Infrastructure | E&P | NGI All News Access

U.S. Adds One Natural Gas Rig as BHI Oil Count Finishes Flat

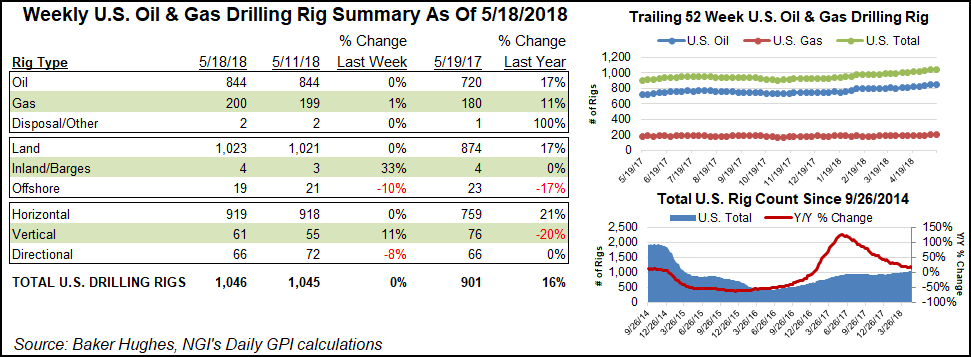

The United States added one natural gas rig for the week ended Friday as recent growth in oil drilling activity took a pause, according to data from oilfield services giant Baker Hughes Inc. (BHI).

The U.S. rig count ended the week slightly higher at 1,046, versus 901 rigs a year ago. Six vertical units and one horizontal unit were added, while six directional units left the patch, according to BHI. Two rigs were added on land and one in inland waters, while the Gulf of Mexico finished down two rigs to end the week at 18.

Canada added four rigs for the week to finish at 83, down slightly from 85 rigs a year ago.

The combined North American rig count finished at 1,129, up five week/week and up from 986 active units in the year-ago period.

Among plays, the Permian led the way with four rigs added during a week of mostly small adjustments, according to BHI’s breakdown. The West Texas and southeastern New Mexico play finished at 467, up 29% from 361 active rigs at this time last year.

The Cana Woodford saw a net gain of two rigs for the week to end at 72. A more detailed breakdown of BHI data by NGI’s Shale Daily showed three rigs added in the STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties), with one exiting the SCOOP (South Central Oklahoma Oil Province).

Declines this week among plays included the Eagle Ford Shale, the Mississippian Lime, the Utica Shale and the Williston Basin, which each saw one rig depart.

Among states, New Mexico (up three) and Texas (up two) saw the largest weekly increases, unsurprising given the activity in the Permian. Kansas also added a rig — the only active unit in the state as of Friday, according to BHI.

Alaska, Colorado, Louisiana, North Dakota and Ohio each saw one rig exit the patch during the week.

U.S. natural gas well production during 2017 climbed a staggering 35% year/year, pushed by efficiency improvements from three big shale plays, the Utica (78%), Haynesville (44%) and Marcellus (28%), according to a recent review by Sanford C. Bernstein & Co. LLC.

Bernstein analysts were surprised in their review of 2017 initial production (IP) rates versus 2016 figures for onshore gas production. They reviewed wells across the onshore, including in the Eagle Ford and Permian.

“Overall, we found that the average gas IP rate of wells was up 11% year/year,” said analyst Jean Ann Salisbury and her colleagues. “Part of the continuing improvement is due to higher oil IPs of associated basins driving further improvements in gas IPs.”

Meanwhile, natural gas and oil production out of the United States’ seven most prolific onshore unconventional plays will be higher in June than in May, according to the U.S. Energy Information Administration (EIA), continuing a trend dating back 18 months.

Looking at the Anadarko, Appalachian and Permian basins, and the Bakken, Eagle Ford, Haynesville and Niobrara formations, EIA said all seven plays are expected to see increased natural gas production in June compared with May, and total gas production from the plays is expected to reach 68.12 Bcf/d, a 1.6% increase compared to 67.03 Bcf/d in May.

Total oil production in the seven plays is expected to increase to an estimated 7.18 million b/d in June, a 2% increased compared to 7.03 million b/d in May, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |