Mexico’s Jaguar CEO Says Myriad Onshore Opportunities Tied to Partnering with Communities

A Mexico upstart exploration and production company formed as the country’s energy reform took hold is finding that building industry and community alliances should ensure decades of work ahead.

The energy reform begun four years ago still is being finessed, but for CEO Javier Zambrano, who runs Jaguar Exploracion y Produccion de Hidrocarburos SAPI de CV, the company is taking the challenges and turning them into opportunities. He shared some insight at the 4th Mexico Gas Summit held earlier this month in San Antonio, TX.

Jaguar, a unit of Grupo Topaz, was created with a “mandate to explore onshore mature fields” with other operators, Zambrano said.

Last year, Jaguar cleaned up in Rounds 2.2 and 2.3 in partnership with Calgary-based Sun God Resources by winning 11 of the 24 blocks on offer. In May, Jaguar agreed to partner with Vista Oil & Gas SAB de CV, the first alliance between two Mexico-based companies under terms of the 2013-2014 reform.

However, energy reform is still in its early stages, with more challenges ahead, Zambrano said. Those challenges may take time to overcome, but Jaguar is not a short-term company, he added.

“There’s a lot of opportunity there, but private investment is a little bumpy. We created a team of talented Mexican geoscientists to evaluate the rounds, and in 2015 we participated in the first onshore round unsuccessfully.” However, “we learned a lot in the process. We kept going and in Rounds 2.2 and 2.3 we were successful. We’re happy with the results.

“We now are operating and producing from five of those 11 blocks, and we are…working toward activating the other six fields.”

To date, 46 onshore blocks have been awarded to private companies, with an estimated 436 million boe of prospective resources and about $600 million of committed investments through Rounds 1.3, 2.2 and 2.3, he said. The 46 blocks were awarded to 51 companies as consortiums or single-operated companies, with 39 won by Mexican-based operators, five U.S.-based producers, five Canadian producers and two Chinese companies.

“This goes to show the interest that the global community has had in Mexico,” Zambrano said. “This is just the beginning.”

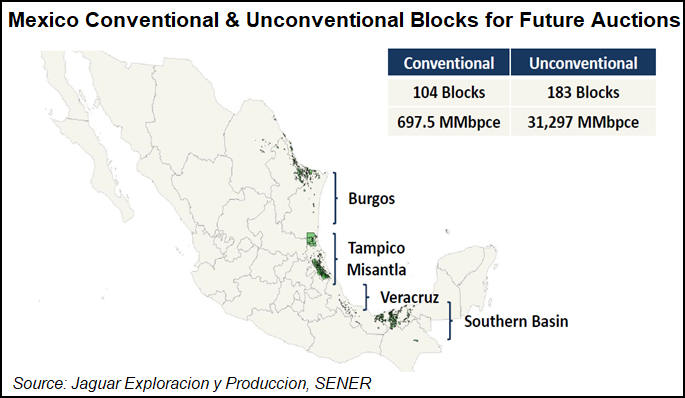

He explained that the five-year plan of the energy ministry, SecretarÃa de EnergÃa, i.e. Sener, indicates 104 conventional blocks will be up for bid in future auctions that hold close to 700 million boe, along with 183 unconventional onshore blocks holding an estimated 32 billion boe.

The official resource estimates are “conservative,” and he expects to see a “nice surprise” in higher estimates once seismic imaging and initial drilling is completed in the onshore blocks within the Burgos, Tampico-Misantla, Veracruz and Southern basins.

What potential producers need from the government to keep making investments, he said, is more certainty about the fiscal terms of the blocks offers, access to infrastructure and capital markets and stable regulation.

“Those are, I think, the main variables that will lead to successful or unsuccessful rounds.”

Some “improvements” need to be made to lower exploration fees “because you have big blocks that have to pay a lot of taxes and fees upfront without having any production, a deterrent for some production” as it may discourage “serious” investments.

Overall, there are “signs progress has been made.” The bidding rounds to date have been held “with the utmost transparency…That’s always an incentive for private companies to invest.”

There still is “a lot of paperwork…which is kind of a hassle,” but regulators “understand the challenges and are working toward solutions…There is a willingness from government agencies to work with us. And they have been very open to feedback.”

With the regulatory structure on track, exploration activity by outside parties should increase. “The more the merrier,” Zambrano said of potential competition. “Private investment in the upstream enables and maximizes the development of onshore fields,” which in turn increases “production, reserves, the government’s take and energy independence.”

Communities and Security

Zambrano said he’s often quizzed about how the company deals with Mexico’s “communities and security” as many areas are poor and the crime rate is high. The company hasn’t had an “incident in six months, but that doesn’t necessarily mean it doesn’t impact our operations.”

While Jaguar has yet to begin “heavy drilling,” which may entail seven-day, 24-hour operations, “you have to adapt…It’s manageable.”

Jaguar is finding that working closely with local and state authorities is the best solution.

In many prized oil and gas areas onshore, exploration companies often are in communities suffering from high rates of unemployment and they need “more and better schools,” Zambrano told the audience. There is “demand and the need for basic health care” and many citizens lack access to clean drinking water. Overhanging all of it is organized crime in some of the poorest areas.

“These are all complicated issues, but all of these issues have a solution,” Zambrano said. “That also represents an opportunity…to engage with the community and act as a good neighbor, not only because we want to build, but also because it’s good business to be a good neighbor if you are going to be there for 25 or 30 years…With the right approach, we see these issues as opportunities for companies to engage.”

For example, to work in the Burgos Basin, which is in the state of Tamaulipas, Jaguar is actively engaged with community leaders, who in turn help connect the company for “needs to be done.”

Jaguar also has approached community leaders in other areas where it works as “it’s important to have local support,” Zambrano said.

It’s “knowing who to call and how to react as special circumstances arise,” he said.

A few months ago, he said the company was approached by a person “with a semi-automatic weapon” who offered to protect the workforce in return for payment.

“It’s sad to say,” but in some areas, business long has been done that way. “You cannot do that. You cannot do that,” he said. “That’s something that does not scare Mexicans that have dealt with this.” However, understanding a community and having a relationship with its leaders can help bridge any issues.

While some regions lack access to good schools and the unemployment rate may be high, the country overall “has a well educated and globally competitive workforce, with vast talent in the Mexico oil and gas industry,” the Jaguar CEO said.

Jaguar’s “main source” for talent includes former employees of state-run Petroleos Mexicanos, as well as experts from the Mexico Petroleum Institute and academia who have “extensive experience” in the basins and the fields.

Still, there is room for improvement in other areas, including in the oilfield services (OFS) sector. While many OFS operators are offering support, “there is room for improvement there as well,” Zambrano said. Many OFS operators “typically work for one customer and tend to work one way and have one mindset only,” he said. The sector “could benefit” from more competition from international companies, as in the United States.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |