Natural Gas Futures Stable Ahead of EIA Storage Data; Mild Weather Limits Spot Price Moves

Natural gas futures traded near even Wednesday as the market opted to stay put ahead of the release of government storage data expected to show a ramp up in injections. Shoulder season weather continued to limit spot market action across most regions, though prices fell in constrained West Texas and across much of the West; the NGI National Spot Gas Average fell 3 cents to $2.32.

The June contract settled 0.5 cents higher at $2.737 Wednesday, never venturing beyond Tuesday’s range after trading as high as $2.759 and as low as $2.725. The July contract settled at $2.760, unchanged day/day.

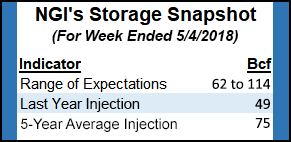

Estimates for Thursday’s Energy Information Administration (EIA) storage report show the market expecting a larger-than-average injection into Lower 48 gas stocks approaching triple digits for the week ending May 4.

A Reuters survey of traders and analysts on average predicted a 91 Bcf build, with responses ranging from 75 Bcf to 114 Bcf. A Bloomberg survey produced a median 90 Bcf injection, with a range of 62 Bcf to 114 Bcf.

IAF Advisors analyst Kyle Cooper called for a 96 Bcf build, while Intercontinental Exchange EIA storage futures settled Tuesday at an injection of 94 Bcf for the upcoming report.

Last year, EIA recorded a 49 Bcf injection for the period, and the five-year average for the week is a build of 75 Bcf, EIA data show.

Consensus estimates have whiffed on the past few EIA storage reports. Last week, EIA reported a 62 Bcf injection, about 10 Bcf looser versus expectations. The week before that, EIA reported an 18 Bcf April withdrawal that beat most estimates to the bullish side.

“As long as production remains high, if we start getting some triple digit injections over the next couple weeks, I think the market would come under some pressure,” Rafferty Commodities Group Vice President Steve Blair told NGI.

On the other hand, if recent above-normal temperatures continue it could translate into cooling demand later this month, presenting some upside risk, he said.

“At this point, I really don’t expect too much out of the market…if we start getting some really hot weather, that’ll change the dynamic pretty quickly,” Blair said. “But short of that, the market’s probably going to sit in this range.”

Meanwhile, the big news in the energy space this week came when President Trump on Tuesday announced that he would be withdrawing the United States from the Iran nuclear deal entered into by the Obama administration.

“Following the announcement, other signatories of the deal including Europe, Russia and Iran reiterated their support for the agreement as well as their desire to revisit it,” analysts with Goldman Sachs Commodities Research said Wednesday. “This support may not be sufficient however to offset the more hawkish U.S. stance and the likely high level of efficiency of unilateral U.S. secondary sanctions.”

“…Importantly, this does not imply that Iran supply losses will go unanswered, with Saudi Arabia already commenting that it would seek to mitigate production losses and” U.S. Strategic Petroleum Reserve “releases also possible,” the Goldman Sachs team said. “Nonetheless, such supply responses would still end up reducing limited levels of spare capacity in a market already in large deficit.”

Tuesday’s announcement, along with “rising geopolitical tension” in key producing nations including Saudi Arabia and Venezuela, adds risk of more production losses “in the face of depleted inventory buffers,” the analysts said. “This leaves risk for our summer $82.50/bbl Brent price forecast squarely skewed to the upside.”

Genscape Inc. natural gas analyst Rick Margolin noted that the news helped lift West Texas Intermediate crude prices above $70/bbl “for the first time since November 2015.”

And higher crude prices will lead to more associated gas from the U.S. onshore.

“These rallies in crude keep lifting our Spring Rock production forecasts” for natural gas, with forecasts this week showing a “year-on-year increase of more than 7.5 Bcf/d for the calendar strip,” Margolin said. “The crude rally’s impact on gas production resonates in liquids-rich plays” like the Permian Basin, Denver-Julesburg and Bakken Shale. “Even in areas like the Eagle Ford, which — just a few months ago — was priced to show declining gas production is now poised to add more than 0.3 Bcf/d year-on-year.”

EBW Analytics Group CEO Andy Weissman called the proposition of reinstating U.S. sanctions on Iran “a distressing development” for natural gas producers.

“Over the next 12-24 months, a large gap is likely to develop in global oil supplies, pushing global prices up sharply,” Weissman said. “To fill this gap, it will be necessary to grow U.S. production at a record rate. Due to infrastructure constraints, it is possible that the full impact of this rapid growth may not be apparent until Q3 or Q4 of next year.

“From that point forward, however, production of associated gas is likely to soar — potentially constraining natural gas prices for several years.”

Natural gas takeaway constraints impacting the Permian, DJ, Bakken and Western Canada, are currently serving as a limiting factor on production growth, according to Genscape’s Margolin.

“The Permian may get a small amount of relief from the recent announcement the Old Ocean and North Texas pipelines will be resurrected,” he said. For the additional 170 MMcf/d expected from Old Ocean this year to benefit Permian producers “work to expand the North Texas Pipeline will need to be done. Our infrastructure team is roughly estimating the expansion on North Texas could add about 150-200 MMcf/d out of the Permian by 4Q2018.”

In the spot market Wednesday, West Texas points fell as Genscape has recently reported on various maintenance events expected to restrict Permian outflows this week.

Waha dropped a dime to $1.74, while El Paso Permian shed 7 cents to $1.56.

“High pressure will dominate most of the country this week with very comfortable spring conditions where highs will reach the 70s to mid-80s,” NatGasWeather.com said in its one- to seven-day outlook Wednesday. “There will be exceptions to the hotter side over the Southwest and into Texas with 90s to 100s, while cooler across the north central U.S., where a weak weather system will bring showers and highs of 60s.

“A stronger weather system will track into the west-central U.S. this weekend but still with a mostly comfortable U.S. pattern elsewhere with highs mostly of 70s to lower 90s.”

Points throughout California and the Rockies sold off for the second straight day Wednesday.

Southern Border, PG&E fell 21 cents to $1.77, while Opal gave up 21 cents to $1.75. Bucking the trend was Northwest Sumas, which jumped 79 cents to average $1.55 after shedding 34 cents on Tuesday.

Planned maintenance on the Westcoast Pipeline could limit up to 160 MMcf/d of Canadian exports into the Pacific Northwest starting Thursday, according to Genscape analyst Joe Bernardi.

“Westcoast is performing maintenance at its Compressor Station 9 in southern British Columbia, which will require Huntingdon operating capacity to be reduced to around 1,200 MMcf/d” after averaging 1,368 MMcf/d over the past month, according to Bernardi.

In the Northeast, changes were mixed, with Transco Zone 6 New York climbing 14 cents to $2.69 as a number of New England points pulled back. Further upstream in Appalachia, Tetco M2 30 Receipt added 3 cents to $2.09, while Dominion South added 3 cents to $2.11.

Rover Pipeline LLC on Monday told FERC it’s ready to start up its Majorsville Lateral, the latest in a series of filings that show the operator nearing full service for the 3.25 Bcf/d, 713-mile Appalachian takeaway project.

The 23.9-mile, 24-inch Majorsville Lateral would add a tie-in running from Marshall County, WV, to an interconnect with Rover’s Clarington Lateral in Belmont County, OH. As part of its request, Rover also said it’s ready to start up its Majorsville Compressor Station and Majorsville Meter Station.

The latest request comes after Rover secured approval last week to start up its Market Segment, Vector Delivery Meter Station and Defiance Compressor Station. Prior to that, FERC OK’d the project’s Mainline Compressor Station 3 and part of its Mainline B for service. Rover has been waiting since February for FERC authorization to start up its Burgettstown Lateral extending into southwestern Pennsylvania.

Meanwhile, the West Virginia Department of Environmental Protection (WVDEP) last week lifted a cease and desist order issued in March that had halted Rover construction in Doddridge, Tyler and Wetzel counties, WV, according to a letter filed this week to the project docket. WVDEP had issued the order in response to what it said were improper erosion and sediment controls during construction of Rover’s Sherwood and CGT laterals [CP15-93].

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |