OPEC Sees Murkiness in Global Markets, but Clear-Eyed on Surging U.S. Liquids Output

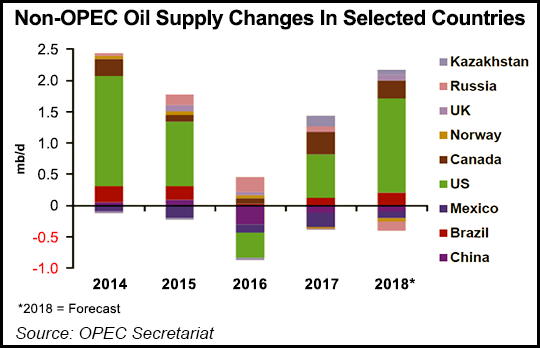

Global oil supply outside the cartel that makes up the Organization of the Petroleum Exporting Countries, i.e. OPEC, has recovered since contracting in 2016, but uncertainties remain about where the market may be headed through the rest of this year.

OPEC’s Monthly Oil Market Report (MOMR) issued on Monday noted that supplies by non-OPEC countries climbed by 0.87 million b/d in 2017 as prices increased. However, capital expenditures (capex) rose by only 2% year/year (y/y), and were down by about 42% from 2014 levels.

The “outlier,” as has been the case for the past few years, is the U.S. tight oil industry, where investments rose by more than 42% y/y in 2017, to about $138 billion. The second half of 2017 saw more expansion as crude oil prices strengthened, MOMR noted.

“Easy access to capital, cheap money and production hedging contributed to this trend,” researchers said.

U.S. crude oil output surpassed 10 million b/d last November as domestic tight oil supply continued to benefit from lower unit prices and more efficient operations. Estimated ultimate recoveries rose on average by 20% in key tight oil plays from the second half of 2016 to 3Q2017, while the average well cost per lateral length fell by more than one-third between 2014 and 2017, MOMR researchers estimated.

On a country-specific basis, about 86% of total non-OPEC supply growth last year came from the United States, followed by Canada, Kazakhstan and Brazil. Declines were seen in Mexico, China and the North Sea.

Non-OPEC supply this year now is forecast to grow by 1.7 million b/d y/y, with 89% from the United States. Canada, Brazil, the UK and Kazakhstan also are anticipated to grow.

OPEC is forecasting U.S. liquids production this year to increase by 1.5 million b/d, with 94% from tight crude and unconventional natural gas liquids, on increased investments and upgraded completion metrics, versus 90% in 2017.

“According to preliminary supply data for 1Q2018, the combined liquids supply in the U.S. and Canada increased by 1.8 million b/d y/y,” said MOMR.

Over the same timeframe, oil supply increased in Africa, Latin America, the Former Soviet Union and Asia Pacific countries that are members of the Organisation for Economic Co-Operation and Development (OECD). Meanwhile, production declined in OECD Europe, Other Asia and the Middle East.

“Globally, a total of 269 projects are anticipated to be approved in 2018, with 30 projects currently in final investment decisions — outside of tight oil — of which 54% will be onshore and 46% offshore, with Brazil showing the largest growth potential from new field start-ups,” according to OPEC.

Increased tight oil production and an increase in output from Canada and Brazil should further support non-OPEC supply toward the end of this year.

U.S. producers are facing pressure from shareholders to remain disciplined in capital spending and to ensure returns, which could come at the expense of increased expenditures. MOMR predicted total spending by non-OPEC operators this year would increase by about 3.5% from 2017 and by 8.1% in 2019.

“Global investment in shale — mostly in the U.S. — is projected to increase by 20% y/y in 2018 and then moderate to 16% in 2019,” according to MOMR.

However, the cartel’s experts also warned that geopolitical developments may continue to impact global oil supply in the months ahead. In addition, Trump administration initiatives could weigh on global markets. These include imposing certain tariffs on steel and aluminum products and trade negotiations with China.

“The area of trade tariffs must be closely monitored as the potential for tit-for-tat retaliations and continued uncertainty may impact growth negatively and could have more serious economic consequences,” according to OPEC. “This may then lead to rising global inflation, declining business sentiment, as well as other effects that could dampen ongoing global growth.

“The initiation of further sanctions on Russia and the withdrawal from the Iran nuclear deal are additional elements that may be a source of uncertainty in the future, impacting the U.S. economy and global trade.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |