Regulatory | Mexico | NGI All News Access | NGI Mexico GPI

Draft Proposal to Complete Release Program for Pemex Natural Gas Contracts

Energy regulators have issued a draft proposal outlining the final phase of Mexico’s release program for the natural gas marketing portfolio of Petroleos Mexicanos (Pemex), the state-run former oil and gas monopoly.

The draft accord, issued Wednesday by the Comision Reguladora de Energia (CRE), also includes updated results from the program’s first phase, which took place last year. The draft was released for a 10-day public comment period.

As part of Mexico’s ongoing gas market liberalization, the CRE is applying asymmetrical regulations to break up Pemex’s dominant position in the marketing segment. The gas release program is intended to force the company’s downstream subsidiary, Pemex Transformacion Industrial (Pemex TRI), to relinquish up to 70% of its 3.56 Bcf/d marketing portfolio before the end of next year.

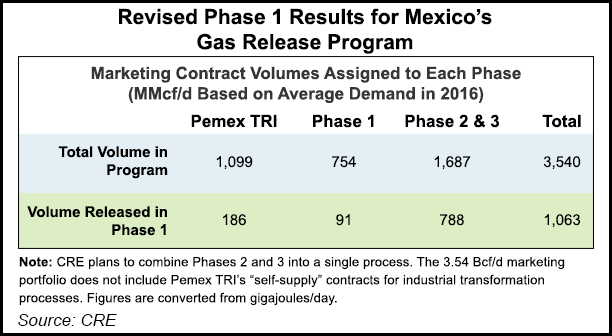

The revised results show that Pemex TRI ceded 30% of that portfolio last year, or about 1 Bcf/d of demand. The final results are a couple of percentage points lower than the originally reported figure of 32.2%, but still well above the CRE’s Phase 1 goal of 20%.

The regulator has decided to fold the remaining Pemex contracts into one final process, instead of two separate phases as originally planned. This last phase involves a total marketing volume of 890 MMcf/d, or about one-quarter of Pemex TRI’s original portfolio.

However, other clients may also end migrating to new suppliers in the process, according to CRE’s Graciela Rojo Chavez, general director for natural gas regulations.

“The release program is like a shop window where we display certain contracts with certain characteristics, but the process is not limited to any specific moment in time,” Rojo told NGI’s Mexico GPI. “At any time in the program, consumers may make the decision to leave Pemex and sign a contract with another marketer.”

Early last year, the CRE randomly selected 31% of Pemex TRI’s clients to remain with the state company, 21.3% for Phase 1 and 47.7% for later phases. Small consumers were packaged together based on their location on Mexico’s main gas transmission network, the Sistrangas, which includes the national pipeline system that was formerly in the hands of Pemex.

Pemex TRI then issued and published binding offers for each contract or package of consumers selected for Phase 1.

Third-party marketers could then to present counter-offers that were, at a minimum, on par with the base conditions offered by Pemex TRI. They could also approach other clients no included in that first group of contracts.

Few of the clients in the Phase 1 group ended up migrating — only 91 MMcf/d of a total 754 MMcf/d. Another 186 MMcf/d of the clients selected to remain with Pemex also signed contracts with new marketers, but the majority of the migrations came from the final group of 47.7%.

The contracts on offer in the next stage of the release program are from that same final group. They are broadly representative of the current makeup of Mexico’s gas market.

“Their characteristics reflect the market’s structure,” a CRE spokesperson told NGI’s Mexico GPI last month. “The remaining contracts for release consist of, in order of importance, power sector users, industrial consumers, and distribution companies. Geographically, the main volumes up for release are located in the Gulf, Central and West” tariff zones on the Sistrangas system.

The final stage is to follow the same procedure as last year, with binding offers from Pemex and counteroffers from other marketers.

Customers that have reserved capacity on the Sistrangas network may temporarily transfer those rights to a marketer if they wish to contract supply from a third-party, according to draft document. “When a contract holder does not hold any capacity rights on the Sistrangas, marketers may offer all the necessary services to deliver the marketable gas” in the contract.

The entire final stage is expected to take around 100 business days, based on the timelines set out in the document.

The process would get underway when the CRE published the final version of the accord in the Diario Oficial, Mexico’s equivalent of the Federal Register. When that occurs, Pemex would have 10 business days to make the binding offers to its customers.

Once those offers are received, the clients would have 60 business days to evaluate and receive offers from other marketers. As before, they may also opt to remain with the state company.

“Ninety business days after the binding offers” are issued by Pemex TRI, “the final phase of the gas contract release program will come to an end, and its goals will be completed,” according to the draft document. That would also mark the end of the asymmetrical regulation of Pemex.

The final results of the release program may not reach the 70% target, given that the regulator intends to respect gas consumers’ freedom to choose a marketer of their preference.

“In effect, it’s not necessary that we reach the 70% volume figure since what we established in the regulations is that Pemex only has to make those contracts available to third parties,” Rojo said. “For example, the company made 21% of its portfolio available to the market in Phase 1, but many clients decided to remain because they have the contractual freedom to do so.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 |