Infrastructure | E&P | NGI All News Access

Natural Gas Declines Drive U.S. Rig Count Lower as OPEC Spurs Oil Markets

Driven by a drop in natural gas-directed drilling, the U.S. rig count fell for the second week in a row after seven units exited the patch, according to data released Friday by Baker Hughes Inc. (BHI).

The United States dropped six gas-directed units and one oil-directed unit to fall to 1,052 active rigs for the week ended Friday, up from 941 a year ago, according to BHI. Five directional units packed up, along with two horizontal units. Three rigs departed on land, along with two in the offshore and two in inland waters. The Gulf of Mexico fell by one rig to 18, down from 21 a year ago.

Canada saw its rig count continue upward for the week, adding 16 oil units and five gas units to grow its tally to 160 (170 a year ago).

The combined North American rig count ended the week higher at 1,212 units, versus 1,111 units at this time last year, according to BHI.

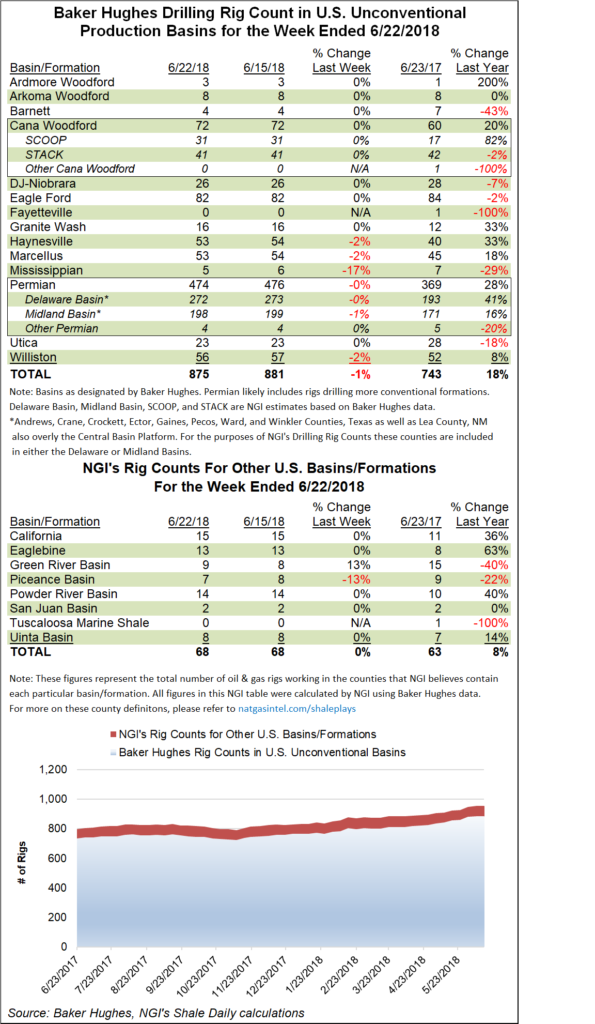

No major basins tracked by BHI posted weekly gains, with net losses in the Permian Basin (down two to 474 units), and in the Haynesville Shale, Marcellus Shale, Mississippian Lime and Williston Basin, which each dropped one rig.

Among states, Alaska saw two rigs return to action to end at nine, while Wyoming added one rig to finish at 26.

Louisiana posted the biggest net weekly decline at four to finish with 56 active units, down from 67 a year ago. Oklahoma saw two rigs exit the patch, while Colorado, North Dakota, Pennsylvania and Texas each finished lower by one, according to BHI’s breakdown.

The week’s natural gas drilling declines come as production is expected to continue rising. Analysts with IHS Markit said in a recent report that domestic gas production is forecast to increase by nearly 8 Bcf/d in 2018, or 10%.

“Altogether, U.S. production is expected to grow by another 60% over the next 20 years,” researchers said in “The Shale Gale Turns 10: A Powerful Wind at America’s Back.” Additionally, an estimated 1,250 Tcf of U.S. supply was found to be economic below $4.00/MMBtu Henry Hub, versus an estimate of 900 Tcf in 2010.

Meanwhile, crude oil markets on Friday were processing the news that the Organization of the Petroleum Exporting Countries (OPEC) secured a compromise, albeit modest, that effectively will add about 600,000 b/d to the market, or around 0.5% of global supply.

New York Mercantile Exchange West Texas Intermediate prompt-month futures were trading about $3 higher Friday at around $68.62/bbl.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |