EIA Storage Injection Tops Estimates; Natural Gas Futures Slide

Natural gas futures fell for the second straight day Thursday, with a bearish miss from Energy Information Administration (EIA) storage data failing to provide support for a well-supplied market anticipating much larger injections in the weeks to come.

Spot market action featured generally modest shoulder season declines in most regions; the NGI National Spot Gas Average dropped 6 cents to $2.30.

The June contract settled at $2.726 Thursday, down 2.8 cents, after venturing as low as $2.700. July settled 3.2 cents lower at $2.759.

“We finally got the test of $2.70-2.72 we expected this week as weather-adjusted balance data through the week has remained quite loose, short-term weather forecasts are unimpressive and Thursday’s EIA print showed a significantly looser market than last week’s,” Bespoke Weather Services said.

“…At this stage, we struggle to see prices move above the $2.75 level heading into the weekend, even though we see risks for warmer forecast trends in the long-range.”

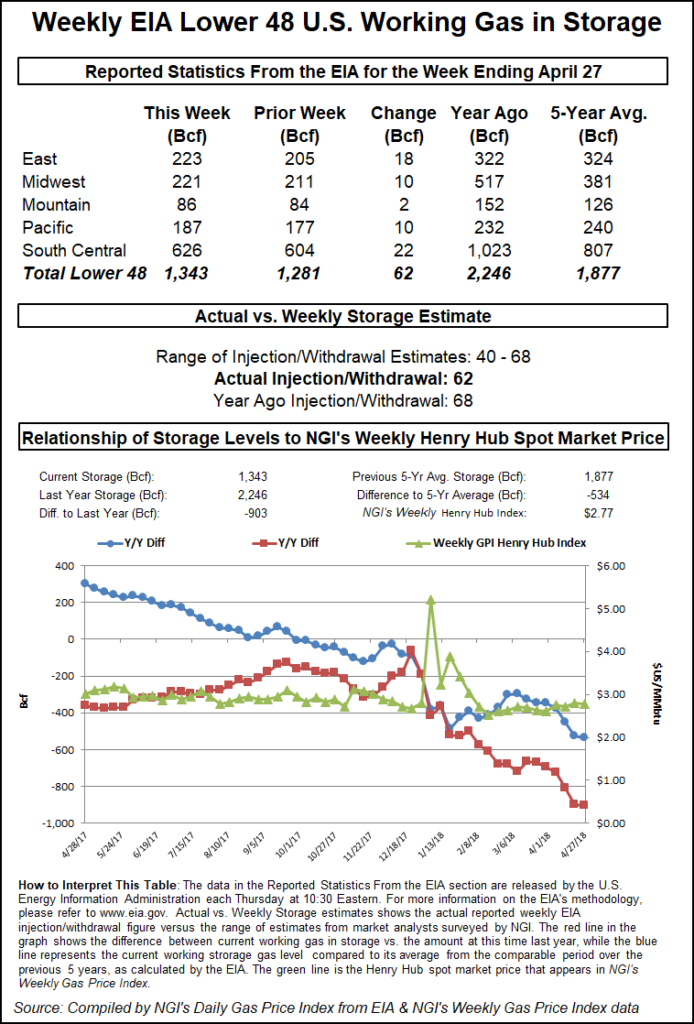

EIA ushered in the start of injection season Thursday with a reported 62 Bcf build into Lower 48 gas stocks for the week ending April 27, about 10 Bcf looser versus surveys that had anticipated a build of around 51-52 Bcf. Last year, EIA recorded a 68 Bcf injection for the period, and the five-year average is 69 Bcf.

Shortly after the 10:30 a.m. ET release of the number, the June contract — already down after selling earlier in the morning — dropped about 2 cents to around $2.700-2.710. By 11 a.m. ET, June was trading around $2.705, down about a nickel from Wednesday’s settle.

Prior to the release of the final number, a Reuters survey of traders and analysts on average had called for EIA to report a 52 Bcf injection, with responses ranging from 40 Bcf to 68 Bcf. A Bloomberg survey had produced a median build of 51 Bcf, with a range of 40 Bcf to 62 Bcf.

IAF Advisors analyst Kyle Cooper had predicted a 53 Bcf injection, while Genscape Inc. had called for a 55 Bcf injection. Intercontinental Exchange EIA storage futures settled Wednesday at an injection of 55 Bcf for the upcoming report.

The larger-than-expected injection came after a string of consecutive bullish misses — withdrawals driven by colder-than-normal April weather.

“We see this print as slightly bearish; EIA data the last couple of weeks ran decently tight to expectations, while this more bearish print confirms that was overdone,” Bespoke said. “We now set up to see a trio of very large storage injections, with multiple triple-digit injections expected into the final third of May. This could put $2.65 in play with tightness concerns waning, though late May heat will add support.”

Total working gas in underground storage stood at 1,343 Bcf as of April 27, versus 2,246 Bcf last year and a five-year average inventory of 1,877 Bcf. The year-on-year deficit increased slightly week/week from 897 Bcf to 903 Bcf, while the year-on-five-year deficit widened from 527 Bcf to 534 Bcf, EIA data show.

By region, the largest build came in the South Central at 22 Bcf, with EIA reporting 8 Bcf injected into salt and 15 Bcf injected into nonsalt. The East region saw a build of 18 Bcf for the week, while 10 Bcf was injected in both the Midwest and Pacific regions. The Mountain region saw a 2 Bcf build for the week, according to EIA.

In note released prior to the EIA data, analysts with Morningstar Commodities Research pointed out the lack of upward momentum for prices despite below-average inventories. Looking at inventories as of April 20, “the last time storage levels came in below 1,281 Bcf in week 16 was in 2014, when working gas in storage was 899 bcf,” said analysts Matthew Hong and Dan Grunwald.

“Spot month gas prices in April 2014 traded significantly higher at between $4.28 and $4.83. This compares with a range between $2.66 and $2.82 this April.”

Hong and Grunwald noted higher production this year, with 80.8 Bcf/d modeled dry production for April on the one hand, and on the other, potential growth from liquefied natural gas (LNG) exports that could soak up some of this supply if U.S. projects can enter service in time to take advantage.

“The challenge for U.S. producers and exporters will rest on the nation’s ability to ramp up projects in tandem with export demand growth, and the ability for those domestic projects to be competitive with the slew of projects expected across the globe,” the analysts said. “…Only time will tell if the current slate of U.S. projects will be available to meet demand, or if the nation will be late to the party, exacerbating what may be an already oversupplied domestic market.”

Such bearish price action coming despite what would typically be a bullish storage picture signals “a structural shift in the market,” Hong and Grunwald said. “In the absence of a significant change in demand, which could come from the export market, the normal demand levels are insufficient for keeping pace with current production.

“The market not only appears comfortable with current storage levels, but also appears to be sending signals that the market will remain oversupplied for some time.”

In the spot market, day-ahead prices at Henry Hub followed the futures lower Thursday, dropping 4 cents to $2.69.

In its latest forecast Thursday, NatGasWeather.com said, “Pleasant highs of 70s and 80s will dominate the southern and eastern U.S. into the weekend, resulting in very light demand. There will still be areas of showers and thunderstorms focused over the Plains and portions of the northern U.S., but with only limited cool air.

“There’s expected to be brief cooling across the Great Lakes and Northeast Sunday and Monday but only for a slight increase in demand,” the firm said. “We continue to expect the second and third weeks of May to play out exceptionally comfortable across most of the country with widespread highs of 70s and 80s. The exception will be the hotter Southwest with 90s to 100s, occasionally extending into Texas.”

Radiant Solutions was calling for hot temperatures along the Interstate 95 corridor Thursday — roughly 20 degrees above normal in cities including New York and Washington, DC, with highs in the 80s and low-90s — to remain hot Friday before moderating into the weekend.

Spot prices along the East Coast eased Thursday, with Algonquin Citygate shedding 18 cents to $2.44 and Transco Zone 6 New York dropping 7 cents to $2.69. Further south, Transco Zone 5 dropped 3 cents to $2.79.

In California, SoCal Citygate gave up a significant chunk of gains from an early-week price spike, dropping 59 cents to $3.03, still roughly a $1 premium to most other points in the region.

The import-constrained Southern California Gas Co. reported actual system demand Wednesday of 2.661 million Dth/d, exceeding receipts of 2.494 million Dth/d. Estimated demand Thursday of 2.519 million Dth/d was expected to fall gradually to just above 2.1 million Dth/d by the weekend.

Elsewhere in the region, SoCal Border Average shed 5 cents to $1.95.

Further upstream in West Texas, prices were mixed. Genscape has reported a number of maintenance-related restrictions impacting flows out of the Permian Basin this week, including a restriction through El Paso Natural Gas Co.’s L2000 meter that was scheduled to be lifted Thursday.

El Paso Permian gained 23 cents Thursday to $1.68, trimming what had been a nearly 25-cent discount to the regional average on Wednesday. Waha fell 3 cents to $1.79.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |