Markets | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Natural Gas Imports in March Climb 10.2% Year/Year

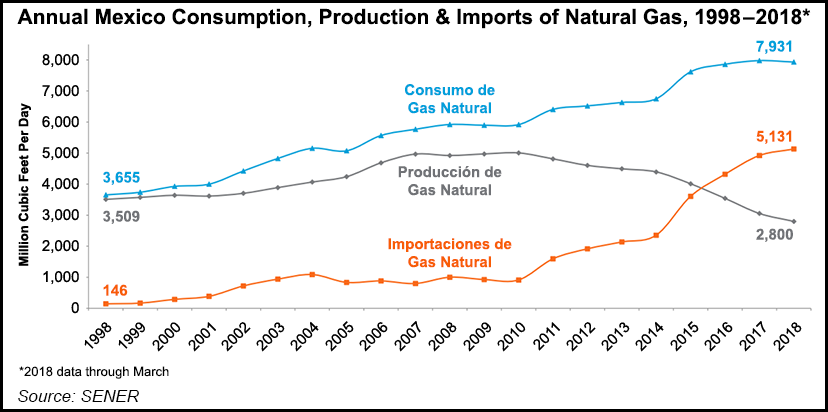

Mexico’s natural gas imports rose 10.2% year/year (y/y) in March, driven by a spike in liquefied natural gas (LNG) deliveries.

The country imported 5.14 Bcf/d during the month, compared with 4.66 Bcf/d in March 2017, according to the latest data from the Mexican Energy Ministry (Sener). The March 2018 import figure was down slightly by 1.2% compared to February, when Mexico imported 5.2 Bcf/d.

LNG supplied 818 MMcf/d of the imports, rising 60.4% y/y from 510 MMcf/d. Pipelines shipped the remaining 4.32 Bcf/d, up 4.1% compared with 4.15 Bcf/d in the year-ago month.

Mexico’s total supply of natural gas in March was 7.98 Bcf/d, according to Sener. Gas demand averaged 7.93 Bcf/d in 1Q2018, compared with 7.77 Bcf/d during the first three months of 2017.

Imports supplied 64.4% of Mexico’s natural gas in March. Excluding gas used in upstream activities by Petroleos Mexicanos (Pemex) and operators, imports account for an estimated 85% of the country’s marketable dry gas.

The Manzanillo LNG import terminal on the Pacific Coast in Colima state contributed 545 MMcf/d, compared with 500 MMcf/d in March 2017. The facility has operated at or near full capacity since last year.

The Altamira terminal, on the Gulf Coast in Tamaulipas state, operated at 39% capacity in March, injecting 273 MMcf/d versus 180 MMcf/d in the year-ago month. A third terminal on the Baja California peninsula has not supplied any gas to the Mexican market since mid-2016.

Mexico uses its LNG terminals for short-term system balancing and to complement shortfalls in pipeline imports from the United States.

The country’s LNG needs are expected to diminish after the start-up later this year of pipelines in the northwest and on the Gulf Coast.

The pending northwest pipelines are downstream from the U.S. border. Delays to these projects have constrained gas imports into Mexico from the Waha Hub in the Permian Basin.

Two major border crossings in the region, San Isidro and Ojinaga, received a respective 101 MMcf/d and 3 MMcf/d in March. The San Isidro crossing, near San Elizario, TX, includes the 1.1 Bcf/d Comanche Trail pipeline and the 570 MMcf/d Roadrunner Gas Transmission LLC. Ojinaga is fed by the 1.4 Bcf/d Trans-Pecos pipeline at Presidio, TX.

March deliveries at all border crossings into the northwest states of Sonora and Chihuahua averaged 707 MMcf/d, or 13.8% of all Mexican gas imports, according to the Sener data.

Most U.S. pipeline shipments into Mexico currently flow through the northeast region. NET Mexico shipped 1.81 Bcf/d in March, 42% of all piped gas and 35% of all Mexican gas imports. The 2.1 Bcf/d cross-border pipeline connects with the Los Ramones system in Tamaulipas state.

Kinder Morgan Inc.’s Mier-Monterrey pipeline was the second largest importer of the month at 490 MMcf/d, followed by the Arguelles border crossing with 432 MMcf/d.

Imports at Arguelles, which is on the border in Tamaulipas, reached a record level of 455 MMcf/d in February and have nearly doubled since December. Two pipelines deliver gas into Mexico at Arguelles: Energy Transfer Partner’s Arguelles Pipeline and the Kinder Morgan Border Pipeline LLC.

Energy Transfer Partners LP held an open season in September to contract the remaining 120 MMcf/d of Arguelles’ total capacity of 220 MMcf/d. Kinder Morgan is planning a 150 MMcf/d expansion for later this year on the 300 MMcf/d Border Pipeline.

Mexico’s domestic supply of gas continued its y/y slide in March, falling 11.5% to 2.84 Bcf/d. However, gas production rose 3.1% in the month/month comparison.

March gas prices in Mexico averaged 68.855 pesos/gigajoule (GJ), or $3.888/MMBtu, the energy regulator Comision Reguladora de Energia (CRE) reported in April. The March price is the lowest recorded since the CRE began publishing its national index last year, using transactional data reported by gas marketers operating in the country.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |