Markets | NGI All News Access | NGI Data

Bullish EIA Natural Gas Storage Miss Offset by Bearish Revision; Futures Retreat

The Energy Information Administration (EIA) on Thursday reported a below-consensus natural gas storage build for the week ended June 22, but prompt month futures pulled back a few cents as the market reacted to a revision that increased the prior week’s reported net build by 4 Bcf.

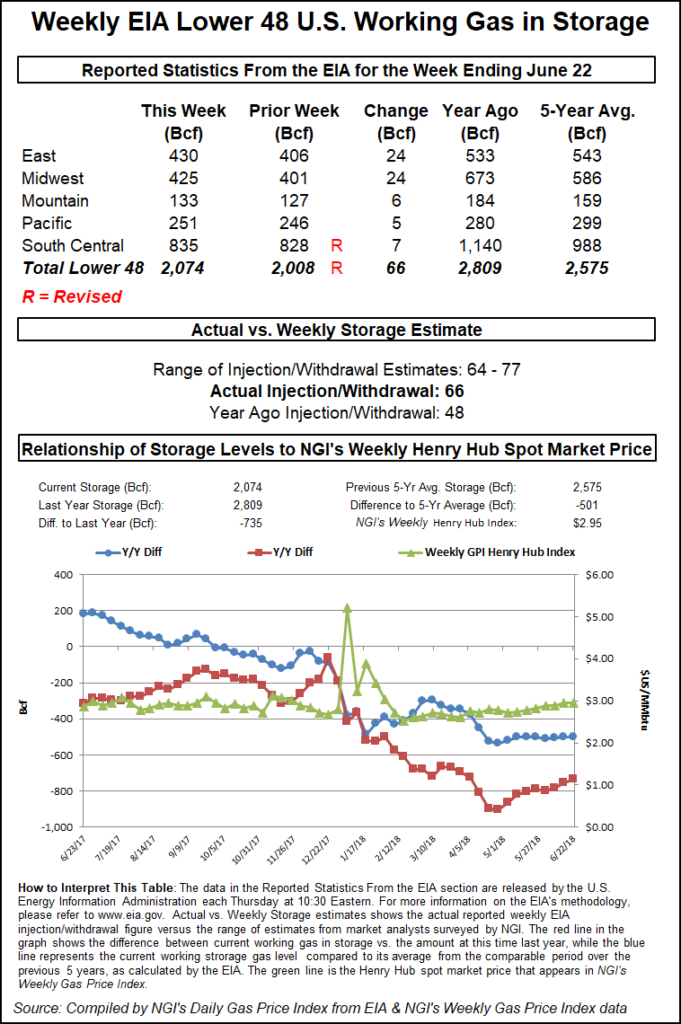

EIA reported a net 66 Bcf injection into Lower 48 gas stocks for the period, on the leaner side of market expectations leading up to the report. Last year, EIA recorded a 48 Bcf injection, and the five-year average is a build of 72 Bcf.

But the otherwise-bullish injection figure in this week’s report came with an asterisk. EIA said a reported revision “caused the stocks for June 15 to change from 2,004 Bcf to 2,008 Bcf. As a result, the implied net change” from June 8 to June 15 increased to 95 Bcf, higher than the 91 Bcf build the agency published in last week’s report.

Bespoke Weather Services said the revision effectively neutralized any bullish implications of the leaner-than-expected build.

“Storage levels are now estimated to sit at 70 Bcf above where they were estimated at this time last week,” Bespoke said. “The print over the past week is supportive, indicating significant weather-adjusted power burn tightening we had observed. Yet this reclassification indicates that previously, when heat was not as strong, we were even looser than expected, and on a two-week basis are not tight.

“This data is not yet bearish, as burns remain tight, but as they loosen” and long-range heat tapers off “downside arrives.”

Indeed, the report seemed to temper the market’s enthusiasm for the August contract, which had gained momentum earlier in the morning, climbing above $3.01 in the minutes leading up to EIA’s report.

But minutes after the EIA data crossed trading desks at 10:30 a.m. ET, August had dropped into the $2.980-2.985 area. Just after 11 a.m. ET, August was trading around $2.971, down about a penny from Wednesday’s settle.

Prior to the report, the market had been looking for a build in line with the five-year average. A Reuters poll of 25 industry traders and analysts had produced a tight 64 Bcf to 76 Bcf injection range with a 71 Bcf consensus expectation.

Working gas in underground storage stood at 2,074 Bcf as of June 22, versus 2,809 Bcf last year and five-year average inventories of 2,575 Bcf. Week/week, the year-on-year storage deficit shrank from 757 Bcf to 735 Bcf, while the year-on-five-year deficit increased slightly from 499 Bcf to 501 Bcf, EIA data show.

By region, the largest weekly builds were reported in the East and Midwest, which each returned 24 Bcf to the ground. In the Pacific, 5 Bcf was injected, while 6 Bcf was injected in the Mountain region. The South Central — where the revision to last week’s inventories was reported — saw a net build of 7 Bcf for the week ended June 22, with a 13 Bcf injection into nonsalt offsetting a withdrawal of 6 Bcf from salt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |