Infrastructure | E&P | NGI All News Access

U.S. Natural Gas Rig Count Flat but Oil Count Nudges Higher

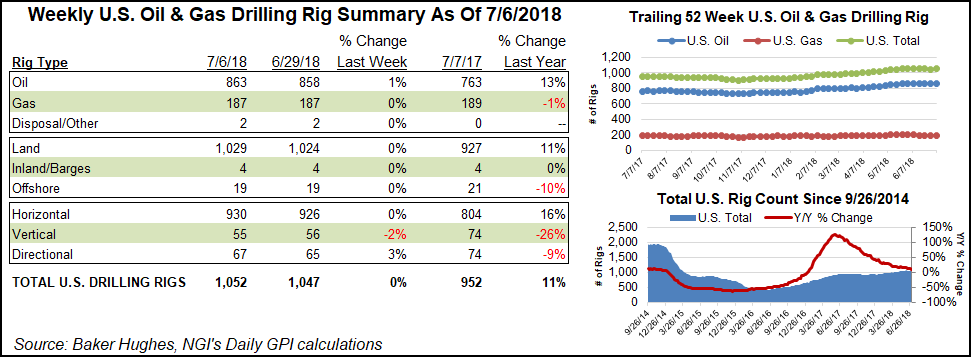

The number of domestic natural gas-directed rigs held flat at 187 for the week ended Friday as an uptick in oil activity drove the overall U.S. count higher, according to data from Baker Hughes Inc. (BHI).

The United States added five rigs — all oil — during the week ended Friday to grow its tally to 1,052 for the week. That’s up from 952 rigs at this time last year.

Four horizontal units returned to the patch along with two directional units, offsetting the departure of one vertical unit. All of the rigs added for the week were on land, while the Gulf of Mexico held at 18 units, down from 21 in the year-ago period, according to BHI.

Canada, meanwhile, saw 10 rigs return to action for the week, including nine oil-directed and one gas-directed, putting its count at 182 as of Friday.

The combined North American tally finished the week at 1,234 versus 1,127 last year.

Among plays, the biggest gainer for the week was the Williston Basin, which added three rigs to finish at 57, improving on its year-ago tally of 52. The Eagle Ford Shale and Permian Basin, meanwhile, each saw one rig return to the patch for the week.

On the negative side of the ledger, the Cana Woodford in Oklahoma posted the sharpest decrease among plays as six units departed to drop its count to 68 from 63 a year ago.

A more detailed breakdown of BHI data by NGI’s Shale Daily showed the week’s losses in the Midcontinent focused in Oklahoma’s STACK (aka, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties). The STACK saw its rig count decline 14% from 43 to 37 active units, leaving the play down from its year-ago tally of 43. The SCOOP (South Central Oklahoma Oil Province) finished even at 31 units, up from 18 a year ago, the Shale Daily breakdown indicated.

The Ardmore Woodford, Denver Julesburg-Niobrara and Haynesville Shale each dropped one rig for the week, according to BHI.

Among states, the biggest weekly increase occurred in New Mexico, which added four rigs to end at 99. Oklahoma and Wyoming each finished with a net increase of one rig. North Dakota’s count unsurprisingly saw a corresponding increase with the Williston gains, adding three units.

Texas led declines among states for the week as four rigs left the patch. Alaska and Utah each saw two rigs pack up, while one rig departed in Colorado.

The week’s oil drilling gains come during a period of renewed strength for crude prices, with August New York Mercantile Exchange West Texas Intermediate futures adding close to $10/bbl since mid-June. The August contract was trading close to $74/bbl Friday afternoon, up nearly $1 on the day.

Geopolitical events have helped rebalance global crude oil fundamentals, but the ability of U.S. onshore oil operators to ramp up quickly could again throw the market into oversupply, according to Morningstar.

The Organization of Petroleum Exporting Countries and its allies agreed to voluntarily reduce output, which helped realign global inventories. In addition, major oil producer Venezuela remains in crisis, and plans by President Trump to abandon the Iran nuclear accord likely will widen the oil supply/demand imbalance and accelerate the decline in inventories.

“However, we believe the market continues to underestimate the capacity of the shale industry to throw oil markets back into oversupply,” Morningstar equity analyst Joe Gemino said of U.S. operators. “Crude prices have largely held above $65/bbl for West Texas Intermediate in 2018, which provides attractive economics for many U.S. producers.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |