Natural Gas Futures Rebound Ahead of Potentially Lean EIA Report; Spot Prices Mixed

Natural gas futures bounced Wednesday as analysts pointed to production easing off recent highs, while the upcoming Energy Information Administration (EIA) storage report is likely to have some say in whether the rally continues.

The spot market was mixed as temperatures and cooling demand look to pull back from last week’s levels; the NGI National Spot Gas Average added 3 cents to $2.69/MMBtu.

The August Nymex futures contract added 4.1 cents to settle at $2.829 Wednesday, recovering its losses from the previous session. August traded as high as $2.832 and as low as $2.780. The September contract added 3.9 cents to settle at $2.797.

The August contract recovered Wednesday morning “as daily balances began to marginally improve and overnight model guidance showed slightly hotter trends in the medium- and long-range,” Bespoke Weather Services told clients. “Afternoon guidance backed off some of these trends; the South continues to trend hotter but the Midwest and East easily” offset with cooler trends. “However, tight power burns began to matter more today as well as production more clearly pulled back from recent highs.

“As long as production remains off highs, prices will be able to find a bid,” Bespoke said. “…Increasingly, we expect weather to exert a bearish influence on natural gas prices as long-range cool risks become more clear and short-term heat is seen as fleeting. However, weather may take a back seat here with enough heat across the South to still keep cash prices bid given the current storage deficit, and accordingly all eyes will be on production, weather-adjusted power burns” and Thursday’s EIA storage data.

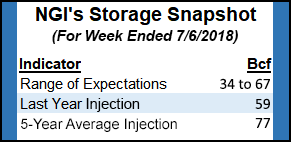

Estimates for this week’s EIA report point to a build well shy of the five-year average. A Reuters survey of traders and analysts on average showed respondents anticipating a 56 Bcf build for the week ended July 6, with responses ranging from 47 Bcf to 67 Bcf. A Bloomberg survey produced a median 55 Bcf injection, with a range of 34 Bcf to 67 Bcf.

IAF Advisors analyst Kyle Cooper predicted a 50 Bcf build, while Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at an injection of 49 Bcf.

Last year, EIA recorded a 59 Bcf build, and the five-year average is an injection of 77 Bcf.

Expectations for a lighter-than-average build could have aided Wednesday’s rally, according to NatGasWeather.

The firm said midday data continued to show periods of cooling in the Great Lakes and Northeast over the next two weeks.

“What will be needed for patterns to again become solidly bullish is for the core of the hot upper ridge to shift back over the east-central, although the data has yet to show when this might occur but suggests during the last week of July, but more likely first week of August,” according to the firm. “Until forecast maps show more impressive heat over the Great Lakes and Northeast, a sustained rally isn’t likely. That is, of course, unless” Thursday’s “EIA report shows a big bullish miss.”

Meanwhile, Hurricane Chris, upgraded from a tropical storm this week, was located about 440 miles east-northeast of Cape Hatteras, NC, Wednesday, the National Hurricane Center (NHC) said.

“Chris is moving toward the northeast near 22 mph,” NHC said. “The hurricane is forecast to remain on this general heading with an increase in forward speed for the next several days. On the forecast track the center of Chris will pass near southeastern Newfoundland on Thursday.”

Turning to the spot market, Southern California points remained elevated Wednesday with above-normal temperatures in the region expected to continue through the end of the week. Radiant Solutions was forecasting highs in the upper 80s in Burbank, CA, over the next several days, with temperatures averaging about 5-6 degrees warmer than normal.

Compared to more dramatic moves since late last week, SoCal Citygate posted a relatively modest 19-cent gain to average $4.60. SoCal Border Average added 36 cents to $3.54.

Further upstream, prices strengthened across the Rockies and West Texas. Kern River added 10 cents to $2.50, while Waha gained 18 cents to $2.26.

Genscape Inc. observed a drop in production out of the Permian Basin and Oklahoma Wednesday morning, apparently related to maintenance on the Atmos Intrastate Pipeline at the Maryneal Compressor Station, “which sits on the border of the zones that bring gas from the West to the East area of the pipeline system,” according to analyst Nicole McMurrer.

On Tuesday morning the firm’s Permian Texas production estimate “decreased around 770 MMcf/d day/day, with only about 65 MMcf/d revised upwards” Wednesday morning, McMurrer said. “Production along El Paso Natural Gas Pipeline and Northern Natural Gas Pipeline was shut-in at processing plant meters near the Atmos Waha header. Deliveries to Gulf Crossing in East Texas dropped around 200 MMcf/d. Atmos has not publicly stated when the maintenance will conclude, however rumors around the market indicate a late August end date.”

Prices were mixed in the Northeast Wednesday. Algonquin Citygate added 13 cents to $2.69 as Transco Zone 6 New York backed off 3 cents to $2.92.

“A brief minor swing to lighter national demand will occur the next two days as a weak cool front sweeps across the Northeast with highs easing back into the 70s to mid-80s,” NatGasWeather said. “However, a swing back to strong demand is expected this weekend into early next week as the hot ridge re-strengthens to again dominate most of the country besides the Northern Plains.”

Genscape’s supply and demand tally shows cooling demand dropping off week/week, according to analyst Margaret Jones.

“Last week Genscape’s gas demand for power estimate averaged 37.1 Bcf/d, topping out” last Thursday at 39.2 Bcf/d. “Lower 48 population-weighted” cooling degree days “for the end of this week have backed off considerably versus last week (and relative to last week’s forecast), and total estimated power demand this week is estimated at 35.6 Bcf/d” as of Wednesday morning, Jones said.

“There is some potential for temperatures and demand to climb again next week, with current expectations putting average power demand at 36.7 Bcf/d for the week…potentially spiking to 38.7 Bcf/d on Monday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |