Natural Gas Futures Rally on Bullish EIA Storage Miss

A bullish miss in Thursday’s Energy Information Administration (EIA) storage report helped natural gas futures rally sharply following a stretch of narrow price moves earlier in the week. Day-ahead prices in the West weakened further as much of the spot market continued its recent shoulder season lull; the NGI National Spot Gas Average shaved off a penny to $2.31/MMBtu.

The June contract jumped 7.7 cents Thursday to settle at $2.814 after trading as high as $2.820. July settled at $2.828, up 6.8 cents on the day.

EIA on Thursday reported a weekly natural gas storage injection that came in on the low side of expectations, and futures picked up some bullish momentum on the news.

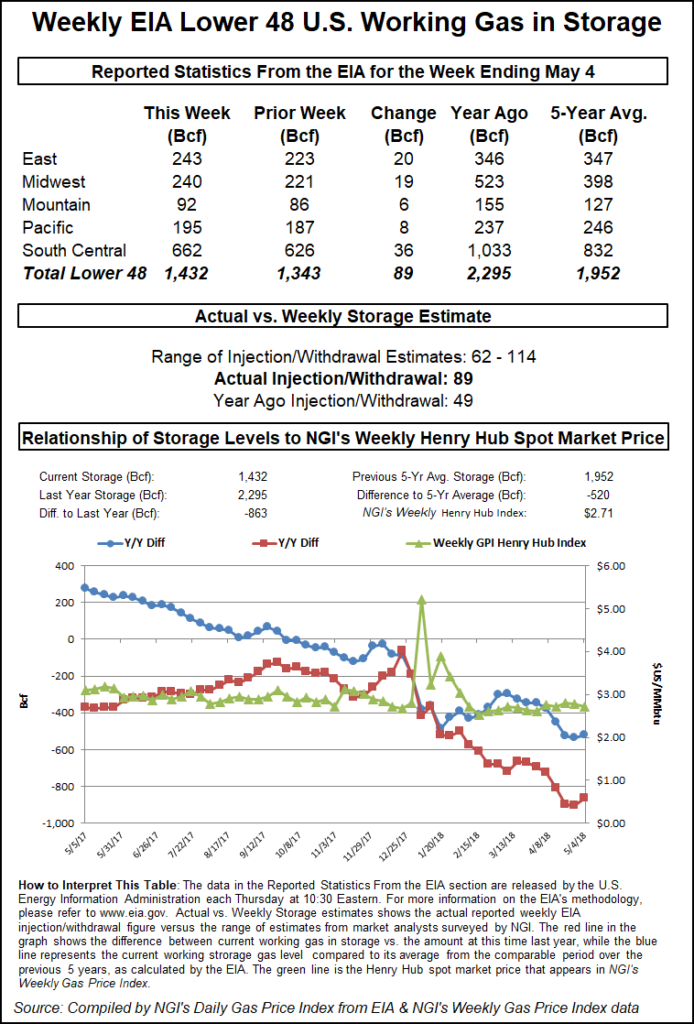

EIA reported an 89 Bcf injection into Lower 48 gas stocks for the week ending May 4, versus consensus estimates for a build in the low- to mid-90s. Last year, EIA recorded a 49 Bcf injection. The five-year average is a build of 75 Bcf.

Shortly after the 10:30 a.m. ET release of the final number, the June contract popped about 3 cents to trade above $2.785 after already gaining a few cents earlier in the session. By 11 a.m. ET, June was trading around $2.795, up about 5.8 cents from Wednesday’s settle.

Prior to Thursday’s report, consensus estimates had the market looking for an injection somewhat larger than the actual figure.

A Reuters survey of traders and analysts on average had predicted a 91 Bcf build, with responses ranging from 75 Bcf to 114 Bcf. A Bloomberg survey had produced a median 90 Bcf injection, with a range of 62 Bcf to 114 Bcf. IAF Advisors analyst Kyle Cooper had called for a 96 Bcf build, while Intercontinental Exchange EIA storage futures settled Wednesday at an injection of 94 Bcf.

Total working gas in underground storage ended the period at 1,432 Bcf, versus 2,295 Bcf a year ago and five-year average inventories of 1,952 Bcf. The year-on-year deficit shrank week/week from minus 903 Bcf to minus 863 Bcf, while the year-on-five-year deficit decreased slightly from minus 534 Bcf to minus 520 Bcf, EIA data show.

By region, the largest injection came in the South Central at 36 Bcf, including 14 Bcf injected into salt and 22 Bcf into nonsalt. The East saw a 20 Bcf build for the week, while 19 Bcf was injected in the Midwest. The Mountain and Pacific regions saw builds of 6 Bcf and 8 Bcf, respectively, according to EIA.

“Through the day we saw the prompt month contract lead us higher as EIA data showed less loosening last week than we had expected, seemingly justifying prices moving to the upper end of their current trading range,” Bespoke Weather Services said. “However, we are skeptical that prices are ready to break out of their current range in the short-term, with $2.82 resistance proving firm today and stronger resistance remaining above at $2.85-2.86.

“Today’s EIA print was rather supportive, but we still expect to see a decently larger injection next week, with sizable injections through the remainder of May,” the firm said. “Though short-term heat is impressive, in the medium-term the signal is significantly less so.”

Even after Thursday’s rally, bulls hoping for a breakout still have some work to do, technically speaking, according to NGI’s Patrick Rau, director of strategy & research.

“We are still very much in the range,” Rau said. “In order to break above the horizontal channel that has gripped June really since mid-February, the prompt contract must first rise and settle above its previous reactionary high of $2.844 from April 26, followed by the channel top of $2.873 reached March 13.”

Lower 48 temperatures are expected to warm up to well above normal levels next week, Genscape Inc. natural gas analyst Rick Margolin told clients Thursday.

Based on overnight model runs heading into Thursday, Genscape meteorologists were “calling for even warmer-than-previously expected cooling degree days (CDD) to start next week, with CDDs rising to a peak of 57.3 CDDs by Tuesday, then decreasing to about 30 CDDs by Friday,” Margolin said. “Even at that low point, CDDs are expected to be 90% hotter than normal for this time of year.

“The bulk of the CDD deviations from normal” are expected from the Electric Reliability Council of Texas (ERCOT), Southwest Power Pool (SPP), Midcontinent ISO-South (MISO-South) and the SERC and Florida, according to Margolin.

Looking at the midday weather data, “slightly stronger demand held for next week,” potentially shifting “weather sentiment from bearish more towards neutral,” according to NatGasWeather.com.

“It’s still a mostly comfortable pattern apart from being hot at times over the southern U.S., and slightly cool across the northern U.S.,” NatGasWeather said. “…With slightly stronger demand trends over the past day or two, the natural gas markets could be realizing production may not be able to cut into deficits as fast as they might have been expecting, especially when considering” Thursday’s EIA storage miss.

Going into Thursday’s trading, NatGasWeather’s team said it thought “the more time passed with bears failing to push prices lower, the more likely time would eventually run out as seasonal buyers gradually step in.” That could have accounted for Thursday’s “pre-EIA report move higher, then aided by the bullish miss.” The storage numbers showed “it’s going to take quite some time to reduce deficits back toward minus 400 Bcf, likely not until late June, assuming normal weather.”

Turning to the spot market, the volatile SoCal Citygate fell sharply in what was largely a tranquil day of shoulder season trading.

SoCal Citygate finished 25 cents lower Thursday to average $2.87. Southern California Gas (SoCalGas) was forecasting system demand to drop heading into the weekend, falling to just above 2 Bcf/d from around 2.2-2.3 Bcf/d mid-week. Receipts totaled slightly more than 2.4 Bcf/d Wednesday and were expected to remain at that level through the weekend, according to the utility.

In the California market, “gas demand is structurally contracting because of the growth of renewables alongside aggressive energy efficiency standards that hold load growth in check,” according to Genscape’s Margolin. This week “that trend gained further momentum with the California Energy Commission adopting a rule requiring all new homes built after Jan. 1, 2020 be equipped with solar.”

Citing information from the California Solar Association, Margolin said the rule could lead to 65,000 more residential solar additions per year in the state.

“According to the California Public Utilities Commission, there is presently about 4 GW of residential solar generation already installed in the state,” he said. “This is in addition to utility-scale, grid-tied solar. Grid-connected solar generation has been growing at an average annual rate of more than 9 GWh/d since 2012. First quarter 2018 solar generation is up 63% (21.4 GWh/d) from 1Q2017.”

Prices also fell across the Rockies and Arizona/Nevada Thursday. Kern River gave up 7 cents to $1.69, the lowest average there in almost two years. El Paso S. Mainline/N. Baja fell 7 cents to $1.87.

El Paso Natural Gas Co. LLC (EPNG) has filed at FERC to build its proposed South Mainline Expansion Project, which would increase capacity on the company’s Line Nos. 1100 and 1103 in Hudspeth and El Paso counties in Texas. It would increase contracted capacity by 321,000 Dth/d, allowing EPNG to meet demand for increased westbound capacity on its South Mainline system to serve markets in Texas, New Mexico, Arizona, California and Mexico.

In the Northeast, Transco Zone 6 New York tumbled 23 cents to average $2.46, erasing a 14-cent gain from the day before.

Genscape was calling for Appalachian demand — including New York and New Jersey — to decline into the weekend, with Saturday’s demand forecast to dip to 5.75 Bcf/d, versus a recent seven-day average of 9 Bcf/d.

“Weak weather systems will bring showers and cooling across the northern U.S. the next several days with highs mainly in the 50s and 60s, locally 70s over the Northeast,” NatGasWeather said in its one- to seven-day outlook Thursday. “It remains warm with 70s and 80s over the middle of the country, while hot over the Southwest with 90s and 100s. It’s also a touch hot over portions of the Southeast with highs of upper 80s to lower 90s.

“There will be cooling into the west-central U.S. this weekend, but still quite warm over most of the southern and east-central U.S. with 70s to lower 90s.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |