Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Loses Two Natural Gas Rigs; Oil Rig Count Surges to 859

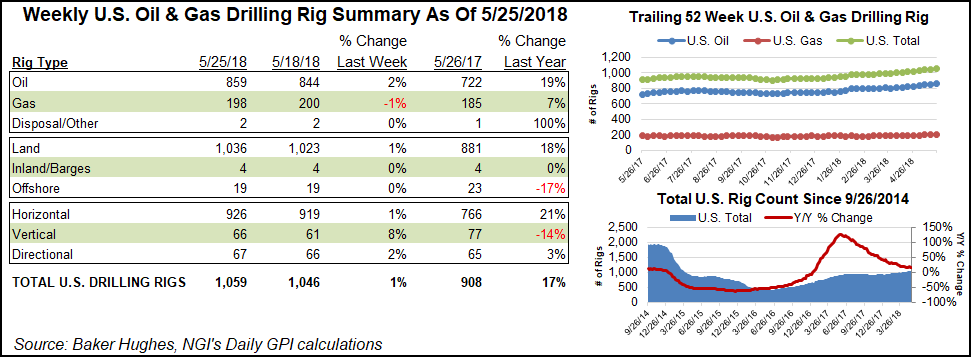

The United States lost two natural gas rigs for the week ended Friday May 25, but more than made up for it by adding 15 rigs on the oil side of the ledger, according to data from oilfield services giant Baker Hughes Inc. (BHI).

The U.S. rig count ended the week slightly higher at 1,059, a 17% increase compared with 908 rigs a year ago. Of those, 859 were oil rigs and 198 were natural gas rigs, BHI said.

Five vertical units, seven horizontal units and one directional unit were added, according to BHI. Thirteen rigs were added on land, while numbers in inland waters and the Gulf of Mexico remained unchanged.

Canada lost two for the week to finish at 81, down 2% from 93 rigs a year ago.

The combined North American rig count finished at 1,140, up 11 week/week and up from 1,001 active units in the year-ago period.

The Permian Basin led all plays with 11 rigs added during the week, according to BHI’s breakdown. The West Texas and southeastern New Mexico play finished at 478, up 32% from 362 active rigs at this time last year. A more detailed breakdown of BHI data by NGI’s Shale Daily showed four rigs added in the Delaware sub-basin, four added in the Midland sub-basin, and three more added in the rest of the Permian.

The Cana Woodford saw a net gain of one rig for the week to end at 73. Single rig additions were also made in the Ardmore Woodford, Barnett, Denver-Julesburg Niobrara, Eagle Ford, Marcellus, Mississippian and Williston. Declines were not reported in any play.

Among states, Texas saw the largest weekly increase, reaching 534 by adding nine rigs in the Permian surge. Alaska, Colorado and Oklahoma each added two rigs, while North Dakota and West Virginia each added a single rig.

The growth in Permian activity can be measured by other metrics as well. According to the Texas Workforce Commission (TWC), 3,400 upstream oil and gas jobs were added in April, making it the 17th consecutive month of upstream job growth in the state.

Texas has recovered 33% of jobs lost between the high point in employment in December 2014 and the low point in September 2016, TWC data show. During that time, employment in the Texas upstream sector has grown by 38,400 jobs.

“Record production in the Permian Basin is driving sustained job growth in Texas,” said Todd Staples, president of the Texas Oil & Gas Association. “Investment and innovation in the oil and natural gas industry are not only creating good jobs for Texans but also securing our economy, our environment and our future.”

In fact, Permian oil production is increasing at such a rate, some analysts say the associated, or free gas coming out of the play could push more gas-focused plays such as the Marcellus and Haynesville out of the picture.

Earlier in the week, Sanford C. Bernstein & Co. LLC. analyst Jean Ann Salisbury and her colleagues wrote that associated gas is making up an increasingly larger share of supply, enough to take care of domestic demand for years.

From 2021-2025, associated gas from the Permian alone could meet most domestic demand, “leaving little room for gas-driven basins like the Marcellus or Haynesville,” according to Bernstein.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |