E&P | NGI All News Access | NGI The Weekly Gas Market Report

Global E&P Spending Outlook Improving, with U.S. Onshore Budgets Tweaked Higher

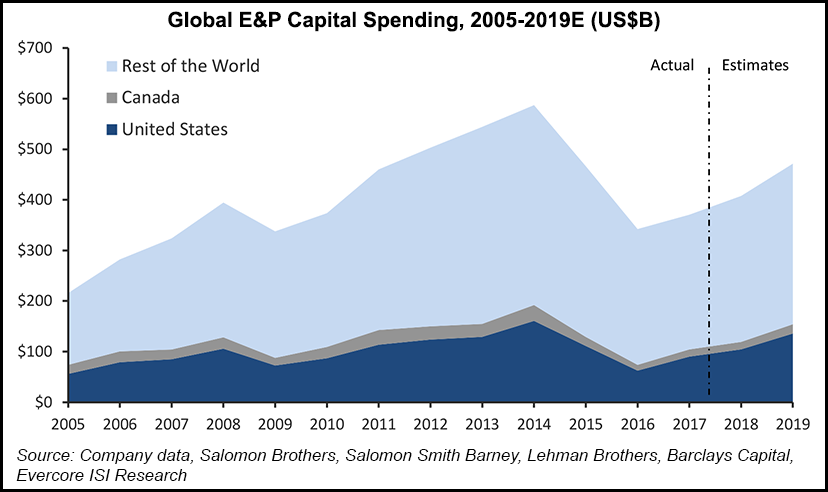

Global exploration and production (E&P) expenditures are predicted to increase 10% this year following an 8% hike in 2017, with North America’s shale and tight plays, especially the Permian Basin, serving as the “epicenter” for the recovery.

U.S. capital expenditures (capex) are predicted to be up 16% over 2017, versus a 15% estimate from a survey of operators completed last December, according to The Evercore ISI Global E&P Mid-Year Spending Outlook.

Since Evercore’s initial survey, momentum has continued to build, with 2018 marking the first time in three years that global E&P capex are forecast to climb above $400 billion.

“From a trough of $340 million in 2016, we project total spending will increase by a net 19% to approximately $408 billion,” said Evercore senior managing director James C. West. “However, capex remains more than 30% below the 2014 peak — highlighting the enduring detriment of the 2015-2016 downturn.

“If global spending continues to recover at the current rate, the 2014 peak could be reached by 2022. We believe it will arrive sooner as spending accelerates.”

Evercore had predicted a 7% gain in worldwide capex this year from 2017. The upward revisions reflect a 310 basis point (bp) improvement from the survey completed late last year. The “magnitude” of the capex increase remains underwhelming considering the trajectory in oil prices, West said.

“It’s interesting to note that not only did the percentage growth rate improve relative to our initial forecast, but there was also an upward adjustment (3%) to our 2017 spending estimate. Our revised 2018 global capex estimate thus represents a 13% increase relative to our initial estimate for 2017 spending.”

Evercore’s spending outlook is the culmination of six months of collecting data from a variety of sources and fine-tuning estimates. Analysts initially surveyed about 300 oil and gas companies worldwide about their 2018 spending intentions in late 2017 and published the first outlook in December. The second wave of data gathering concluded in late June.

North America (NAM) onshore plays, particularly the Permian, are serving as the centerpiece for global capex recovery, according to Evercore.

“However, we continue to forecast NAM capex increasing by about 14% in 2018, relatively unchanged from our initial forecast,” West said. “We expect U.S. capex to increase by about 16% in 2018, an 80 bp improvement from our December forecast.”

Evercore had forecast U.S. E&P capex would improve by around 15% over 2017, with Canada capex rising 9%.

The increase in U.S. capex expectations is offset by a downward revision in Canada, where capex now is expected to only gain by 3%, “as takeaway capacity constraints and unfavorable oil price differentials stave off incremental capital,” West said.

Overall, it’s the short-cycle investments attracting the lion’s share of incremental upstream investments, according to Evercore. However, analysts warned about the “limits” of shale/tight oil and gas production, which “are clearly being tested….”

West and his colleagues said it has become increasingly clear that a “global, synchronized increase in upstream capital is necessary to address the supply-demand imbalance we envision over the intermediate term.”

Meanwhile, the recovery in international upstream capex has begun and should increase by 8% year/year in 2018, up from Evercore’s previous forecast of 4%. The biggest capex improvements are seen in India, Asia and Australia, up by an average of 14% overall, followed by Russia/Former Soviet Union at 13% and Middle East capex gains estimated at 10%.

“We project spending in Europe to rise by 7% and project a modest 2.5% increase in Latin America,” West said. “Africa is the lone region where we still expect capex to fall in 2018, and we now estimate spending will be down by 8.5% in the region compared to minus 10% previously.”

Analysts expect the major international oil companies to post a moderate increase in capex this year, which would arrest a multi-year decline and represent an about-face from Evercore’s prior estimate for spending to decline by 4% in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |