NatGas Cash Strong on Summer Sizzle; July Futures Expire Just Shy of $3

With summer beginning to kick into high gear, natural gas market watchers are eager to see whether periods of prolonged heat can provoke enough cooling demand to put a dent in robust gas supply and nudge prices higher.

In its swan song as prompt month, the July natural gas futures contract on Wednesday made a run at a $3-plus expiration before going off the board at $2.996, up 5.7 cents from Tuesday.

In the physical next-day natural gas market, Wednesday’s action was mostly on the plus-side of the ledger, with a vast majority of U.S. points gaining from a nickel to around 30 cents. The only abstainers from the bullish party were found in the Rockies and California, where declines from a few pennies to nearly 30 cents could be found. NGI’s National Spot Gas Average climbed 4 cents to $2.62/MMBtu.

Lower 48 natural gas demand may crack the summer-to-date high by Friday with even stronger gains starting to show up in next week’s forecast, according to an analysis conducted by Genscape Inc. on Wednesday.

“Genscape mets are forecasting Lower 48 population weighted [cooling degree days] will rise to as much as 24% above normal by Saturday and remain elevated through the end of next week,” Genscape senior energy analyst Rick Margolin said. “Accordingly, Genscape Daily S&D is projecting demand to rise from [Wednesday’s] estimated 64.6 Bcf/d to a high of 67.2 Bcf/d by Friday. Last summer, demand did not top the 67 Bcf/d mark until mid-July.”

He added that power burns are expected to increase by about 4.1 Bcf/d by Friday from Wednesday’s 33.1 Bcf/d.

On the supply side, Genscape unit SpringRock estimates show Lower 48 production finally holding steady above 79 Bcf/d, although Wednesday’s estimate is nearly 0.74 Bcf/d below Monday’s record high, which was a tick short of 80 Bcf.

“Top day volume declines versus Monday are largest in the Gulf region (specifically Northern Louisiana), Texas, and East: all down” more than 0.2 Bcf/d each, Margolin said. “Permian production is showing a roughly 140 MMcf/d retreat.”

Turning attention to the futures arena, following July’s sub-$3 termination, all eyes are now focused on the August contract, which finished Wednesday’s regular session at $2.981, up a nickel. August’s first real prompt-month test will take place Thursday morning with the Energy Information Administration’s natural gas storage report for the week ended June 22.

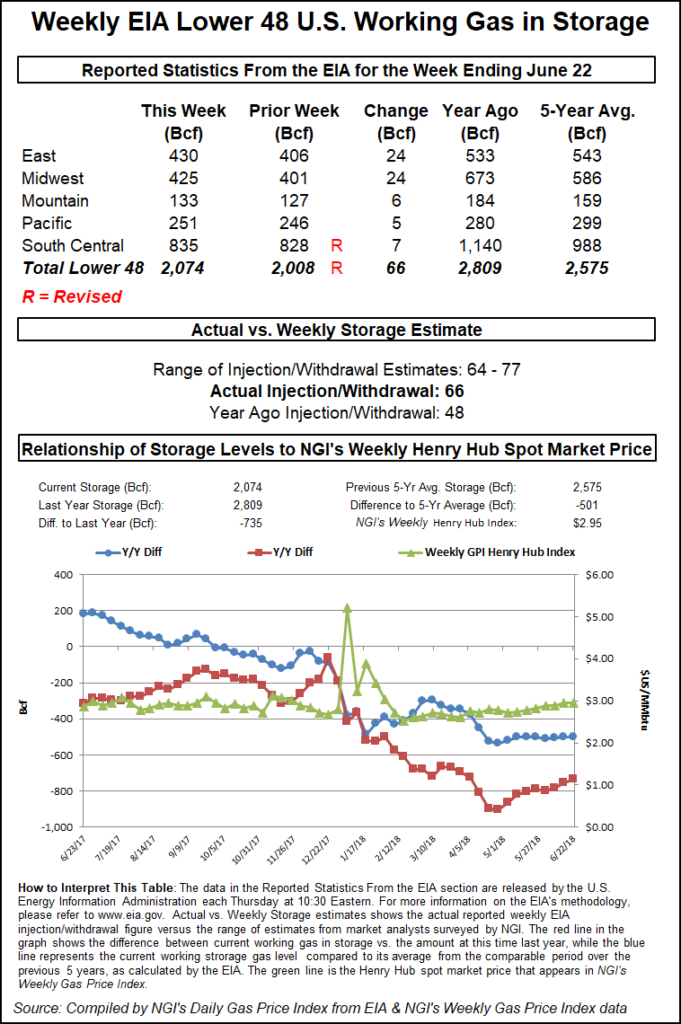

Indeed, after two bearish storage injections in a row, the market is looking ahead to Thursday’s inventory report. Mobius Risk Group said the injection is expected to be 70 Bcf, which would imply relatively flat year-on-year (y/y) demand growth and would be consistent with the previous week’s reported injection of 91 Bcf.

A Reuters poll of 25 industry traders and analysts produced a tight 64 Bcf to 76 Bcf injection range with a 71 Bcf consensus expectation. The number revealed Thursday will be compared to last year’s 48 Bcf build and a five-year average injection of 72 Bcf.

Looking at the larger storage picture, Mobius said an additional 1 Bcf/d of production growth from this point through the end of the storage injection season would still leave end-of-injection season storage levels at less than 3,600 Bcf, assuming flat y/y demand and normal temperatures.

In the physical market, the largest gains could be found in the Northeast, where Algonquin Citygate added 23 cents to average $2.81, and Transco Zone 6 NY tacked on 29 cents to average $3.02.

The largest decline was in California. While SoCal Citygate added 19 cents to average $3.71, SoCal Border Average was headed in the opposite direction, shedding 29 cents to $2.44.

Points in the Rocky Mountains were down on average, mostly by a few pennies. Exceptions included Stanfield, which recorded a 21-cent drop to average $1.66, while Northwest Sumas gave up 28 cents to $1.47 and Kingsgate tumbled 70 cents to average 83 cents on the day.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |