E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Global Natural Gas, Oil Spend Rising, with U.S. Unconventionals Still A Good Bet, Says IEA

Fossil fuel investments increased worldwide last year for the first time since 2014, with U.S. shale/tight oil and gas prospects improving, the International Energy Agency (IEA) said Tuesday.

The IEA’s World Energy Investment outlines trends in energy spending for the upstream sector, electricity, nuclear power, coal and renewables. Global energy investments last year totaled $1.8 trillion, a 2% decline year/year in real terms.

More than $750 billion went to the electricity sector last year while $715 billion was spent on oil and gas supply globally — the second year in a row that electricity investments exceeded oil and gas spending. Renewables investment also declined last year following years of robust growth.

For the U.s. shale and tight oil and gas sector, last year was a positive inflection point, said IEA Executive Director Fatih Birol.

“The United States shale industry is at turning point after a long period of operating on a fragile financial basis,” he said. “The industry appears on track to achieve positive free cash flow for the first time ever this year, turning into a more mature and financially solid industry while production is growing at its fastest pace ever.”

For the U.S. onshore specifically, the global energy watchdog noted that between 2010 and 2014, operators had spent up to $1.8 for each dollar of revenue. However, the industry since has almost halved its breakeven price, providing a “more sustainable basis for future expansion” and underpinning a record increase in domestic light, tight oil production that this year is estimated at 1.3 million b/d.

“One notable trend concerns the relationship between oil prices and upstream costs,” said researchers. “In the past, there has been a roughly linear relationship between upstream costs and oil prices. When price spiked, so did costs, and vice versa.

“What we are noting now is a decoupling. While prices have more than doubled since 2016, global upstream costs have remained substantially flat and for 2018 we estimate those increasing very modestly, by just 3%. Companies appear to have learned to do more with less.”

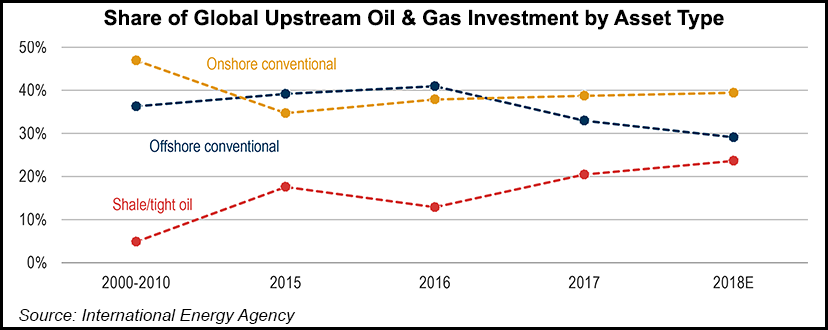

The U.S. onshore oil and gas industry has changed worldwide spending too.

“The oil and gas industry has been traditionally characterized by long-lead times projects with predictable production profiles,” researchers said. “Yet as a result of the shale revolution in the United States, this trend is changing and the industry is re-thinking the way they choose, execute and manage projects.

“Furthermore, investment in conventional assets (responsible for the bulk of supply) remains focused on expansion of existing projects rather than developing new sources of production.

Moving forward, the overall balance of market supply will be given by combination of conventional activities (which respond slowly) and unconventional projects (which respond to market conditions in a much more rapid way) suggesting the possibility of more volatility ahead in the markets.”

Conventional oil project investment, responsible for the bulk of global supply, remains subdued, with spending in new conventional capacity set to plunge this year to about one-third of the total, a “multi-year low raising concerns about the long-term adequacy of supply,” said researchers.

State-backed investments also are accounting for a rising share of investment, as government-owned enterprises remain more resilient in oil/gas and thermal power versus private actors.

“The share of global energy investment driven by state-owned enterprises increased over the past five years to over 40% in 2017,” according to the report.

Government policies also are playing a bigger role in driving private spending.

“Across all power sector investments, more than 95% of investment is now based on regulation or contracts for remuneration, with a dwindling role for new projects based solely on revenues from variable pricing in competitive wholesale markets,” researchers said. “Investment in energy efficiency is particularly linked to government policy, often through energy performance standards.”

Following several years of growth, IEA also found that combined global investment in renewables and energy efficiency fell by 3% year/year. There is a risk it may slow even more this year.

“For instance, investment in renewable power, which accounted for two-thirds of power generation spending, dropped 7% in 2017,” IEA noted. Researchers pointed to policy changes in China, which are linked to support for deploying solar photovoltaic technology, raise the risk of slowing investments.

Energy efficiency showed some of the strongest expansion in 2017, but it was not enough to offset a decline in renewables. Efficiency investment growth also weakened in the past year.

“Such a decline in global investment for renewables and energy efficiency combined is worrying,” said Birol. “This could threaten the expansion of ”clean’ energy needed to meet energy security, climate and clean-air goals. While we would need this investment to go up rapidly, it is disappointing to find that it might be falling this year.”

Meanwhile, nuclear power plant retirements last year exceeded new construction starts as investment in the sector declined to its lowest level in five years.

The share of national oil companies in total oil and gas upstream investment remained near record highs, a trend expected to persist in 2018.

Although it remains a small piece of the market, electric vehicles (EV) “now account for much of the growth in global passenger vehicle sales, spurred by government purchase incentives,” researchers said. “For electric cars, nearly one-quarter of the global value of EV sales in 2017 came from the budgets of governments, who are allocating more capital to support the sector each year.”

The story for coal is a push-me, pull-you situation. Final investment decisions for coal power plants to be built in the coming years declined in 2017 for a second straight year, reaching one third of their 2010 level.

“However, despite declining global capacity additions, and an elevated level of retirements of existing plants, the global coal fleet continued to expand in 2017, mostly due to markets in Asia,” said IEA. “And while there was a shift toward more efficient plants, 60% of currently operating capacity uses inefficient subcritical technology.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |