Mexico | NGI All News Access | NGI Mexico GPI

Oil, Gas Reserves in Mexico Boosted by Pemex and Foreign-Led Discoveries

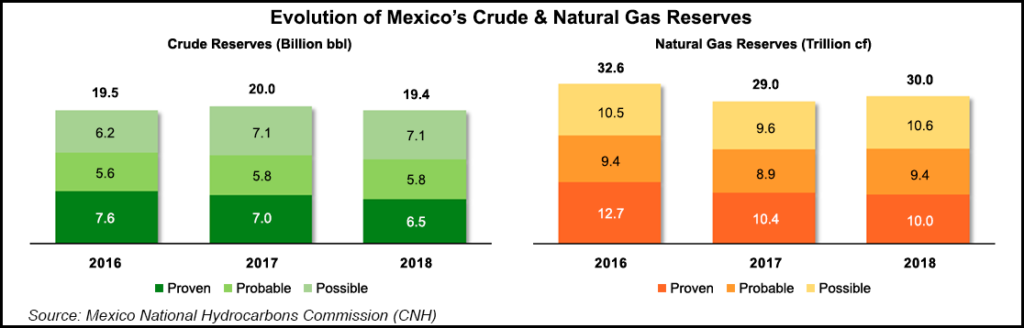

Mexico’s proven, probable and possible, i.e. 3P, reserves of oil and natural gas slipped to 25.5 billion boe at the end of 2017, down from 25.9 billion boe a year earlier, the National Hydrocarbons Commission (CNH) reported last week.

There is a marginal trend toward more natural gas reserves and lower oil reserves, the CNH said.

Total gas reserves at the end of 2017 came to 30 Tcf, versus 29 Tcf in 2016, including 10 Tcf proven, 9.4 Tcf probable and 10.6 Tcf possible.

The increase in gas reserves is attributed to several discoveries by state-owned Petroleos Mexicanos (Pemex), including Nobilis, Hok, Octli, Suuk, Teekit Profundo, Valeriana and Ixachi. Also included in the higher reserve count were discoveries following the second auction of Round One that were awarded to Eni Mexico, a unit of Italy’s Eni SpA, and Hokchi Energy, a unit of Argentina-based Pan American Energy.

Eni and Hokchi reported increases in blocks one and two, respectively, that were almost double or higher than those officially estimated before the auction. They were also the first private sector contributions to the nation’s hydrocarbon reserves.

According to the most recent estimates reported to the CNH, Eni Mexico’s block now has possible reserves of 369.1 million bbl of crude, 237.3 Bcf of natural gas, and possible reserves of 626.2 million bbl of crude and 436.3 Bcf of gas.

Hokchi’s block is reported to have probable reserves of 177.1 billion bbl of crude and 54.7 Bcf and possible reserves of 178.1 million bbl of crude and 54.8 Bcf of gas.

Taken together, the figures from the Round One blocks of Eni and Hokchi, along with the Pemex discoveries, amounted to an addition of probable reserves of 578.3 million bbl and 1.19 Bcf, plus additional possible reserves of 1.03 billion bbl and 2.6 Bcf.

Meanwhile, according to the most recent production figures for April, Pemex crude oil production stood at 1.89 million b/d, a year/year drop but a 1.2% sequential increase from 1.86 million b/d in March.

April natural gas output excluding nitrogen by Pemex was 3.02 Bcf/d, down by 9.7% from 3.35 Bcf/d in April 2017, but up by 3.4% from 2.93 Bcf/d in March.

Production of both oil and natural gas by the competitors of Pemex that have arrived since the 2013-2014 energy reform thus far is statistically marginal.

Sales of gasoline and other petroleum products by Pemex fell sharply in April by 16% year/year. Gasoline output alone stood at 276,828 b/d.

Once upon a time, Mexico stood to win heavily from a surge in international crude prices. However, that’s no longer the case, given the continued decline in oil production and its sharp growth in consumption.

However, Energia a Debate’s editor and publisher David Shields said “the good news is that the increase in prices is like a tide that lifts all boats in the energy industry, including those that are scarcely profitable.”

Upstream operators such as Eni and Hokchi are beginning to reap benefits of the 2013-14 energy reform. “Better prices should boost the exploration and production opportunities now open to private capital,” said Shields. “After the spendthrift years in which production by Pemex was steadily reduced, possibilities that are being opened up can now make deepwater production a reality.”

As for natural gas, the stagnant prices currently can make the fuel more competitive with other sources for power generation. “That can open new niches, for example in motor vehicles with fleet users,” Shields said. “Mind you, the bureaucracy that besets permitting continues to hold many projects back. The regulators must cut down on red tape.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |