Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bakken Production Shatters 2014 Record; More Rigs in North Dakota Expected By Year’s End

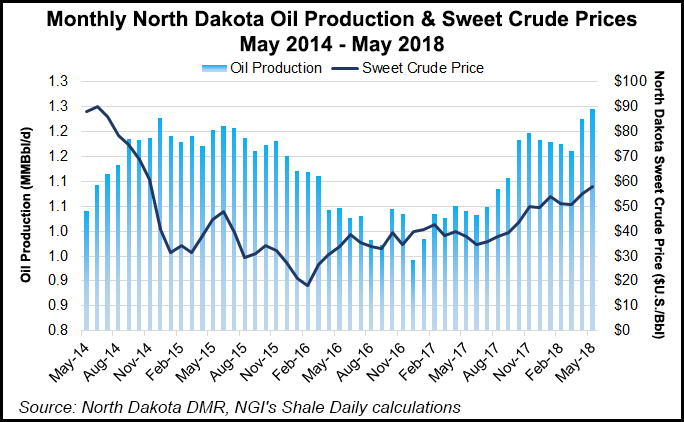

Calling it the “most encouraging” oil and natural gas production total in more than three-and-a-half years, North Dakota’s chief oil and gas regulator on Friday reported sharply increased Bakken Shale output play in May compared with the previous month.

“We really shattered the old record,” said Lynn Helms, director of the state Department of Mineral Resources. “We had 17,000 b/d more than the previous record (December 2014). On the natural gas front there was a 4% month-over-month production increase in May.

“This is the first time that North Dakota has produced more than 70 Bcf/d for a month,” added Helms, noting continuing positive numbers in permitting, strong global oil price numbers and a rig count that is at 67 and is expected to grow by another “five or so rigs” before the end of the year.

When the previous Bakken record was set there were up to 190 drilling rigs in operation. “It is a real testimony to the efficiencies that industry has generated,” Helms said. “It’s a real feat being able to break a record the way that they have with about one-third of the rigs they had in December 2014.”

In May, the month for which there are the most up-to-date completed statistics, oil production was 38.5 million bbl (1.244 million b/d), compared to April totals of 36.7 million bbl (1.225 million b/d). Gas production in May was 71.8 Bcf (2.31 Bcf/d), compared to 67.2 Bcf (2.24 Bcf/d) in April.

Helms said that the number of inactive and non-completed wells were both up in May, tempering other statistics as a result.

The only major negative in Helms’ report was the fact that the state missed its flaring goal in May, as gas capture volumes dropped to 83%. Helms attributed an outage at the Robinson Lake gas processing plant as the main reason for the reversal in industry’s efforts to capture more gas at the wellhead.

“The processing plant was down most of the month of May for major maintenance. It is a little too soon to tell if we are going to have production restrictions,” Helms said. Production restrictions for three of the state’s top 10 producers — Hess Corp., Marathon Petroleum, and WPX — may follow.

Compared to the last steady production increases in 2014, the current increases are different in that the pace of gas increases is about twice what oil production growth is, Helms said. This more rapid growth in gas is “really straining” midstream infrastructure in the state.

Helms also said that he expects production to continue to grow in the Bakken, and that sanctions aimed at Iran will cause a drop in global oil supplies, driving up Brent prices. The latter will tend to widen the spread between U.S. domestic based pricing and Brent, which in turn drives more Bakken production to be shipped by rail to any of the three major coasts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |