Natural Gas Futures Slide as Triple-Digit Build Expected; Spot Prices Mixed

After Tuesday’s sell-off, natural gas futures slid further Wednesday ahead of a weekly government storage report expected to show a triple-digit storage injection, though more supportive afternoon weather guidance offered some hope for the bulls.

In the spot market, the volatile SoCal Citygate pulled back after spiking Tuesday, while Midwest prices rebounded somewhat with more heat on the way; the NGI National Spot Gas Average notched 2 cents to average $2.52/MMBtu.

The July contract followed a 6.0-cent decline Tuesday by falling another 1.8 cents Wednesday to settle at $2.885. July traded as high as $2.906 and as low as $2.867 on the day. August dropped 1.8 cents to settle at $2.905.

The afternoon European model came in “hotter than the previous two runs to add several” cooling degree days (CDD) “throughout the 15-day forecast, including the important second week of June,” NatGasWeather.com said Wednesday. While not as hot as the Global Forecast System, the European “did take a step in that direction. If the bulls wanted to use this as fodder, there’s certainly an opportunity.”

That said, markets might want to see more heat in the East or wait to see if the hotter midday trends hold overnight before making a move higher, according to the firm.

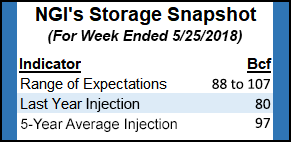

Meanwhile, estimates for this week’s Energy Information Administration (EIA) storage report show the market anticipating a triple-digit injection slightly larger than the five-year average.

A Reuters survey of traders and analysts on average predicted a 102 Bcf injection for the week ended May 25, with responses ranging from 88 Bcf to 107 Bcf. A Bloomberg survey produced a median 102 Bcf injection, with responses from 96 Bcf to 107 Bcf.

Last year EIA recorded an 80 Bcf injection, and the five-year average is an injection of 97 Bcf.

Late last week, The Desk’s Early View natural gas storage survey showed respondents on average anticipating a 102.3 Bcf build from this week’s EIA report, with a median of 101 Bcf. ION Energy called for a 105 Bcf build, while Price Futures Group estimated a build of 101 Bcf. The Intercontinental Exchange EIA Financial Weekly Index settled Tuesday at an injection of 100 Bcf for Thursday’s report.

Global research consultancy Energy Aspects issued a preliminary estimate for a 103 Bcf build this week.

Looking ahead to the next few reports, a 90-plus Bcf injection for the current week ending June 1 is possible “thanks to the long Memorial Day holiday weekend impacting the industrial sector gas and power demand,” according to Energy Aspects. “Beyond that, preliminary weather forecasts show storage activity near 80 Bcf for the following two reports” for the weeks ending June 8 and June 15.

“On average, that rate of injection will keep the market just over 1.0 Bcf/d looser year/year, below what is necessary in terms of ”latent demand’ for storage this injection season,” the firm said. “Thereafter, if summer heat materializes as forecast, late June additions could easily fall back toward the 50-60 Bcf weekly range.”

In terms of quantifying the recent hotter temperatures, May is expected to set a new record for U.S. population-weighted cooling degree days (CDD) going back to 1950, according to Gaithersburg, MD-based forecaster Radiant Solutions.

Over the Memorial Day weekend, Minneapolis saw a high of 100 degrees, the earliest triple-digit heat on record there, while Milwaukee saw its hottest May temperature on record at 95 degrees on Sunday, the firm said.

“May has been a month of frequent summer-like heat across much of the U.S., including key power regions such as MISO,” Radiant Senior Meteorologist Steve Silver said.

The heat should continue through the first part of June, focused over the Southwest and south-central United States. Texas should see sustained heat, including frequent highs in the 100s in cities like Dallas, according to Radiant.

“With the extreme heat coming much earlier this season across ERCOT, Dallas has the potential to surpass last year’s total of 100-degree days rather quickly this summer,” Silver said.

Genscape Inc. said Wednesday that it was still anticipating above-normal temperatures this week despite slightly cooler revisions to near-term weather forecasts.

“Genscape meteorologists are forecasting CDDs will continue increasing daily through Saturday to a peak of 93 CDDs versus a seasonal norm of 53 CDDs,” analyst Rick Margolin said. “The bulk of the above-normal temps are in Texas, the Midwest and Southeast/Mid-Atlantic, but we should see notable heat move into the Northeast markets by week’s end as well.”

Turning to the spot market, prices in the Midwest rebounded Wednesday as forecasts showed hotter temperatures in the region Thursday. Radiant Solutions was calling for highs in Chicago to reach 90 degrees Thursday before moderating Friday to highs in the low 70s. The firm’s forecast showed Cincinnati and Minneapolis with highs in the 80s Thursday, around 10 degrees above normal.

Chicago Citygate added 4 cents to $2.66.

“Remnants from Alberto will bring heavy showers over the eastern U.S. the next few days, while a second weather system over the Midwest will also bring showers with cooling,” NatGasWeather.com said in its one- to seven-day outlook Wednesday. “Texas and the Southwest remain hot with 90s and 100s as high pressure dominates. The Northwest into the Rockies will be mild due to weak systems sweeping through.

“This weekend into early next week will bring areas of showers across the northern U.S. with highs of 70s and 80s, while very warm to hot continuing over Texas and the Southwest.”

In the Southeast, Transco Zone 5 added a nickel to $2.96.

In the Northeast and Appalachia, prices were mixed amid moderate demand expectations in those regions. Genscape was calling for demand in New England to drop from 2.79 Bcf/d Wednesday to around 1.6 Bcf/d over the next two days. Appalachian demand was expected to decline from just over 9 Bcf/d Wednesday to around 7 Bcf/d Thursday and Friday.

Transco Zone 6 New York fell 7 cents to $2.72, while further upstream Transco-Leidy Line tumbled 13 cents to $1.14. Dominion South shed 2 cents to $2.40.

Rover Pipeline LLC on Wednesday again urged the Federal Energy Regulatory Commission to issue a number of in-service authorizations for remaining portions of its 713-mile, 3.25 Bcf/d Appalachian takeaway project as soon as possible.

The operator asked that FERC approve service on the Burgettstown Lateral, Majorsville Lateral, Supply Connector Line B and remaining Mainline B segments by 9 a.m. CT Thursday.

“With construction of pipeline and related facilities now complete, gas on the remaining facilities can begin to flow immediately,” the operator told FERC. “Given the substantial progress Rover has made toward restoration, and the commitment Rover has made to complete the restoration work, Rover respectfully submits that it is not in the public interest to prevent gas from flowing.”

The operator cited large inventory deficits and the need to refill storage in time for the 2018/19 heating season as a compelling reason to enable the additional volumes to flow on Rover, which has been transporting about 1.6 Bcf/d east-to-west across Ohio to interconnects with ANR and Panhandle Eastern.

“Approval of the requested Rover segments could account for roughly 28% and 17% of the daily storage injection deficit as compared to the five-year average and last year’s inventory levels, respectively,” Rover said.

Earlier this year FERC took issue with Rover’s failure to complete restoration work on time at its Mainline compressor stations 1 and 2.

“Rover stresses that it remains fully committed to completing all restoration work in the times set forth” in a supplemental filing submitted last week, the operator said Wednesday.

Management for Rover backer Energy Transfer Partners LP said during a May 10 earnings call that they planned to bring the remainder of the project into service by June 1.

In the West, the volatile SoCal Citygate dropped 54 cents to average $3.16 after spiking $1.34 in trading Tuesday.

The reason for Tuesday’s price spike was not immediately obvious, Genscape’s Margolin said early Wednesday.

Southern California Gas (SoCalGas) “system demand is up to about 2.27 Bcf/d, which — although higher than the holiday weekend — is not terribly greater than last week levels,” Margolin said. “Gas imports are up and have shifted somewhat to Rockies-originated molecules, but with demand not keeping pace the increase implies the incremental imports are going to storage. That is not confirmed, however, by the SoCalGas-reported injection number.”

The firm did observe an unexpected ramp-up in in-market power generation in the region that “brought some gas-fired units normally out-of-the-money into stack,” he said, though power prices were retreating Wednesday.

El Paso Natural Gas (EPNG) notified shippers Wednesday of a force majeure on its Line 2000 downstream of the Lordsburg Compressor Station.

EPNG “identified an anomaly on Line 2000” downstream of the Lordsburg compressor requiring the line to be shut in for repairs. “Consequently, the CIMARRON constraint point will be reduced to zero Dth/d” starting Thursday, according to the operator.

El Paso S. Mainline/N. Baja fell 3 cents to $2.25, while in West Texas, El Paso Permian finished even at $2.03. Elsewhere in West Texas, Waha dropped a nickel to $2.05.

As supply growth from the Permian Basin has driven steep discounts on Waha spot prices, “incremental demand — from exports to Mexico for gas-fired power generation as well as for power demand in Texas — has provided some relief for West Texas prices in recent weeks,” RBN Energy LLC analyst Sheetal Nasta said earlier this week. “But Texas power demand is seasonal and, while Waha’s exports to Mexico are expected to continue growing, it’s likely to be on a piecemeal basis.”

New takeaway will be needed to balance the Permian market longer term, Nasta said, and a number of new projects are in development.

“Nearly 4.0 Bcf/d of new pipeline capacity has been proposed to target the Agua Dulce/Corpus Christi area in South Texas,” with another roughly 4.2 Bcf/d planned to head to the Houston Ship Channel/Katy area and 2.0 Bcf/d proposed for takeaway to Gillis, LA, according to Nasta.

“…Based on these projects, we know that much of the incremental Permian supply growth over the next five years will head east to the Texas and Louisiana Gulf Coast. But which pipes get built will determine where along the coast all that gas will end up — South Texas, Louisiana or somewhere in between,” she said. “And that, along with the timing of” liquefied natural gas “export demand, will drive downstream prices at Agua Dulce, Houston Ship Channel and Henry Hub.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |