Natural Gas Futures Slide Despite Heat as SoCal Citygate Spot Prices Soar

Natural gas futures slid Thursday as production concerns and some anticipated cooling in the Northeast sent prices lower, despite a generally bullish forecast for the next two weeks. In the spot market, projected triple-digit heat sent SoCal Citygate prices spiking, while East Coast points fell on cooler temperatures ahead; the NGI National Spot Gas Average added 2 cents to $2.72/MMBtu.

The August futures contract settled at $2.837 Thursday, down 3.3 cents after trading as high as $2.894 and as low as $2.822. The September contract fell 3.4 cents to settle at $2.812.

“This market remains in a battle between concerns of lower than normal storage and hot weather through the next couple of weeks and complacency that recent record high production levels will easily bail the market out of any shortages it may see through the winter,” Bespoke Weather Services said Thursday.

“With production levels at record highs it appears likely they will win out, and that overall risk remains lower,” even though last week’s Energy Information Administration (EIA) storage report “appeared to show that these production estimates were overdone,” the firm said. “The result then is a market that is attempting to break even lower on record production levels and weather into the weekend that is not impressive, but has found a bid at support from $2.80-2.82 on concerns that power burns are tight enough to justify keeping prices in their current range.”

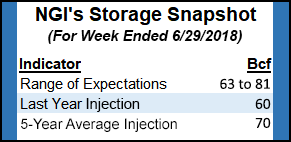

Estimates for this week’s EIA storage report — set for release on Friday because of Independence Day — point to a build somewhat higher than the five-year average.

A Reuters survey of 21 traders and analysts showed respondents on average expecting EIA to report a 75 Bcf build for the week ending June 29. Survey responses ranged from 63 Bcf to 81 Bcf. Last year, EIA recorded a 60 Bcf build, and the five-year average is a 70 Bcf injection.

IAF Advisors analyst Kyle Cooper predicted a build of 78 Bcf, while Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a build of 77 Bcf.

NatGasWeather said the midday Global Forecast System data Thursday was “little changed overall.”

After cooler temperatures in the East over the weekend, “recent data continues to maintain hotter trends for next week into the following week by advertising the heat dome dominating most of the country.” The pattern has seen “numerous” cooling degree days “added since early in the week as highs of 90s return from Chicago to New York City” to go with hotter temperatures across other regions, according to the firm. Guidance shows the Northeast cooling off again July 17-20 to ease national demand.

In the past, a weather outlook as hot as the current one would be sufficient to drive prices higher, according to NatGasWeather.

“But with production running more than 7 Bcf/d higher year/year,” markets seem to be weighing supply growth “more heavily than hefty deficits and hot summer temperatures. If the eastern U.S. were to trend hotter for the second half of July, then the markets would surely notice, and that is the focus going into the weekend break.

“The main question is how hot does it need to get” to push the August contract back to $3? The markets since last Thursday have said that “while plenty hot most days the next two weeks with hefty deficits holding, it’s still not enough to counter negative sentiment associated with record production,” the firm said.

Turning to the spot market, prices in Southern California skyrocketed right on schedule Thursday as temperatures in the region look to reach triple-digits over the next several days. The biggest gainer was the usual culprit, SoCal Citygate, a location prone to price spikes and volatility lately due to a number of ongoing restrictions to pipeline imports and storage.

Radiant Solutions was calling for average temperatures in Burbank, CA, to reach 90 degrees Friday, about 16.5 degrees hotter than normal, including a high of 107. Saturday’s high was also expected to hit triple-digit territory at 104, according to the forecaster.

Utility Southern California Gas (SoCalGas) on Thursday was forecasting demand to reach 2.884 million Dth/d Friday, up from less than 2 million Dth/d on Wednesday. Friday’s projected demand total would be enough to force a 351,115 Dth withdrawal from storage that day, according to the utility.

Day-ahead prices at SoCal Citygate more than doubled Thursday, gaining $4.84 to average $8.28. Other locations in the region saw hefty gains on the day, including SoCal Border Average (up 84 cents to $3.38) and Kern Delivery (up $1.11 to $3.73).

Portland, OR-based analytics firm Energy GPS earlier this week had predicted the price spikes at SoCal Citygate and noted that import capacity on the SoCalGas system has been limited to 2.6 Bcf/d, a situation compounded by the regulatory restrictions on the Aliso Canyon storage cavern that have made it a resource of last resort.

The firm estimated that an average temperature of 90 degrees in Southern California would equate to about 3.2 Bcf/d of demand for SoCalGas — enough to potentially require withdrawals from the heavily scrutinized Aliso Canyon.

Further upstream, prices in the Rockies and West Texas strengthened by double digits. Kern River climbed 27 cents to $2.61, while El Paso Permian added 26 cents to $2.29.

Meanwhile, a number of locations throughout the Northeast and Appalachia fell by double digits Thursday as recent hot temperatures in the East are expected to cool off significantly into the weekend.

Thursday was “the last day of impressive heat across the East with highs into the 90s,” NatGasWeather said. “This will be followed by a weather system with showers, thunderstorms and cooling set to track across the northeastern U.S. Friday through Saturday, dropping highs into the 70s and 80s, easing national demand back to near normal levels.”

Algonquin Citygate tumbled 51 cents to $2.67, while further upstream Dominion South dropped 12 cents to $2.22. In the Mid-Atlantic, Transco Zone 5 shed 13 cents to $2.93.

In South Texas, volumes have recovered from a force majeure declared June 14 that restricted Tennessee Gas Pipeline (TGP) flows to Mexico, according to Genscape Inc.

“Two weeks prior to the decrease in flows, exports averaged 455 MMcf/d, and beginning June 19, exports dipped to an average 278 MMcf/d through June 29, a drop of 177 MMcf/d,” Genscape analyst Esteban Trejo said. “These same exports have now averaged 458 MMcf/d since June 30. Flows through Station 1 and Station 9 (the locations affected by the force majeure) have remained above their stated operational capacity.

“On June 27, TGP posted an update to the force majeure stating that repairs would be delayed to July 9 due to ”wet conditions’ and that these repairs would last through July 23,” Trejo noted.

Trejo estimated limited impact on TGP exports to Mexico through July 23 based on pipeline outage reports, but “these repairs will partially coincide with downstream pig runs on Sistrangas. In multiple Sistrangas notices posted Wednesday, Sistrangas stated that they will be performing pig runs” on Thursday, Friday and next Wednesday “that could affect imports from TGP” and Texas Eastern.

Tennessee Zone 0 South fell 3 cents to average $2.72 Thursday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |