E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Matador Ensures Permian Natural Gas Takeaway Via GCX, Third Parties

Dallas-based independent Matador Resources Co. has joined several Permian Basin peers in securing better takeaway terms for its natural gas production.

The exploration and production (E&P) company has a firm gas sales agreement with an affiliate of Kinder Morgan Inc. for 110,000-115,000 MMBtu/d based on Houston Ship Channel pricing via the the 2 Bcf/d Gulf Coast Express (GCX) Pipeline. The agreement would begin on the in-service date of GCX, which is set to ramp up in October 2019 to carry gas to the Agua Dulce hub in South Texas.

“The GCX project’s proximity to the Gulf Coast and Gulf Coast natural gas pricing, including Houston Ship Channel, are attractive because of the access to industrial users like refineries and petrochemical facilities, utilities, liquefied natural gas exports and Mexican markets,” management said.

Matador also secured agreements with third-party gas transportation companies, including El Paso Natural Gas Co. LLC, for firm takeaway for all of its anticipated volumes in the Wolf and Rustler Breaks asset areas of the Delaware sub-basin, which represents about 93% of output. Matador produced 82.8 MMcf/d from the assets in 1Q2018.

The agreements “should also ensure firm takeaway capacity for anticipated Matador and other producers’ natural gas volumes” at the tailgate of Matador’s midstream affiliate San Mateo Midstream LLC’s Black River Processing Plant in the Rustler Breaks area.

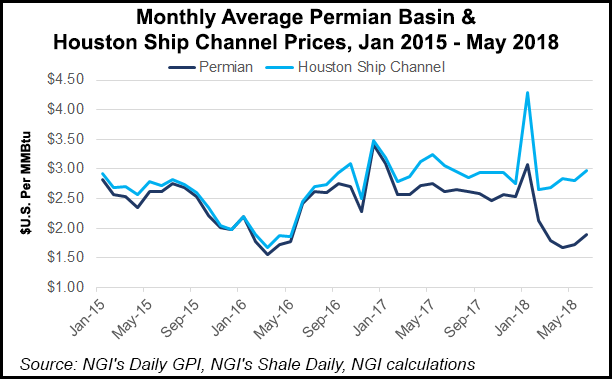

“As a result, Matador believes it already had sufficient firm capacity and flow assurance for its existing and anticipated natural gas production volumes prior to entering into the firm sales agreement.” The agreement “provides further flow assurance and significantly reduces Matador’s exposure to the Waha basis differential, which has widened significantly in the last year.”

Many Permian E&Ps during first quarter conference calls attempted to assuage investors concerned about widening differentials in the Permian for oil and gas including Apache Corp., Cimarex Energy Co., PDC Energy Inc. and Pioneer Natural Resources Co.

Matador also said San Mateo has completed its expansion of the Black River cryogenic processing plant in Eddy County, NM, which brings total capacity 260 MMcf/d. In addition, San Mateo completed a natural gas liquids (NGL) pipeline connection at the tailgate of the Black River plant to the NGL pipeline owned by Epic Y-Grade Pipeline LP.

Matador said it further mitigated its exposure of Delaware oil production by entering into swaps. As of last Friday (June 1), it had about 55% of its anticipated Delaware oil output hedged for the rest of 2018, limiting its differential at a weighted-average price of minus $1.02/bbl.

In addition to its takeaway update, Matador touted results from four recently completed and turned-to-sales wells in the Permian, two in the Arrowhead area and two in the Wolf.

The SST 6 State No. 123H and No. 124H wells are the “two best Second Bone Spring wells drilled and completed by Matador to date in the Arrowhead asset area,” management said. The 24-hour initial production rates were 435-490 boe/d per 1,000 feet of completed lateral. Both wells had completed laterals of more than 4,200 feet.

Matador’s annual meeting, which is to be webcast, is scheduled on Thursday in Dallas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |