Markets | NGI All News Access | NGI Data

EIA’s Storage Figure Tops Survey Averages as Natural Gas Futures Steady

Bulls hoping for a lean natural gas storage report from the Energy Information Administration (EIA) Friday left disappointed as the agency came out with a net build on the higher side of average estimates. Still, futures prices stayed the course after briefly dropping on the news.

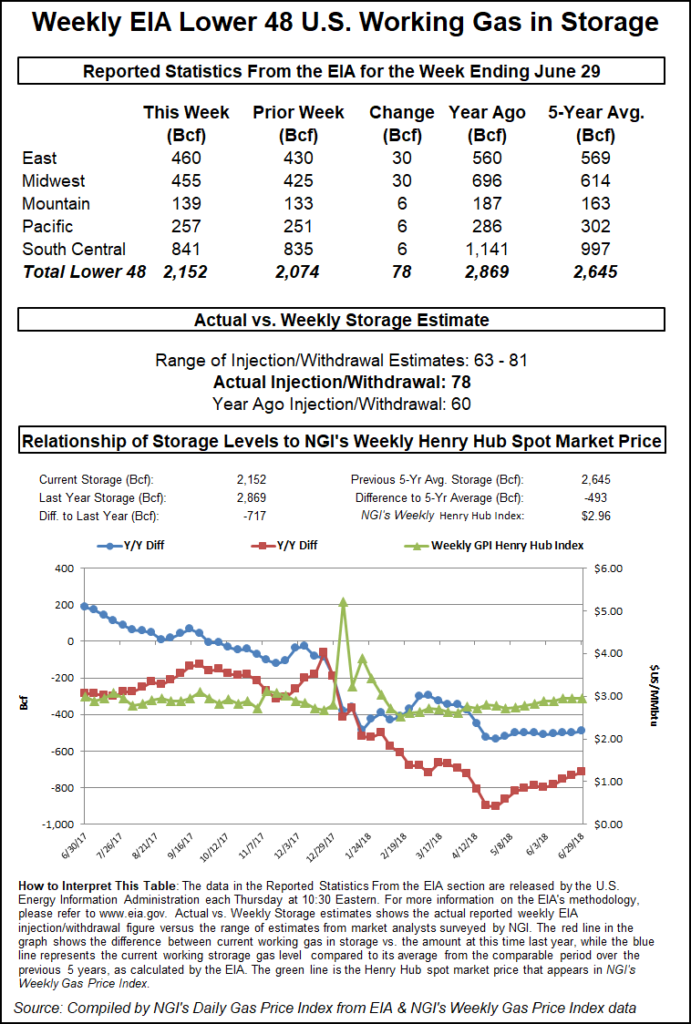

EIA, issuing its weekly report a day later than usual due to the Independence Day holiday, said Lower 48 natural gas stocks saw a net 78 Bcf build for the week ending June 29, versus a 60 Bcf injection recorded a year-ago and a five-year average 70 Bcf build.

The number also topped major survey averages by around 3 Bcf, a reversal from the prior week’s bullish miss (although that report also included a bearish revision to stocks for the week ended June 15).

Immediately after the 10:30 a.m. ET release of the injection figure, August Nymex futures shed about 2 cents to reach as low as $2.826, testing what analysts have pegged as a key support area for the prompt month. But prices bounced back within minutes, and by 11 a.m. ET August was trading around $2.848, up about 1.1 cents from Thursday’s settle and in line with prices prior to the open.

In the lead-up to Friday’s report, a Reuters survey of 21 traders and analysts had showed respondents on average expecting EIA to report a 75 Bcf build for the week, with responses ranging from 63 Bcf to 81 Bcf. A Bloomberg survey had produced an average 75 Bcf injection, with a range of 66 Bcf to 81 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures had settled Wednesday at a build of 77 Bcf.

Bespoke Weather Services said the 78 Bcf build confirmed its estimate prior to the report.

“Our strong reading of current balance appears to have helped in identifying the downside in natural gas prices over the past week and a half, and today’s slightly larger print than the consensus confirms the production that is coming online,” Bespoke said. “The print is not so large as to indicate production is overwhelming all else, so small bounces toward $2.90 may be possible” with the addition of any gas-weighted degree days to the outlook, “but with production loosening the market further and heat likely to break later any rallies remain sells.”

Total working gas in underground storage stood at 2,152 Bcf as of June 29, versus 2,869 Bcf last year and five-year average inventories of 2,645 Bcf. Week/week the year-on-year deficit shrank from minus 735 Bcf to minus 717 Bcf, and the year-on-five-year deficit narrowed from minus 501 Bcf to minus 493 Bcf, EIA data show.

By region, the Midwest and East each recorded a net build of 30 Bcf for the week, while the rest of the country saw smaller inventory gains, according to EIA. The Mountain region saw a 6 Bcf build, as did the Pacific. In the South Central, which also finished with a net 6 Bcf build, 13 Bcf was injected into nonsalt, offsetting a 7 Bcf withdrawal from salt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |