Infrastructure | E&P | NGI All News Access

BHI’s Domestic Rig Count Drops Amid Both Oil, NatGas Oil Declines

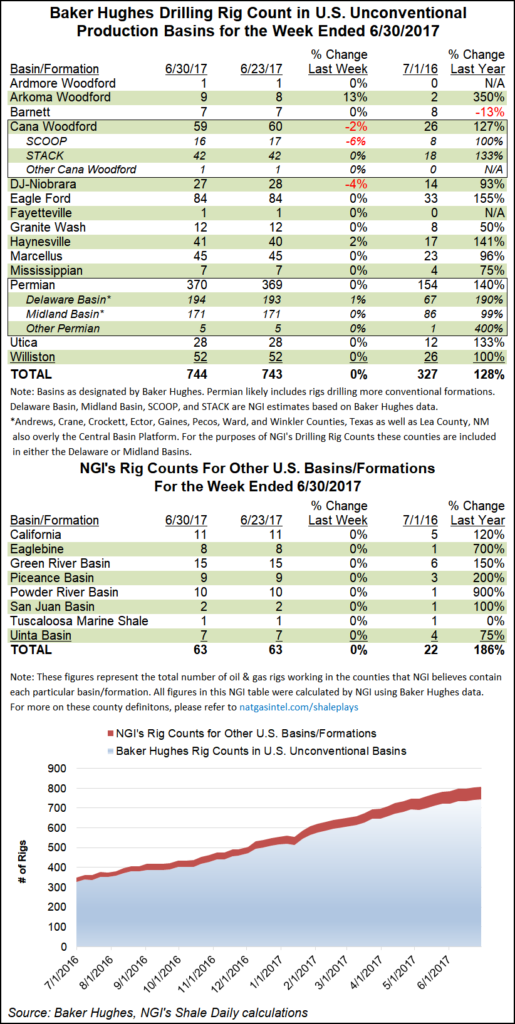

The U.S. rig count fell by five units for the week ended Friday thanks to a drop in both oil and natural gas activity, including declines in the Haynesville and Eagle Ford shales and in the Williston Basin, according to data from Baker Hughes Inc.

It would appear U.S. natural gas producers have finally taken notice of the price signals being sent as the number of rigs on the hunt for the commodity have dropped for the third consecutive week.

For the week ending June 29, Baker Hughes reported that the number of rigs drilling for natural gas dropped by one to 187. In the two prior weeks, a total of 10 natural gas-directed rigs ceased operation. The decline has taken place as front-month natural gas futures values have found it near impossible to top $3. After wrestling with the $3 psychological price level for its entire run as the prompt-month contract, the July futures contract expired on Wednesday at $2.996.

Over on the liquids side, crude oil, which is enjoying prices hovering north of $73/bbl, saw a dip in active rigs as well. Rigs drilling for oil declined by four rigs for the week, but at 858 rigs, levels are still fairly robust.

Removing current commodity price levels from the equation, storm clouds for U.S. oil and natural gas production growth — predicated on growing exports — could be forming if President Trump’s recent trade war offensive continues to escalate.

Speaking at the World Gas Conference (WGC) in Washington, DC, on Tuesday, ExxonMobil Corp. CEO Darren Woods and Chevron Corp. CEO Mike Wirth noted that the Trump administration’s decision to impose tariffs may imperil relationships with overseas markets and dampen energy demand, adding that the United States, now the world’s largest natural gas producer, is exporting more supply overseas, but tariffs could very well undermine those plans.

“The world economy is growing, really for the first time in a decade or so,” Wirth said. “We see it in demand for our products…” However, “the risk of trade skirmishes or trade wars starts to weigh on people’s perceptions of economic growth. From a demand standpoint, I think that’s a risk.”

“We’re still in this turbulent time in terms of where exactly this lands and how it settles out,” Woods said of the tariffs. “Our perspective is we’re trying to keep a level-headed voice in the conversation” and voice concerns about how a trade war could impact the oil and gas business.

“These are global businesses, and we compete globally,” he said. “Free trade underpins the strength of those businesses and our competitiveness as a U.S. company.”

Taking a look at rig activity in the unconventional basins, the only real gainer for the week could be found in the the Oklahoma’s Sooner Trend of the Anadarko Basin mostly in Canadian and Kingfisher counties, aka STACK, which saw a two-rig addition to 43. The overall Permian Basin count stood pat at 474, even as sub-basins added one and dropped another to offset.

In the loss column, the gassy Haynesville Shale declined by three rigs to 50, while the Eagle Ford Shale and Williston Basin each dropped two rigs to 80 rigs and 54 rigs, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |