E&P | NGI All News Access | NGI Mexico GPI

Mexican-Norwegian Consortium Awarded OFS Contract for Two Mature Fields in Southern Mexico

A Mexican-Norwegian consortium has won an integrated oilfield services (OFS) contract with Petroleos Mexicanos (Pemex) for two mature onshore areas in the southern state of Veracruz.

The state oil company awarded the 10-year contract to develop the San Ramon and Blasillo fields to Mexican OFS company Grupo R Operaciones Petroleras and Olso-based AGR Petroleum Services AS, in a bidding process that wrapped up June 28.

The OFS contract, due to be signed this month, includes a 12-well drilling campaign to be carried out within the first two years of its term.

Pemex launched the tender in November and prequalified seven companies in March, including OFS giants Schlumberger Ltd. and Baker Hughes Inc., a GE company, as well as China Petroleum and Chemical Corp. (Sinopec).

In the end, however, the largest players stayed away. Pemex received three offers from smaller, mostly local firms, one of which was disqualified because of problems with its bid bond.

Pemex first discovered and developed the San Ramon and Blasillo fields in the 1960s, reaching production peaks in the 1970s and early 1980s.

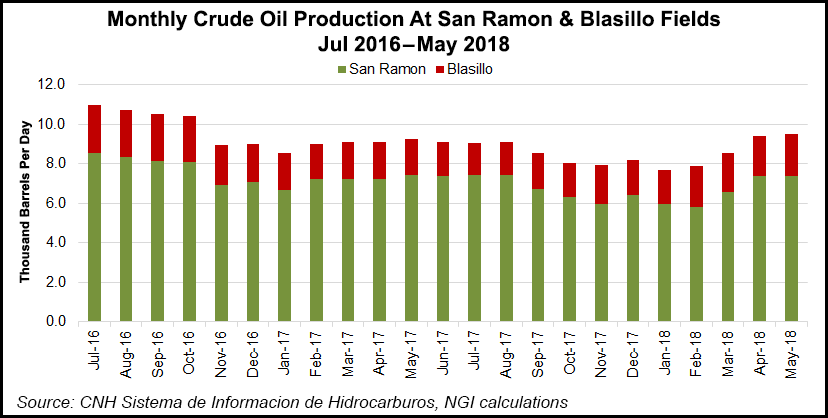

Output from both areas is predominantly light crude. San Ramon produced 7,382 b/d of oil and 6.2 MMcf/d of natural gas in May, according to data from upstream regulator Comision Nacional de Hidrocarburos (CNH). In the same month, Blasillo averaged 2,121 b/d and 8.5 MMcf/d.

“The producing sequences in the San Ramon and Blasillo fields are semi-consolidated sandstones in the Lower Concepción Formation of the Lower Pliocene and in the Ecanto Formation of the Middle and Lower Miocene,” according the tender documents.

Certified proven, probable and possible reserves for the two areas stood at 20.6 million bbl of oil and 39.2 Bcf of gas in January 2017.

The integrated contract is a revised model of the OFS agreements that Pemex signed with private and foreign partners before the 2013-2014 energy reforms ended its decades-long monopoly over the upstream sector. Contractors under the new model receive a per-barrel or per-Mcf fee that increases as production rises.

For the San Ramon-Blasillo contract, bidders offered a base fee and a second higher fee that would kick in when output exceeds a certain threshold. The winning consortium bid a base fee of $8.43/bbl (57 cents/Mcf) and a second fee of $11.55/bbl (78 cents/Mcf).

In March, Pemex signed another integrated OFS contract with San Antonio, TX-based Lewis Energy Group to evaluate and develop an unconventional natural gas project in northeast Mexico. The new contract, for the Olmos field in Coahuila, appeared to replace an older OFS agreement that Lewis had won at a bidding round in 2004.

Pemex signed a total of 22 OFS contracts before the energy reforms got underway. The company has since begun migrating the other OFS agreements to the new contract models introduced by the reforms, allowing its partners a direct share in production or revenue in order to incentivize new investments.

So far, Pemex has moved two OFS contracts to production-sharing agreements. In December, it migrated the Santuario-El Golpe project and in March the Mision block.

The national oil company is also planning a farmout tender on Oct. 27 for operating stakes in seven onshore blocks in southern Mexico. The auction would be the last under the watch of President Enrique Peña Nieto’s administration.

Former Mexico City mayor Andrés Manuel Lopez Obrador, a left-leaning populist and frequent critic of the energy reforms, is slated to take office Dec. 1.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |