Markets | Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Developing Asian LNG Benchmark No Simple Task, Say Panelists

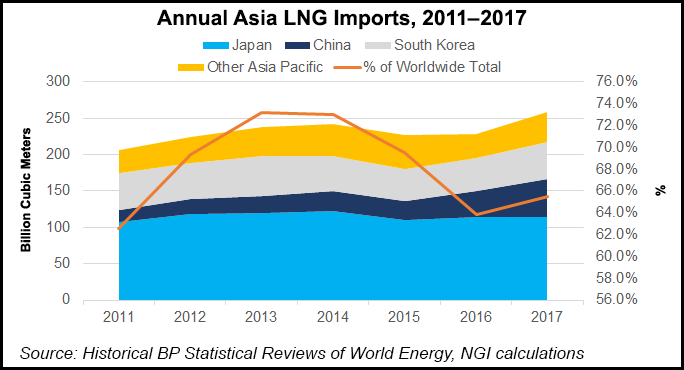

Even as a majority of global liquefied natural gas (LNG) demand is focused in Asia, developing a transparent price index — or multiple indexes — to reflect the region’s supply and demand dynamics remains a significant challenge, according to a group of panelists at last month’s 2018 World Gas Conference in Washington, DC.

There are “a lot of barriers” that make determining a regional gas price for Asia difficult, according to Osaka Gas Senior Analyst Chikako Ishiguro.

Japan, for instance, lacks the kind of wholesale gas market that the United States and Europe have. Japan’s market is fragmented, consisting of individual companies importing LNG and using it for their own needs, Ishiguro said.

Different pricing schemes and “many types of subsidies” in Asian countries add to the challenge, according to Ishiguro. Developing a trading hub based on LNG could also prove difficult given that LNG isn’t traded daily and given the time gap between buying and the actual imports.

“Even if someone provided such an LNG hub, Asian players” will need to institute reforms to increase their liquidity, Ishiguro said.

BP Head of Gas Analysis Anne-Sophie Corbeau noted that the trading hubs that have emerged in the United States and Europe have “been based mostly on production and also on pipeline gas.”

Japan, Singapore and China have been “talking a lot about trading hubs…but there has been very little progress in each of these countries.” The Japan Korea Marker (JKM) seems to be gaining traction but lacks transparency, according to Corbeau.

“Asia is a very fragmented market, but it’s also a market that depends a lot on LNG,” Corbeau said.

Cheniere Energy Inc.’s Najla Jamoussi, director of market fundamentals, said the growth of U.S. LNG exports will provide supply to the global market in a “reliable and transparent manner” that will assist spot buyers.

“Developing an LNG-tradeable forward curve, while challenging, will attract more liquidity and will attract risk management tools for both buyers and sellers alike to optimize their trades and to be able to transact efficiently,” Jamoussi said. “When the industry finally sets that in motion, we believe it will essentially pave a path for a much more transparent and more resilient market.”

Jamoussi’s comments preceded this week’s announcement that Cheniere and CME Group plan to develop a Henry Hub-indexed LNG futures contract with physical delivery to the Sabine Pass terminal on the U.S. Gulf Coast.

As for whether Asia should price off of an LNG benchmark based around Henry Hub in the United States, Jamoussi said, “I think it’s appropriate and beneficial for the Asian market to have its own benchmark that can reflect the supply and demand of the local market. In the meantime, there are indicators like the JKM that can sort of reflect the fundamentals of that market, but it’s far from being a tradeable forward curve.”

The recipe for developing a true Asian index will require elements like transparency, liquidity and a clearly established methodology, among other things, the panelists said.

Within Asia “there are multiple countries that have broad-based use for gas, and some of them have some of the necessary ingredients to develop a hub, and some don’t,” Jamoussi said. “So they need to work at it. They need to provide the necessary institutional and physical factors that will get us there. You have to have a legal framework. You have to have market tools that will support that.”

Looking at the United States as an example, the integrated infrastructure — including storage — and access to that infrastructure, helped “a true benchmark to develop,” she added. “And we could have that in Asia, whether it’s Japan, Singapore, China. That could be developed over time. There’s a real push from Japan, there’s a real push from China to get there. There’s deregulation going on. But it’s going to take time, and it’s going to take a strong will to get there.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |