Mexico | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Natural Gas Imports Continued Double-Digit Growth in April

Mexican natural gas imports averaged 5.07 Bcf/d in April, up 13.2% year/year (y/y), according to the latest Energy Ministry (Sener) data.

Pipeline shipments from the United States grew 12.5% to 4.35 Bcf/d in April, versus 3.87 Bcf/d in the year-ago month. Mexico’s two active liquefied natural gas (LNG) terminals provided the remaining .72 Bcf/d of imported gas, a y/y increase of 17.5%.

While gas imports continued their double-digit expansion of recent months, total demand growth in Mexico was more subdued in April. National gas consumption, at 7.85 Bcf/d, was up 2% y/y and down 1.6% from March.

The domestic gas supply declined 13.6% y/y in April to 2.78 Bcf/d. Mexico’s gas production has fallen by roughly 59% since 2010, according to Sener.

Pipelines at the U.S. border have filled the gap. Imports supplied 65% of Mexico’s natural gas in April, versus 40% at the beginning of 2015. Excluding gas used by Petroleos Mexicanos (Pemex) and other oil and gas operators for reinjection and other upstream activities, imported gas is estimated to contribute around 85% of the marketable dry gas in the country.

Most Mexican pipeline imports currently flow into the industrialized northeast region and then continue south to demand centers in the central states.

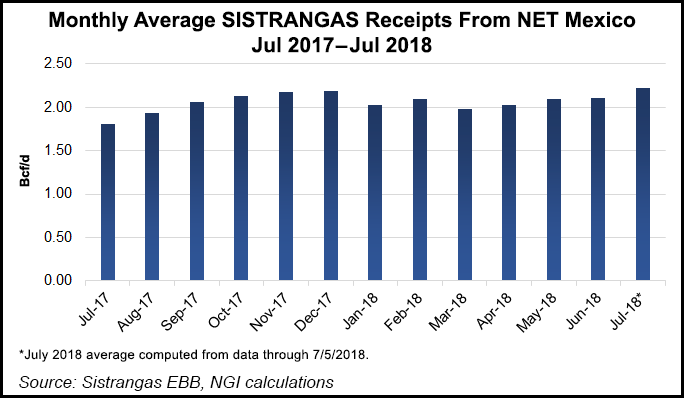

The NET Mexico Pipeline Partners LLC’s 120-mile system, which moves gas from the Agua Dulce hub in South Texas to Mexico and is the largest import point into the country, delivered 1.89 Bcf/d in April, up 11.9% y/y. The pipeline accounted for 37% of all gas imports in the month.

The 2.1 Bcf/d pipeline crosses the South Texas border into Tamaulipas state and connects with the Los Ramones system, part of the national integrated transmission network known as Sistrangas.

The second largest import point, Kinder Morgan Inc.’s Mier-Monterrey pipeline, is in neighboring Nuevo Leon, near the state capital Monterrey. The pipeline delivered 470 MMcf/d in April, down 9.4% y/y.

Also near Monterrey, the Nueva Era pipeline is ramping up to commercial service. Mexico’s state power company, the Comision Federal de Electricidad (CFE), is the anchor shipper on Nueva Era with 504 MMcf/d of capacity. An additional 496 Bcf/d is still available, according to the pipeline’s developer.

Mexico’s third-largest import point is at the Arguelles border crossing, which averaged 412 MMcf/d in April, more than triple the injections for the year-ago month. Two pipelines deliver gas in this area: the Kinder Morgan Border Pipeline LLC and the Arguelles pipeline, owned by Energy Transfer Partners LP (ETP).

In June, ETP launched an open season seeking support for 30 MMcf/d of firm transportation resulting from additional compression on the company’s Edinburg Extension, which connects with Arguelles at the Texas-Mexican border. The expansion would boost Arguelles transport capacity to 250 MMcf/d, from the current 220 MMcf/d.

The Kinder Morgan Border Pipeline has also been planning a 150 MMcf/d expansion that was due in-service at the beginning of this month, and which would boost its total capacity to 450 MMcf/d. Kinder also is pondering more gas takeaway from the Permian to supply Mexico.

Outside of the northeast, delays to pipeline infrastructure downstream in Mexico have curtailed imports from the Waha hub in the Permian Basin. Gas shipments in this region would flow into the northwest states of Chihuahua and Sonora, as well as farther south to Guadalajara.

Two major border crossings in Chihuahua, San Isidro and Ojinaga, received a respective 130 MMcf/d and 10 MMcf/d in April. The San Isidro crossing, near San Elizario, TX, includes the 1.1 Bcf/d Comanche Trail pipeline and the 570 MMcf/d Roadrunner Gas Transmission LLC. Ojinaga is fed by the 1.4 Bcf/d Trans-Pecos pipeline at Presidio, TX.

However, TransCanada Corp.’s “long-awaited El Encino-Topolobampo Pipeline is finally nearing completion, and once it’s online there may be a surprisingly big gain in gas export volumes to Mexico,” RBN Energy LLC’s Jason Ferguson wrote in a mid-July blog post. “As most of this gas will be supplied directly from Waha, Mexico’s impact on Permian gas balances is likely to jump materially in the weeks ahead.”

Running through the southwest area of Chihuahua, El Encino-Topolobampo would complete TransCanada’s Encino-Mazatlan system, which extends into Sinaloa on the Pacific Coast. The system would supply existing CFE power plants, as well as two large combined-cycle plants due online later this year and early 2020.

“The El Encino-Topolobampo Pipeline is expected to receive its initial supply from the Tarahumara Pipeline at the El Encino hub,” Ferguson said. “It could also be supplied by the Ojinaga-El Encino pipeline at El Encino. For now, though, the supply contracts signed by CFE are arranged to utilize the Tarahumara route.”

The Tarahumara pipeline, owned by Mexican company Fermaca, interconnects with the El Paso Natural Gas Pipeline, Roadrunner and San Isidro-Samalayuca, which receives gas from Comanche Trail.

Additional pipelines downstream from El Encino, toward Guadalajara, are also expected to come in-service later this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |