E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Schlumberger North American Ops Accelerate, but Warns Capacity Constraints to Stall Growth in Permian and Beyond

The world’s largest oilfield services operator Schlumberger Ltd. reported improvements almost across the board during the second quarter for its land and offshore operations, but the CEO warned that supply constraints are looming without more investments by exploration operators.

“The second quarter was both busy and exciting for Schlumberger, as we completed a number of major milestones in preparation for the broad-based global activity upturn that is now emerging,” CEO Paal Kibsgaard said during a conference call Friday from London. “We delivered solid top-line growth both in North America and the international markets, building on our strong contract portfolios and our recent tender wins.

“We mobilized an unprecedented 29 new rigs for our international integrated drilling business, including our first commercial ”Land Rig of the Future’ deployment in Saudi Arabia. We successfully rolled out our new, streamlined operations support organization, building on five years of methodical investment to further professionalize all aspects of our work, which will set new standards for internal efficiency, quality, teamwork, and collaboration…”

Specifically in North America, excluding Cameron, second quarter revenue of $2.5 billion increased 12% sequentially as the company continued deploying additional hydraulic fracturing and directional drilling capacity.

“Despite the impact of the spring breakup in Canada, North America land revenue grew 9%, driven by market share gains and operational efficiency improvements while pricing remained flat,” Kibsgaard said.

In the hydraulic fracturing market, Schlumberger also is are seeing “an accelerating customer trend of separating the procurement of pumping services and sand supply. As our multi-year vertical integration investment program approaches completion, it enables us to bid competitively on integrated or stand-alone sand contracts.”

North America offshore activity also began to recover during the second quarter, with new drilling projects starting up in Eastern Canada, the U.S. Gulf of Mexico and the Caribbean, resulting in sequential offshore revenue growth of 22%.

Executive Vice President Patrick Schorn, who oversees the wells division, shared a microphone to discuss progress. The land revenue increase in North America during 2Q2018 “outperformed both the 7% increase in the U.S. land recount and the 8% improvement in the U.S. land’s fracture market stage count.” In Canada, activity dropped as expected as the spring breakup took effect.

What helped gig North American revenue was a 17% quarterly gain in the pressure pumping revenue of unit OneStim, which increased as more fleets when to work.

“Net pricing remains stable as increasing capacity across the market matched increasing customer activity,” Schorn said. “We were also able to leverage the improved efficiency of our operations to grow revenue and gain market share.”

In particular, investments in vertical integration to support pressure pumping activities “has allowed us to respond rapidly to the increasing customer trend of separating pumping services from sand supply,” he said. “This means that we’re able to bid competitively on both integrated or stand-alone sand supply contracts to participate in the full revenue potential of each, particularly as we add more capability in sand supply on a regional basis.”

The U.S. land drilling market activity also was strong, “with a growing customer interest in integrated well construction services, while demand also remained robust for rotary steerable systems,” Schorn said.

Improving the “definition of responsibilities” between Schlumberger and its customers has led to improved quality and efficiencies, said Kibsgaard. The “performance-based contracting model” gives it freedom to “optimize drilling plans, select the appropriate technologies and continuously innovate in the way we run our operations and create additional value, which is shared with our customers.”

For example, for all of its new drilling projects, Schlumberger is deploying “multi-scaling and remote operations,” which has reduced the overall headcount on the rig side by as much as 35%.

However, mobilizing all of the services needed for the new integrated drilling projects “will leave us with no spare equipment capacity by the end of 2018,” the CEO said.

In anticipation of a shortage in capacity, Schlumberger has begun to engage in “pricing discussions” with many customers to allow it to invest in more equipment.

In the North America land business, for example, even as more fracturing fleets were deployed during the second quarter, pricing remained flat.

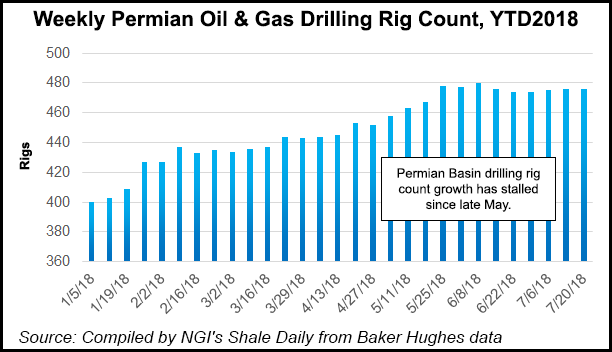

The company is paying particular attention to projected oil and gas takeaway constraints in the Permian Basin. “The rate of permitting and the overall activity levels remain high,” but the constraints “could hamper the activity growth over the coming quarters, which is something we will monitor closely going forward,” said the CEO.

In North America, “the pressure on infrastructure and export pipeline capacity from the Permian Basin is becoming an increasing constraint to production growth, which will likely not be resolved until the second half of 2019.

“The U.S. shale producers are also experiencing production challenges linked in part to well interference as infill drilling in the producing acreage increases and as drilling continues to step out from the Tier 1 acreage.”

In addition, after more than three years of underinvestment by exploration and production (E&P) companies, the international production base has begun to show “accelerating signs of

weakness with noticeable year-over-year production declines in 15 of the world’s producing countries,” Kibsgaard said. “These developments underline the growing need for increased E&P spending, in particular in the international markets, as it is becoming apparent that the new projects coming on line over the next few years will likely not be sufficient to meet the increasing demand.”

Overall, the broader based recovery in the international markets that has eluded the oilfield services sector finally has begun, he told analysts, “which led us to record sequential revenue growth in almost all geomarkets and nearly all product lines in the second quarter.”

One of the growth drivers in the emerging international upcycle is the company’s integrated drilling business, where investments in drilling hardware, fluids and software have created a “well construction platform” that enables it to win a lot of tender work.

“Our tender win rate and backlog increase for integrated drilling projects over the past year is the highest we have ever seen,” said Kibsgaard. “And based on these project wins, we will in 2018 mobilize a total of 90 land rigs, mostly third party, which by itself is equivalent to a mid-sized land drilling contractor.”

As he usually does, the CEO also offered his take on the global oil markets and how Schlumberger expects oilfield activity to unfold.

“The fundamentals of the global oil market continue to evolve favorably for our international business as the balance of crude oil supply and demand tightens further,” he said. “Despite the increase in crude prices, the reporting agencies have not made any changes to their global oil demand forecasts, which still stands at 1.4 million b/d for both 2018 and 2019, while we await further clarity around any potential demand headwinds from the ongoing U.S.-China trade dispute.”

For the third quarter, Schlumberger anticipates a broader based international recovery to continue, with sequential growth driven by Russia, Asia, Latin America and the Middle East, with nominal sequential growth in Europe and Africa.

“In North America land, we do not presently see any impact on the established activity outlook, and we plan to continue to deploy additional fracturing and drilling capacity while we closely monitor the evolution of the market ready to adjust as needed.”

Schlumberger earned $430 million net (43 cents/share) in 2Q2018, down from $525 million in 1Q2018 but a turnaround from the $75 million loss in the year-ago period. Revenue jumped 11% year/year and 6% sequentially to $8.3 billion, driven mostly by gains in the North American OneStim unit. Pre-tax operating margins increased by 75 basis points (bp) to 13%.

Reservoir characterization revenue during the second quarter climbed 5% sequentially to $1.6 billion, with margins increasing 166 bp to 21.4%. Drilling revenue of $2.2 billion increased 5% sequentially, while margins decreased 83 bp to 12.9%. Production revenue of $3.3 billion increased 10% sequentially, with margins up by 239 bp to 9.7%.

Schlumberger generated $1 billion of cash flow between April and June, while net debt rose $600 million to $14.6 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |