CRC Moves from ‘Preservation’ to Mid-Cycle Growth After Elk Hills Deal, CEO Says

Still treading water in terms of earnings, Los Angeles-based California Resources Corp. (CRC) has ramped up capital spending plans in response to the continuing positive outlook for global oil prices and after gaining 100% access of California’s large Elk Hills oilfield.

During a conference call with analysts, CEO Todd Stevens said CRC plans to move from “preservation mode” to growth in the mid-cycle investment environment, increasing its capital expenditures (capex) to a range of $550-600 million as part of a transition to more of a growth mode.

The Occidental Petroleum Corp. spinoff started the year with capex plans in the $425-450 million range. Added capex takes into consideration added resources from a series of joint ventures inked over the past six months.

Production in the first quarter was 123,000 boe/d, the mid-point of guidance, but down compared with 132,000 boe/d in 1Q2017. All production shut that was down in the Ventura of Southern California due to wildfires last fall has now been brought back to full production. Capex for 1Q2018 was $139 million, drilling 44 wells, 30 of which were internally funded, Stevens said.

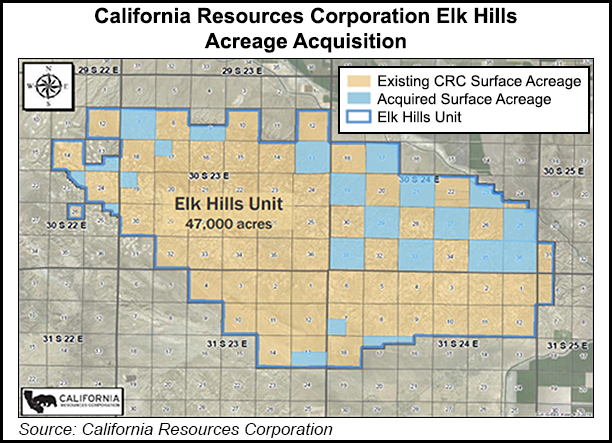

Stevens said he expects “a lot to change” in CRC operations as a result of the completion of the purchase of the full interest in Elk Hills from Chevron Corp. last month.

“The most important thing to understand is that the Elk Hills interests were extremely complex, and different zones and reservoirs in Elk Hills had different ownership interests, although we say they were all about 80%,” Stevens said. “It meant different ways to manage each reservoir, so there are things now that we are clearly freed up to do, and clearly capital spending is going to go up at Elk Hills, and it will allow us to reap all the benefits.”

Stevens said CRC will be shifting to take advantage of “mid-cycle pricing,” compared to high-cycle. “As we make this shift, we are focused on value and focusing more on long-term value creation,” Stevens said. “During the first half of this year, we will spend two-thirds of our facility budget for the year…to help us on the back half of the year, when we plan to focus more on conventional drilling and steam and water floods.”

Stevens said he expects CRC’s drilling program to pick up from the second quarter onward and to become more oily. Currently, production is 62% oil, but company reserves are in the low 70% range. The majority of the company’s gas production is associated with oil.

“If oil prices come down, however, our portfolio will look gasier,” he said. “Over time, I think you’ll see the percentage of oil move up because that is where our investment dollars are going.”

In 1Q2018, CRC reported a $2 million loss (minus 5 cents/share), compared to net income of $53 million ($1.23/share) for the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |