal Citygate during the week, with above-normal temperatures in Southern California driving up gas-fired electric generation demand and pushing the constrained market to its limits. SoCal Citygate jumped $5.18 to average $10.37, including trades as high as $20.00.

Meanwhile, points in the Midwest and East moderated as analysts noted milder temperatures tamping down cooling demand across those regions. Chicago Citygate gave back 5 cents to $2.66, while Transco Zone 5 fell 15 cents to $2.84.

In Appalachia, the return of service on Leach XPress following a June explosion helped lift weekly prices in the region. Dominion South climbed 15 cents on the week to $2.39, while Texas Eastern M2 30 Receipt added 20 cents to $2.41.

Natural gas futures pulled back slightly during an uneventful session Friday, with prices stable one day after rallying close to a nickel on bullish government storage data. The August Nymex futures contract settled at $2.757 Friday, down 1.2 cents on the day after trading in a narrow range from $2.784 to $2.758. August finished slightly above the $2.752 settle from the Friday before but down from Monday’s open of $2.765.

Midday Global Forecast System data Friday came in “a little cooler overall,” losing a few cooling degree days (CDD), according to NatGasWeather. Guidance continued to show systems bringing milder temperatures to the Midwest and east-central United States over the next two weeks, with the western, central and southern parts of the country expected to remain hot.

“Longer term, it’s up to hotter patterns gaining momentum in early August, or weather sentiment will be viewed as neutral,” the firm said, noting that guidance “would likely need to be bullish to justify a sustained rally.”

Still, a bullish surprise from the Energy Information Administration’s (EIA) weekly storage report on Thursday suggested “hefty deficits are going to take longer to replenish than the markets were pricing in, making any hotter trends over the weekend or early next week important if they were to occur.”

EIA’s weekly natural gas inventory report served up a clear reminder that even as production growth has dominated the market’s thinking as of late, it hasn’t made a dent in storage deficits — yet.

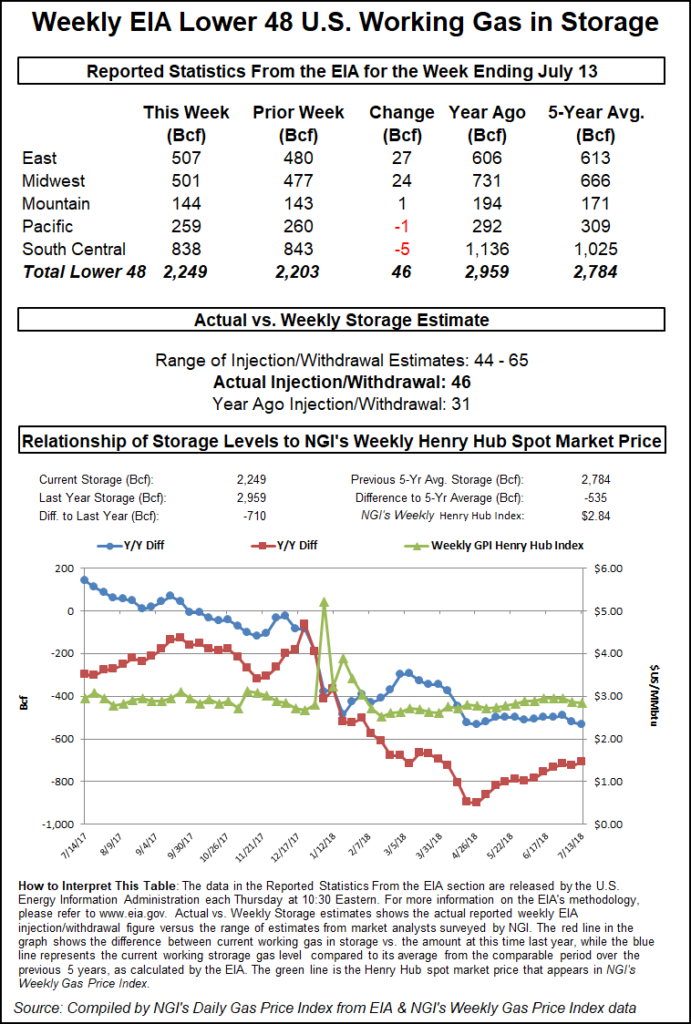

EIA reported a 46 Bcf injection into Lower 48 gas stocks for the week ended July 13, roughly 10 Bcf below consensus estimates based on major surveys. The build also fell below the five-year average 62 Bcf injection. Last year, EIA recorded a 31 Bcf build for the period.

With Thursday’s report marking the second straight week that injections have lagged the five-year average by a wide margin, the bears — firmly in control heading into the session largely because of surging production — seemed to concede that they had gone too far given the risks posed by large inventory deficits.

The number, released at 10:30 a.m. ET, immediately sparked a rally for the prompt month, with prices popping to $2.750-2.760 after languishing down around $2.710 earlier in the morning.

By 11 a.m. ET, the August Nymex futures contract was trading around $2.770, up about a nickel from Wednesday’s settle.

Prior to the report, surveys showed the market looking for a build closer to 55 Bcf. A Bloomberg survey of traders and analysts had produced a median 56 Bcf build, with a range of 44 Bcf to 65 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures had settled Wednesday at an injection of 54 Bcf.

Bespoke Weather Services said this week’s figure came in “a whopping 15 Bcf below our expectation. This indicates that there was significantly more holiday in the print last week than expected, and that the natural gas market is materially tighter” than previously thought.

“This appears due both to power burns that have tightened markedly over the past few weeks as well as production that has pulled back from record highs (and may potentially be overestimated),” Bespoke said. “Unimpressive forecasts could limit how far prices have to run off this bullish print, but we had already been watching for a test of $2.80 that appears more likely following a print that should make the market care more about demand again.”

Total working gas in underground storage stood at 2,249 Bcf as of July 13, versus 2,959 Bcf last year and five-year average stocks of 2,784 Bcf, EIA said. Week/week, the year-on-year deficit narrowed from 725 Bcf to 710 Bcf, while the year-on-five-year deficit grew from 519 Bcf to 535 Bcf, EIA data show.

The lean implied flow for the period included net withdrawals in the South Central and Pacific regions. In the South Central, an 8 Bcf pull from salt offset 3 Bcf refilled in nonsalt for the week, according to EIA. The Pacific saw a withdrawal of 1 Bcf. The East and Midwest regions saw the bulk of the injections on the week at 27 Bcf and 24 Bcf, respectively. In the Mountain region, 1 Bcf was injected.

“If production continues at the same year/year (y/y) growth rate as June (up 8.1 Bcf/d) for the remainder of the refill season, we estimate that the season will end with storage at 3.5 Tcf (about 6% below average),” Jefferies LLC analysts said following EIA’s report.

“For storage to reach 3.8 Tcf, we estimate that production would need to average roughly 10 Bcf/d higher y/y for the remainder of the refill season (this would imply production averaging around 83 Bcf/d, well above current levels). In these scenarios, we assume power demand of plus 2.0 Bcf/d y/y, hold exports flat with recent levels, and assume no y/y changes in residential/commercial or industrial demand.”

Analysts with Tudor, Pickering, Holt & Co. (TPH) said the report indicated the market was about 1.0 Bcf/d undersupplied on a weather-adjusted basis for the period.

“With around 17 weeks of injection season left, inventories would enter withdrawal season below five-year minimums (about 3.6 Tcf) if the market averaged around 2.0 Bcf/d oversupplied until November,” the TPH team said. “Despite a bullish print, outlook remains neutral,” as even with the prospect of increasing exports to Mexico on the El Encino-Topolobampo pipeline, “cooling temperatures and the impending Northeast production ramp temper our expectations.”

Based on degree days and normal seasonality, Genscape Inc. analysts Margaret Jones and Eric Fell said the 46 Bcf build indicated the market is about 1.0 Bcf/d tight versus the five-year average.

“Relative to the previous week, total power generation was down about 21 average GWh,” they said. “Collectively, nuclear and renewable gen were down about 10 average GWh week/week (w/w), with wind down almost 10 average GWh and hydro and solar both down about 1 average GWh.”

Nuclear generation “was up about 2 average GWh. Coal was down an estimated 7 average GWh w/w, and gas generation was down about 1 average GWh for an estimated 0.6 Bcf/d less gas burn w/w.”

Looking ahead, The Desk’s Early View storage survey Friday showed 16 respondents on average anticipating a 39.1 Bcf build from EIA’s report scheduled this coming Thursday (July 26) for the week ending Friday (July 20). The survey produced a range of 30 Bcf to 50 Bcf. Last year, EIA recorded a 19 Bcf injection, while the five-year average is a build of 46 Bcf.

In the spot market Friday, the mercurial SoCal Citygate extended its run higher ahead of more heat expected in California, while points throughout the Gulf Coast and Texas saw modest gains; the NGI National Spot Gas Average added 3 cents to $2.71/MMBtu.

SoCal Citygate added another 68 cents to an already elevated average as hot temperatures in the region were expected get even hotter after the weekend. SoCal Citygate finished the day Friday averaging $14.04, the highest the location has traded since prices there averaged $19.58 on February 20.

Suggesting just how razor-thin the margins have become for a market dealing with ongoing supply constraints to pipelines and storage, the prospect of a little more than 3 million Dth/d of demand Monday for the Southern California Gas Co. (SoCalGas) system, based on the utility’s forecast, was all it took to drive the higher prices in trading Friday. Total system receipts have been capped at around 2.6 million Dth/d.

SoCalGas and San Diego Gas & Electric Co. said a system-wide curtailment that ended Friday would be reinstated starting Monday (July 23) because of high temperatures and an increase in demand for natural gas-fired electric generation.

Radiant Solutions was calling for Burbank, CA, to rack up the CDDs during the upcoming week, with highs climbing from the upper 80s Friday into the mid to upper 90s by Monday. Highs were expected to approach triple digits Tuesday and Wednesday, according to the forecaster.

SoCal Citygate cash prices during the week set a new summer record for the location, topping the highs reached during a heatwave last October, according to Genscape senior natural gas analyst Rick Margolin.

“Demand on the SoCalGas system has touched 3 Bcf/d for the first time this summer due to above-normal temperatures, hydro output entering its seasonal downturn and issues with importing electrons forcing gas-fired generation inside the market to spool up,” Margolin said. “This also comes as limitations on importing gas and accessing storage remain in place.”

The recent volatility in Southern California has also spilled into August forwards. In trading Thursday August fixed price forwards jumped more than 20% day/day to average $7.759, according to Forward Look.

Elsewhere in the region, SoCal Border Average gave up 38 cents to average $3.35 Friday, while El Paso S. Mainline/N. Baja fell 23 cents to $3.77.

“A weather system will track through the Midwest the next several days with showers and thunderstorms, while a second system tracks north up the Atlantic Coast for lighter demand,” NatGasWeather said Friday. “A majority of the nation’s demand will continue to be driven by extreme heat over the western, central and southern U.S., focused from California to Texas as highs reach the upper 90s to 115 degrees.

“The data remains quite warm over the East Coast” early in the week ahead, “seeing high pressure build in off the Atlantic with highs of upper 80s to near 90 degrees returning to major Northeast cities,” the forecaster said. “However, a strong weather system and cool shot is favored into the Midwest midweek and then into the East after and where the pattern just isn’t hot enough to impress.”

The Electric Reliability Council of Texas Inc. (ERCOT) has continued to see record-setting demand during what has been a blistering heat wave. The grid operator said it set a new all-time system-wide peak at 73,259 MW Thursday afternoon, topping the record set a day earlier by more than 1,000 MW.

“We are headed as a state into even more extreme temperatures than we’ve seen in the past few days,” ERCOT spokeswoman Theresa Gage said Thursday. “Everyone in the ERCOT market — from our operators to generators to transmission providers to retailers — is doing what they can to keep the power on for customers.”

Radiant was forecasting highs in Dallas over the weekend of around 110 degrees, while Houston was expected to see highs of 101.

The intense heat inspired only modest strengthening for spot prices across the Lone Star State on Friday. In South Texas, Tres Palacios added 7 cents to $2.80, while in East Texas, Katy climbed 2 cents to $2.87.

Nearby in Louisiana,Henry Hub added 4 cents to $2.76, pulling even with prompt month futures.

Maintenance on the Gillis Compressor, expected to restrict about 0.5 Bcf/d of capacity on the Creole Trail Pipeline in the upcoming week, could impact deliveries to Cheniere Energy Inc.’s Sabine Pass liquefied natural gas terminal, according to Genscape analyst Josh Garcia. The work is scheduled to run from Monday to Wednesday, he said.

“Feed gas deliveries to Sabine from Creole Trail have a month-to-date (MTD) max of 1.24 Bcf/d but have only averaged 1.05 Bcf/d in that time frame, although they have been slightly elevated over the last few days,” Garcia told clients Friday. “Total feed gas deliveries to Sabine have averaged 2.7 Bcf/d MTD as it has not run above nameplate capacity for some time, and maintenance on Creole Trail often corresponds with downstream maintenance at the liquefaction facility, meaning less demand from Sabine’s other upstream points.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |