Regulatory | Infrastructure | NGI All News Access

Cheniere’s 1.44 Bcf/d Midcon-to-Gulf Coast Project Gets Favorable FERC EIS

FERC on Thursday issued a final environmental impact statement (EIS) for the Cheniere Energy Inc.-backed Midcontinent Supply Header Interstate Pipeline (MIDSHIP) Project, putting the 1.44 Bcf/d Anadarko Basin-to-Gulf Coast transmission project a step closer to authorization.

Echoing the draft EIS issued earlier this year, the Federal Energy Regulatory Commission determined that construction and operation of MIDSHIP, under development by Cheniere affiliate Midship Pipeline Co. LLC, “would result in some adverse environmental impacts, but impacts would be reduced to less-than-significant levels” through proposed and recommended mitigation measures. More than half of the project is to be sited on or near existing rights-of-way.

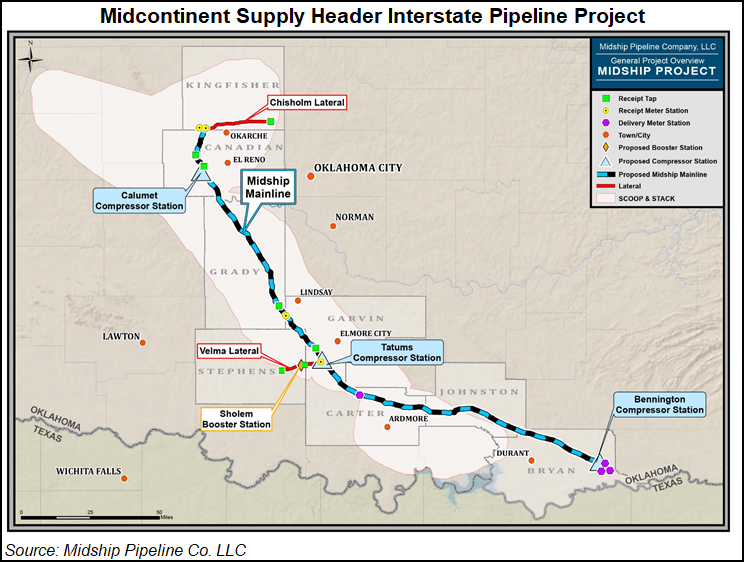

MIDSHIP filed for a FERC certificate for the pipeline last year after securing enough support through precedent agreements. The pipeline would tap supplies from Oklahoma, including from the STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) and SCOOP (South Central Oklahoma Oil Province). Supply would be delivered to Gulf Coast and Southeast markets via interconnects with existing pipelines near Bennington, OK.

The mainline would comprise 199.7 miles of 36-inch diameter pipeline in Oklahoma’s Kingfisher, Canadian, Grady, Garvin, Carter, Johnston and Bryan counties, along with a 20.5-mile, 30-inch diameter lateral in Kingfisher County, a 13.8-mile, 16-inch diameter lateral in Stephens, Carter and Garvin counties, and 0.1-miles of 24-inch diameter tie-in piping in Canadian County, according to FERC. The project also proposes three compressor stations and a booster station totaling 118,400 hp, along with receipt and delivery meters and other associated facilities.

MIDSHIP has binding commitments from Devon Gas Services LP, Marathon Oil Co., Gulfport Energy Corp. and Cheniere’s Corpus Christi Liquefaction LLC totaling 825 MMcf/d.

Corpus Christi Liquefaction is developing a liquefied natural gas (LNG) export project in South Texas at an existing regasification terminal on the La Quinta Channel on the northeast side of Corpus Christi Bay in San Patricio County. Cheniere in May moved forward with plans to build a third train at the site with each of the project’s three trains expected to have a nominal production capacity of about 4.5 million metric tons/year.

Cheniere placed itself in the vanguard of Lower 48 LNG exports in 2016 with the startup of the first export project, the Sabine Pass LNG facility in Cameron Parish, LA. Dominion Energy Inc. followed suit this year when it placed the Cove Point facility along the Chesapeake Bay in Lusby, MD, into service.

With analysts calling for domestic natural gas supply to continue ramping, the industry is expected to lean on a wave of LNG export capacity from the Lower 48 to balance supply over the next few years, putting pipeline access to the Gulf Coast and Southeast region where many of the proposed export terminals are located at a premium.

The United States is forecast to become one of the world’s largest LNG exporters within the next half-decade. IHS Markit expects domestic LNG export capacity to more than double in the next five years, reaching at least 10 Bcf/d by 2023.

An analyst with NextEra Energy Resources recently offered a similar forecast for domestic LNG growth, though she cautioned that U.S. players could face an uphill climb competing for the next wave of expansions expected to be needed to meet global demand by the mid-2020s.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |