Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Colorado, New Mexico Drilling Permits Buoy Onshore and Eagle Ford Accelerating, Says Evercore

U.S. land permitting fell 6% month/month in May to 4,302, but permitting still increased by nearly one-third from a year ago, led by New Mexico and Colorado, according to Evercore ISI.

Analyst James West and his team each month compile U.S. drilling permit data from the major states and federal agencies. Most onshore permits are issued several months before drilling begins, while offshore permits are often secured even further in advance.

Through June 8, domestic land permitting stood at 1,783, with the four-week rolling average of 935 sharply lower than the multi-year high of 1,159 realized in March. For the second straight year, May permits improved year/year (32%), but they declined sequentially on filing/protocol changes in California.

“A 91% increase in Colorado permitting drove the recent week/week improvement, and the four-week rolling permit/week run rate implies a June total well above 4,500, which would imply the first instance of fifth straight 4,000-plus permit months since the second half of 2014,” West said.

“From a momentum standpoint, year/year improvement in year-to-date permitting is most robust in the Rockies (Colorado/Wyoming) and the Permian (New Mexico/Texas), where the Rockies permitting cadence has tripled and the Permian pace has grown nearly 50%.”

During May, weakening permit numbers in North Dakota, off 7% month/month, and in Wyoming, where permits fell by 13%, pressured the totals, but New Mexico climbed 3% and Colorado saw a 29% jump in permitting from April.

Texas permitting fell 2% in May “on the back of a 20% decline the month before,” West said. “With over half of the working U.S. oil rigs, Texas continues to be the single-most important state in terms of evaluating the magnitude and direction of U.S. permitting trends.”

The domestic rig count growth has surprised to the upside year-to-date, and the “slight pullback” in the four-week permit average at the end of May from a multi-year high of 1,159 to 1,076 “still bodes well for continued strength in the rig count,” West said.

The drilled but uncompleted (DUC) well count should continue to build “as operators run their planned rig programs unabated,” but Evercore warned that completions could be curtailed because of oil and gas takeaway constraints looming in the Permian.

“However, even if no completion activity pullbacks are planned, the DUC inventory should continue to grow, given the sheer undersupply of fracture crews versus the current rig count.”

Evercore’s team did some digging on Permian data, the “concern du jour” because production is overtaking pipeline capacity.

“Sure enough, the four-week Permian permitting average has declined steadily through 2Q2018, roughly inline with the U.S. total, which indicates to us that a modest rig count pullback could be in the cards for West Texas,” West said.

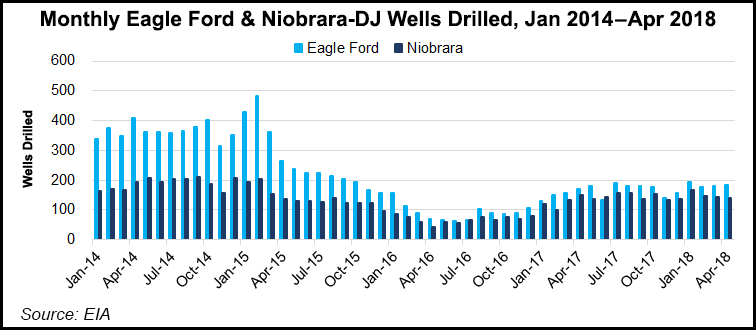

The Niobrara formation along with the Bakken and Woodford shales “have incurred similar declines” as the Permian, which may relate to spuds outpacing completions, higher service costs and seasonality, among other things.

However, Eagle Ford Shale permitting has accelerated through the first half of the year, “consistent with commentary” by exploration and production companies to rotate away from West Texas to the Eagle Ford, which is closer to midstream, refining and export capacity on the Gulf Coast.

“We also surmise that the Bakken, Woodford and Niobrara could be buoyed by additional production growth rotation out of the Permian, although it is also possible that pipeline bottlenecks in the Midcontinent/elsewhere could also make it difficult to rationalize accelerated production growth in these auxiliary basins,” said West.

The overarching takeaway, he said, is U.S. production growth may be challenged in all of the major unconventional plays, “which bodes well for global oil prices and should be acknowledged with capital inflows to international/offshore geomarkets.

Once the takeaway capacity issues are resolved, there should be another scramble for completion assets as the broader oil patch plays catch up.

“Currently, we see minimal risk to the U.S. land rig count, despite the concerns surrounding Permian pipelines,” West said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |