Bakken Shale | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Bakken Differentials in Sweet Spot, Says Whiting CEO

Price differentials are becoming increasingly favorable for Bakken Shale crude oil versus other major U.S. basins, Whiting Petroleum Corp. CEO Brad Holly said last week.

Sharing a panel with other energy executives last Thursday on the final day of the Williston Basin Petroleum Conference (WBPC) in Bismarck, ND, Holly and his colleagues outlined how the recent 2014-2016 global oil price crash spawned an outburst of innovation, efficiencies and profit-creating by Bakken operators, keeping oil production above 1 million b/d and pushing natural gas to record highs above 2 Bcf/d.

“Our intelligence tells us that up to $3 billion will be invested in the next 18 months to try to keep up with gas production,” Holly said.

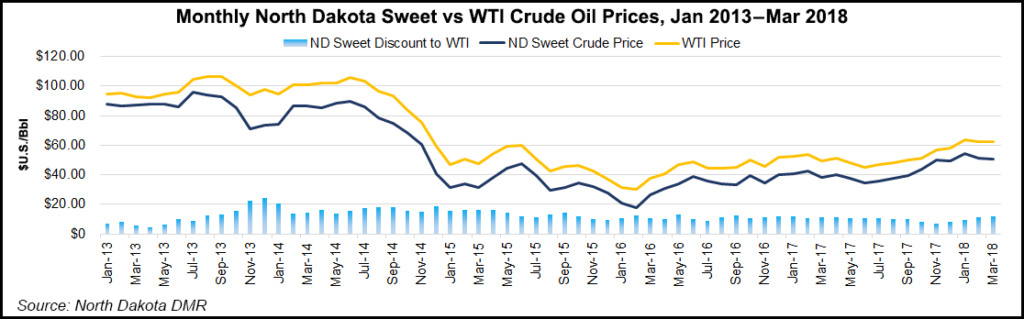

In mid-2017, Bakken oil price differentials were lagging far behind other basins, but the situation then reversed with the Permian Basin.

“Since that time the Bakken has performed very nicely on oil differentials,” Holly said. “Our differentials are hanging in there very nicely, which certainly creates a competitive advantage for this basin.”

Whiting’s differentials have steadily improved in the Bakken, creating “a huge difference for us,” improving steadily quarter/quarter. “Our differentials are competitive now with anywhere oil is being produced in this country.”

In terms of inflation, he claimed the Bakken also has enjoyed an advantage over Texas and Oklahoma, regions which have seen a 60% increase in rig activity since 2016.

“It is putting a lot of pressure on labor costs, sand, infrastructure, so to date the Bakken has enjoyed a slower, more controlled ramp and less cost pressure in our system,” Holly said.

Holly offered his “simple math” on what all the recent turnaround has meant in terms of per-barrel production. His numbers showed Whiting has enjoyed a cost reduction of about $5/bbl, and combined with an $8/bbl improvement in differentials and a $15/bbl commodity price hike, it’s added up to a $28/bbl uplift.

“We’ve seen a drastic difference that has taken the Bakken out of the middle of the pack to the top tier oil producing regions in the country right now,” Holly said.

Innovation also has allowed Bakken operators to come out of the price downturn “thriving” through big data analytics, according to ConocoPhillips’ Erec Isaacson, vice president for Rockies operations. He said big data has become “routine” in the industry.

Today’s $65/bbl oil is the new $100/bbl equivalent, Isaacson said. “One rig now is worth three rigs…We can’t let up, however, because there are some mixed signals out in the market” from the Organization of the Petroleum Exporting Countries and from global oil demand curves, which means “the world remains oversupplied.

“The key takeaway is we need to maintain resilience in the mix of continued global volatility.”

Oasis Petroleum Corp. CEO Tom Nusz said the company’s team of more than 360 Bakken employees is demonstrating resilience as one of the first operators to become cash flow positive coming out of 2016, following 15 years of drilling in North Dakota.

“We’re the fourth largest producer in the Bakken, and this year we will spend about $1 billion here, 75% of that in the upstream,” Nusz said.

With finding costs cut in half, Oasis margins in the Bakken are attractive and the company has “sector-leading” recycle ratios, Nusz said.

Oasis has about 500,000 acres in the Williston Basin and is adding gas processing and beefing up its service crews. With technology advances producers are moving beyond the core Bakken acreage, boosting prospects for the industry as a whole.

Every year, Nusz said, “We feel we are in a position now where we can grow in the mid-teens, and I’m very excited about that.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |