E&P | NGI All News Access | NGI The Weekly Gas Market Report

Drilling Advancements Help Double Colorado Natural Gas Production, Boost Economy

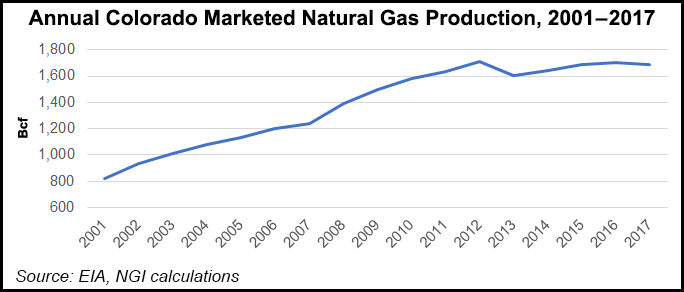

Driven by oilfield technology advances, Colorado has doubled its natural gas production since 2001, boosting the state’s economy in the process, according to a report by the Colorado Petroleum Council, a division of the American Petroleum Institute (API).

As the nation’s fifth largest gas producer and seventh largest oil producer, Colorado’s 53,000 active wells in 11 of the nation’s largest gas fields have created more than 232,000 jobs and $330 million in severance tax revenues (2014), contributing $1.2 billion in public revenues and an economic impact (in 2015) of $31.4 billion, according to “Progress and Opportunity: Colorado Natural Gas and Oil.”

The report, issued on Monday, attempts to tie together an “essential role” for the oil and gas sector in supporting Colorado. It noted that in the recent 10-year period (2006-2016), oil production quadrupled through breakthroughs in directional drilling and hydraulic fracturing (fracking).

According to the 46-page report, Colorado’s oil and gas development has provided widespread opportunity, spurring lower energy costs and increased development. Advancement has taken place in the context of a robust regulatory environment.

“More than 60% of Colorado’s energy comes from natural gas or another petroleum product,” the researchers noted.

Colorado natural gas consumption has shot up 30% in recent years, while the state has the third largest gas reserves in the country and output has doubled since 2001.

“The industry takes seriously its environmental responsibility, supporting strong standards and regulations that have helped contribute to our nation’s energy renaissance,” said API’s Tracee Bentley, executive director of the Colorado council.

The report breaks out well growth by county, and notes that in the past 15 years, Colorado has experienced a 125% increase in gas wells and a 116% increase in gas production. Weld County in the Denver-Julesburg Basin accounted for 43.1% of gas production and 41% of the wells.

Colorado’s oil and gas development has taken place in a “robust regulatory program governing every facet of the industry.” The authors cited the Colorado Department of Public Health and the Environment for “vigorously” monitoring community health improvement. “Its recent report concluded that the state meets its strict air quality standards.”

In the midstream, Colorado is a distribution hub for the West, providing 17,760 miles of interstate gas pipelines and 16,320 miles of interstate oil lines. The combination represents 4% of the nation’s total. As of 2013, Colorado also had 58,200 miles of intrastate gas pipelines, including gathering lines.

Regarding the ongoing issue of drilling near residential and commercial development, the report cited two recent studies that showed there has been no major negative economic impact on local communities from the well sites. A 2014 study from Colorado State University found that the impact of fracking on housing values in Weld County was minimal.

“Its findings indicate that though drilling activity within a half mile of a house offered for sale could reduce its price by 1%, these impacts were only short term and only for urban areas,” the report said. “While drilling had a minor, short term-negative impact, the county-wide effect on housing values would be positive due to an expectation of increases in natural gas and oil employment.”

Complementing the Weld County study, a 2016 study examined property values and the distance to natural gas and oil development across seven Colorado counties, finding “no definitive evidence that hydraulic fracturing significantly, positively or negatively, impacts home values.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |