Natural Gas Futures Curve in Limbo as Market Awaits Storage Data; Spot Prices Fall With Temps

July natural gas prices held fairly steady throughout Wednesday as technical support balanced out cooler weather outlooks before fresh storage data from the U.S. Energy Information Administration (EIA) hit the market on Thursday morning.

Spot gas prices were generally lower on cooler trends in the next few days, particularly in the East. The NGI National Spot Gas Average fell 1 cent to $2.58/MMBtu.

The Nymex July futures contract traded in a tight range of less than a nickel before ultimately settling at $2.896, up six-tenths of a cent on the day. The intraday action saw the prompt-month move in and out of positive territory as the tug-of-war between cooler outlooks for the end of June and mounting storage deficits continued.

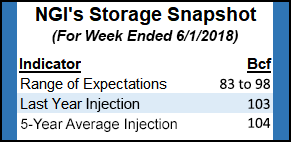

With tomorrow’s EIA storage report reflecting the Memorial Day holiday week, which typically corresponds with a strong storage injection, market estimates were wide ranging, between 77 Bcf and 98 Bcf. Kyle Cooper of ION Energy was projecting a 97 Bcf injection, while a preliminary Bloomberg survey had a median estimate of an 89 Bcf build. A Reuters poll pointed to a 90 Bcf injection, and the Intercontinental Exchange EIA Financial Weekly Index settled Wednesday at an injection of 94 Bcf.

Last year, a build of 103 Bcf was reported by the EIA, and the five-year average build stands at 104 Bcf. There were 71 cooling degree days (CDDs) last week compared with 44 CDDs at the same time last year and a 30-year normal of 42 CDDs. In the week ended May 25, some 96 Bcf was added to storage.

The EIA will release its weekly storage report at 10:30 a.m. ET on Thursday.

INTL FCStone Financial Inc. Senior Vice President Tom Saal told NGI that the story for tomorrow is the Memorial Day weekend. “If we got over 100 Bcf, I wouldn’t be surprised. That weekend should produce a big number.” His official estimate, however, is for a 97 Bcf injection.

Given the amount of gas the Lower 48 is producing, the market should be seeing 100+ Bcf injections, Saal said. “If they’re under 100 Bcf, and you’re already seeing storage on the low side, then it should put some upward pressure on prices when we get some more seasonal hot weather.”

But even an on-target reported injection from the EIA could see prices trend lower toward a $2.82 test, especially if current weather trends hold, Bespoke Weather Services said. The midday Global Forecasting System weather model was slightly warmer trending, but still not hot enough across the northern half of the country June 16-20, according to NatGasWeather.

“Some of the data continues to suggest the hot ridge has the potential to regain strength near or just after June 21, but with much more to prove,” the forecaster said. Until the mid-June upper ridge looks to expand in strength or size, weather sentiment is likely to be viewed as “neutral, potentially slightly bearish.”

Bespoke’s Meisel said that once long-range heat risk arrives, $2.82 (or $2.75) could become buying opportunities, but with current weather risk appears still lower.

NatGasWeather forecasters said, however, that the background dynamic remains bullish as storage deficits are set to remain near or more than 500 Bcf through the next three to four storage reports. Any prolonged sell-off would be unlikely until strong production shows signs of meaningfully reducing deficits.

Indeed, while some industry experts lowered their end-of-October storage targets and have opined that the market does not need as much storage as it has historically thanks to robust production growth, Saal said having adequate storage levels ahead of the peak winter season remains critical. “The supply has to be where the demand is. That Marcellus supply didn’t keep prices from going higher in January. We still pulled a lot of gas out of storage.”

If the United States experiences another winter like last, and storage inventories start the season lower, “then we might get higher prices. You can’t assume shale production is going to bail us out in the wintertime,” Saal said.

In the near term, weather patterns for late June and early July will become of greater importance in determining whether the warm southern U.S. upper ridge will expand to include the North and East, NatGasWeather said. The failure to do so will be bearish, but if the ridge can build into the Midwest and East, then that would provide some bullish support, although the most recent data is mixed between the two scenarios, the firm said.

In the meantime, the spot gas markets trended lower as near-term temperatures are forecast to drop significantly in the eastern U.S. The jet stream is forecast to dip across the Northeast until nearly the end of next week, according to AccuWeather.

“The overall pattern up until around June 13-15 will favor a northwesterly flow aloft which should send multiple weak storms through the region with chilly air in their wake,” according to AccuWeather Meteorologist Paul Pastelok.

Depending on the exact track of a storm on tap for this weekend, a thorough soaking may occur from the Great Lakes to the mid-Atlantic. Dry air may salvage the latter part of the weekend over the upper mid-Atlantic, and could keep rain away from central and northern New England, AccuWeather said.

The warmest part of the period is likely to be Friday to Saturday of this week, when highs will be well into the 70s to the lower 80s from Detroit to New York City and well into the 80s over the Ohio Valley and lower mid-Atlantic corridor, the forecaster said.

Given the cooler forecast, most pricing hubs posted losses on the day. In Appalachia, Tetco M3 delivery dropped 14 cents to $2.42, and Dominion South fell 11 cents to $2.36. New England’s Algonquin Citygate was down 12 cents to $2.51.

Dominion Transmission (DTI) announced an unplanned outage at its Rural Valley Station in Southwest Pennsylvania. While the outage has cut about 40 MMcf/d of receipts at four locations, the losses are being made up for by gains on neighboring DTI gathering meters in that region and West Virginia, according to Genscape Inc.

During the Rural Valley outage, receipts will be limited to primary only at four locations, including two interconnects with Equitrans. Consequently, receipt nominations at these affected locations fell 40 MMcf on June 5, from 53 MMcf/d to 12 MMcf/d; declining even further for today’s gas day, Genscape’s Allison Hurley said.

DTI’s Pennsylvania statewide pipeline sample production, however, is actually higher for Wednesday, by approximately 100 MMcf/d day/day. DTI’s system-wide pipeline sample production is up 60 MMcf/d day/day, the Louisville, KY-based company said.

Meanwhile, Texas Eastern Transmission announced late Tuesday that it had resolved the unplanned outage on its Danville compressor station in Kentucky, restoring 100 MMcf/d of operational capacity through its 30” Southern line. This only restored capacity to levels set by the Mt. Pleasant to Gladeville maintenance event, which is set to last until June 15, Genscape’s Josh Garcia said.

Some market hubs in the East moved against the pack. Tennessee Zone 4 Marcellus spot gas shot up more than 30 cents to $2.09; it traded in a wide range between $1.95 and $2.18. In the Northeast, Transco Zone 6-NY traded at $2.67, up 4 cents on the day.

In the Rockies, Northwest Pipeline-Wyoming Pool spot gas prices fell 6 cents to $2.26, while Opal slipped 7 cents to $2.31. Kingsgate next-day gas held right at the $2 mark, averaging a penny lower on the day.

California market hubs ended the day in the red as well, with most points sliding less than a nickel. Malin shed 3 cents to hit $2.40, while PG&E Citygate dropped 2 cents to $2.95. SoCal Citygate posted a more substantial decline of 10 cents, averaging $2.82.

In the Midcontinent, the overall trend of small losses continued. NGPL-Midcontinent slipped a nickel to $2.40, and Panhandle Eastern dipped 4 cents to $2.35.

Meanwhile, Natural Gas Pipeline Co. of America declared a force majeure on the northbound Segment 11 in southwestern Kansas beginning June 6 and lasting until further notice. Operational capacity will be limited by 300 MMcf/d.

Scheduled volumes through Segment 11, represented at “Sta103 to Sta106”, dropped from 990 MMcf/d to 695 MMcf/d day/day, according to Genscape. “Cooling demand for the Midwest region is projected to be rather low in the next few days, although could increase considerably later this week,” Genscape’s Vanessa Witte said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |