Weekly Natural Gas Prices Rise on Heat; Maintenance Leaves Permian Prices in the Dust

Persistent hot weather in the southern and central United States kept the pressure on regional prices this week, while a string of maintenance events led to wild swings in other markets. The NGI Weekly National Spot Gas Average rose 5 cents to $2.63.

Pricing hubs in the Permian Basin posted the most substantial declines for the June 11-15 period after a revision to El Paso Natural Gas’ maintenance schedule led to a cut of over 200 MMcf/d of flows through the “Waha GE” constraint point in Permian West Texas, Genscape said.

This location tracks volumes moving west near the Waha hub and has been substantially limited for several months due to an ongoing force majeure repair event. A separate meter replacement event that began Tuesday had its associated operating capacity reduction revised, changing the operating capacity limit to 152 MMcf/d from 272 MMcf/d. This point averaged around 350 MMcf/d of flows in the previous month, Bernardi said.

On Thursday, a force majeure on Tennessee Gas Pipeline (TGP) was declared at Station 1 (near Agua Dulce in South Texas) and Station 9 (near Victoria, TX) due to pipeline anomalies. The force majeure went into effect immediately and is to last until further notice. TGP stated the estimated capacity impact to be 100 MMcf/d through Station 1, and up to 225 MMcf/d through Station 9.

Nominations through the NET Mexico pipeline dropped to 439 MMcf/d on June 15 from 485 MMcf/d on June 13; a total change of only 46 MMcf/d. Similarly, nominations through Station 9 dropped 612 MMcf/d on June 15 from 666 MMcf/d on June 13, a total change of 55 MMcf/d. Nominations through Station 1 seem unaffected at the moment, Genscape natural gas analyst Vanessa Witte said.

Meanwhile, Texas Eastern Transmission plans to conduct a station outage at its Joaquin compressor station in East Texas between Tuesday (June 19) and July 7, resulting in no available capacity at this station for the duration of this outage. As much as 163 MMcf/d has flowed southwest from this compressor station in the last month, although flows did reverse in late May due to a separate maintenance event.

“Production in this area could flow into M1 on the 24” Line, but since there is little demand in Northern ETX/Southern M1, it is also likely that producers reroute to other pipes,” Genscape natural gas analyst Josh Garcia said.

El Paso-Permian weekly prices dropped 23 cents to $1.95, while Waha plunged 30 cents to $1.94. Every other pricing location in West Texas and southeastern New Mexico posted similarly steep drops.

Rockies prices also declined this week even regional production declined considerably due to steep drops at the Lancaster meter on Colorado Interstate Gas (CIG). This location represents receipts onto CIG from the Lancaster processing facility operated by Anadarko Petroleum Corp. in Weld County, CO.

After averaging 384 MMcf/d in the previous two weeks, Monday’s volumes dropped to 26 MMcf/d. Early cycle data on Tuesday showed a receipt of exactly 0. A representative for CIG confirmed to Genscape that this reduction was due to “customer activity,” not a constraint on CIG’s side.

Three other meters in the Denver-Julesberg Basin also posted noteworthy day/day declines in early cycle data for Tuesday, totaling a loss of another 190 MMcf/d, according to Genscape. One of these three, the Platte Valley (Narco to CIG) location, is usually inversely correlated with the Lancaster meter. When receipts at one drop off, receipts at the other pick up, Bernardi said. “But this Platte Valley point has actually done the opposite following the recent Lancaster nomination decrease, declining 108 MMcf/d day/day. Two other Weld County receipt points from DCP Midstream onto CIG also dropped a combined 50 MMcf/d day/day,” he said.

CIG DJ Basin prices averaged 8 cents lower at $2.14, while Kingsgate prices were down 7 cents to $1.92.

Meanwhile, mild temperatures pulled the rug out from under SoCal City-gate prices late in the week, although prices for the entire June 11-15 period averaged 15 cents higher at $3.07.

“This doesn’t look like anything other than a normal weather-driven price change, with recent moderately higher demand likely to ease off with much milder weather in the forecast for southern California this weekend,” Genscape Inc. natural gas analyst Joe Bernardi told NGI.

Indeed, AccuWeather showed daytime temperatures in Los Angeles were expected to top out in the low 70s on Saturday and the upper 60s on Sunday after climbing into the low 80s on Friday.

Near-term Heat Enough to Support July Natural Gas

Weather remained front and center this week for Nymex gas futures as heat in both the near term and long term was enough to keep the July contract relatively steady this week in the face of a shocker storage report. The Nymex July contract climbed 7.3 cents from June 11-15 to reach $3.022.

The latest weather guidance increasing heat to close out the month even though the models continue to struggle on where the core of a hot upper ridge will set up to end June, NatGasWeather forecasters said.

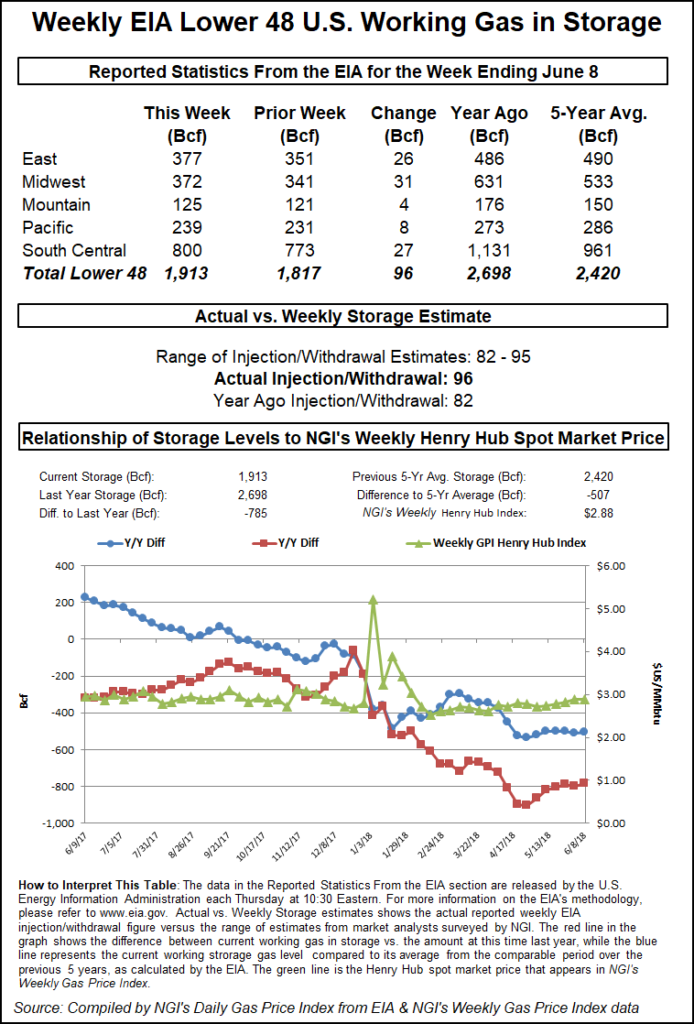

Even without the clarity in the long-range weather outlooks, traders appeared to remain concerned about ongoing storage deficits and the potential impact any lingering heat would have on them. The Energy Information Administration (EIA) on Thursday reported a 96 Bcf build into storage inventories for the week ending June 8. The reported build was considerably higher than even the most bearish of expectations.

“This indicates that much of the looseness last week was not holiday demand destruction but rather loosening in power burns we have been observing, a trend that has continued even into this week,” Bespoke Weather Services chief meteorologist Jacob Meisel said.

Nymex July natural gas futures initially appeared to take the surprise build in stride as the prompt month barely budged after the storage report’s 10:30 a.m. release.

“Prices didn’t fall that much. We were at $2.97 when the number came out, then we dropped a penny,” INTL FCStone’s Tom Saal said. By 11 a.m. ET, the Nymex July contract had dropped to its low of the day at $2.93 before regaining some ground to settle relatively flat compared to Wednesday’s settle.

Market consensus was around a build in the upper-80 Bcf range. EBW Analytics favored a slightly smaller build, while Bespoke Weather Services projected a 90 Bcf injection. Kyle Cooper of ION Energy Services expected a 93 Bcf build, and a Bloomberg survey had a range of 82-95 Bcf, with a median expectation of 90 Bcf. A Reuters poll also had a range of 82-95 Bcf, with a median expectation of 90 Bcf.

Saal said Thursday’s late-morning trading action was likely due to high-frequency traders that don’t necessarily care about such a large discrepancy in storage estimates versus the actual reported build. “The market is groping along now. There’s only so many things it can react to,” he said.

On a technical basis, such a price reversal following a bearish EIA print is “rather impressive”, especially as it was led by the fall strip that has been particularly weak as of late, Bespoke said.

Still, balances remain loose enough that even with limited storage levels it will be hard to rally prices without at least some risk of long-term heat, Meisel said. Most guidance, however, does still show this heat arriving by month’s end and “is part of the reason we continue to see dips as buying opportunities, even as power burns struggle to tighten at all on a weather-adjusted basis (in fact, if anything, there may have been a touch more loosening) and EIA data misses bearish.”

And if heat can indeed return before production recovers from maintenance-related cuts, then prices would easily be able to make a move towards $3.05, he said.

With storage rising to 1,913 Bcf, inventories are 785 Bcf less than last year at this time and 507 Bcf below the five-year average of 2,420 Bcf.

Looking ahead, further reductions in the storage deficit should be seen during the next couple of weeks, and as such, it will be interesting to see how well the market holds up, Mobius Risk Group said.

“While fundamentally there does not appear to be a reason for retesting support at the $2.75 mark, a series of 3 Bcf/d reductions in the inventory deficit might rattle those with long exposure,” Mobius said.

Turning to the crude oil market, prices ended the week more than $1 lower at $65.06/bbl as the market counts down the days until the June 22 meeting of the Organization of Petroleum Exporting Countries.

The meeting is being held in part, to discuss the possibility of key producers raising output to compensate for potential supply shortfalls stemming from U.S. sanctions against Iran and the loss of Venezuela output. The supply reduction put in place has pulled since last year about 1.8 million b/d total from the market.

“Rising political pressure from the United States along with Russia’s desire to restore oil output will basically assure us that OPEC will announce a production increase,” The PRICE Futures Group senior energy analyst Phil Flynn said.

The devil will be in the details, he added. Iran and Venezuela, as well as some other OPEC countries, are against an increase in output. “If Russia and Saudi Arabia agree to bring on production more slowly to appease the hawkish members, then the market will be woefully undersupplied. If they do raise, it takes away most of the global spare capacity,” Flynn said.

Spot Gas Swings on Heat, or Lack Thereof, in Some Regions

Turning back to natural gas markets, hot weather on tap for key demand regions lifted spot prices in most of the country. NatGasWeather said a hot upper ridge would dominate the central and southern United States, with high temperatures reaching the upper 80s to 100s making for strong demand. Heat was expected to also spread across the Midwest late Friday and Saturday and then into the East from Sunday-Tuesday with highs reaching the mid-80s to mid-90s. The West was expected to see mild conditions as rain showers pushed inland.

Indeed, SoCal Citygate spot gas plunged 66 cents to $2.30, resulting in a drop of more than $1 during the past two days. Genscape Inc. natural gas analyst Joe Bernardi attributed the steep declines to nothing more than weather given the extremely mild conditions on tap for the week in California. Highs in Los Angeles were forecast by AccuWeather to stall in the low 70s on Saturday and the upper 60s by Sunday before inching back to the low 70s for Monday. Highs on Friday were forecast in the low 80s.

Malin also fell considerably as spot gas averaged $2.12, down 21 cents on the day. PG&E Citygate held up relatively well as it slipped just 4 cents to $3.01.

Meanwhile, Texas points were a mixed bag as a new round of maintenance events in the region were announced. Genscape reported that a force majeure on Tennessee Gas Pipeline (TGP) was declared Thursday at Station 1 (near Agua Dulce in South Texas) and Station 9 (near Victoria, TX) due to pipeline anomalies. The force majeure went into effect immediately and is to last until further notice. TGP stated the estimated capacity impact to be 100 MMcf/d through Station 1, and up to 225 MMcf/d through Station 9.

Nominations through the NET Mexico pipeline dropped to 439 MMcf/d on June 15 from 485 MMcf/d on June 13; a total change of only 46 MMcf/d. Similarly, nominations through Station 9 dropped 612 MMcf/d on June 15 from 666 MMcf/d on June 13, a total change of 55 MMcf/d. Nominations through Station 1 seem unaffected at the moment, Genscape natural gas analyst Vanessa Witte said.

Meanwhile, Texas Eastern Transmission plans to conduct a station outage at its Joaquin compressor station in East Texas between Tuesday (June 19) and July 7, resulting in no available capacity at this station for the duration of this outage. As much as 163 MMcf/d has flowed southwest from this compressor station in the last month, although flows did reverse in late May due to a separate maintenance event.

“Production in this area could flow into M1 on the 24” Line, but since there is little demand in Northern ETX/Southern M1, it is also likely that producers reroute to other pipes,” Genscape natural gas analyst Josh Garcia said.

Given the various restrictions in the region, El Paso-Permian spot gas plunged 28 cents to $1.60, and Waha dropped 30 cents to $1.58. Houston Ship Channel, meanwhile, rose 3 cents to $3.01, and Carthage picked up a nickel to reach $2.85.

Meanwhile, an explosion Friday morning on the Southern Star Central Gas Pipeline in Harvey County, Kansas, led to a force majeure on line segment 130. Southern Star spot gas had a muted reaction to the incident, increasing only a penny to $2.40.

In the East, Appalachia points shifted a few cents either direction for the most part as Columbia Gas Transmission LLC (TCO) has restored a small percentage of flows on Leach XPress about a week after issuing a force majeure in response to an explosion on June 7 in Marshall County, WV that shut down the 1.5 Bcf/d line.

The company has restored a segment allowing the Stagecoach-LXP meter to return to service. Nominations through the meter ramped to 107 MMcf/d shortly after TCO announced the repair and reached 190 MMcf/d on Friday (June 15). It’s unclear how long it will take to repair the rest of the line.

In addition to Stagecoach’s return to service, the LXPSEG meter operational capacity was listed as having “no restriction,” according to Genscape. Eureka, Gibraltar III and Majorsville production points remain at 0 capacity, as well as the LONEOAKA and TMLXP throughput meters.

Columbia Gas spot gas tacked on 3 cents to reach $2.84, while Tennessee zone 4 Marcellus slipped 2 cents to $2.10. Dominion South, meanwhile, jumped 12 cents to $2.45.

In the Northeast, Algonquin Citygate shot up 52 cents to $2.97 as Algonquin Gas Transmission said it would perform a one-day maintenance event on June on its Southeast compressor station near the New York and Connecticut border. Operating capacity will be set at 864 MMcf/d, representing a cut up to 312 MMcf/d, including no-notice, Genscape said.

When looking strictly at flows through the Southeast compressor station itself (i.e. without no-notice), this restriction would represent a 265 MMcf/d cut, compared to reported month-to-date flows.

“This will likely cut deliveries into Iroquois at Brookfield. Algonquin has a few options to source supply from TGP and Maritimes” downstream of the Southeast compressor station, as those interconnects are not currently full, Garcia said.

Still, the event will likely place additional bullish pressure on any weather-boosted demand generated by the forecasted high temperatures. Genscape meteorologists’ forecasts have New England population-weighted CDDs reaching 15.9 on Monday, roughly 13 CDDs greater than the climatological normal for this time of year for this region. In fact, Genscape’s ISO-New England desk said “that we may be on track to see the highest demand week of the year (thus far) next week,” Garcia said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |