April Cold a Boon to Weekly NatGas Cash in Midwest, Northeast; Futures See-Saw

The cold April weather that has supported natural gas demand and prolonged the withdrawal season continued during the week ended Friday, helping to lift spot prices across most regions and especially in the Midwest and Northeast; the NGI Weekly Spot Gas Average added 18 cents to $2.79/MMBtu.

Some parts of the northern United States even saw some spring snow during the week, and that was enough to put points in the Midwest on the ascent. Chicago Citygate surged 52 cents on the week to $3.15, while Northern Border Ventura added 55 cents to $3.10.

The Northeast saw its share of chilly temperatures during the week, helping the volatile Algonquin Citygate accumulate 73 cents to average $5.96, while Iroquois Waddington tacked on $1.22 to $4.19.

In the West, SoCal Citygate dropped 47 cents to average $3.08 on the week. The point fell throughout the week amid generally moderate demand for utility Southern California Gas Co.

Further upstream, West Texas points continued to come under pressure as Permian Basin production runs up against limited takeaway capacity for both associated gas and crude. And strengthening crude prices during the week raised the prospect of even more growth to come, according to analysts. El Paso Permian fell 9 cents to $1.53, while Waha dropped 21 cents to $1.76.

Natural gas futures reversed course Friday to completely erase Thursday’s sharp selloff, with storage deficits and a slow start to injection season helping the bulls make their case. The May contract rallied 7.9 cents to settle at $2.739 in a perfect mirror of the previous day’s 7.9-cent decline. After all the up-and-down action, May finished close to even week/week after settling at $2.735 the Friday before.

Despite more accelerated moves Thursday and Friday, natural gas couldn’t break out of the recent range of roughly $2.55-2.80 that has held for weeks, Powerhouse President Elaine Levin told NGI.

“If I take a look at the 20-day moving average…the mean’s been about $2.70 and we have not really been able to pull excitingly away from that since the big decline we had in February,” Levin said. “The market just seems very comfortable where it is. Perhaps the fact that we’re still withdrawing has held the support level, but the production potential is keeping us from breaking the resistance.”

Bespoke Weather Services said the driving factor behind Friday’s rally, while not immediately clear, appeared to be the tighter-than-expected storage data from the day before.

Thursday’s Energy Information Administration (EIA) “storage print was quite bullish, and this is now the second week in a row where we have seemed to have a one day delay in the reaction to a bullish EIA miss,” Bespoke said. “Heading into the weekend then we note that confidence is a bit lower than average; cash prices have remained the primary bullish catalyst for natural gas prices and those are expected to ease through next week.”

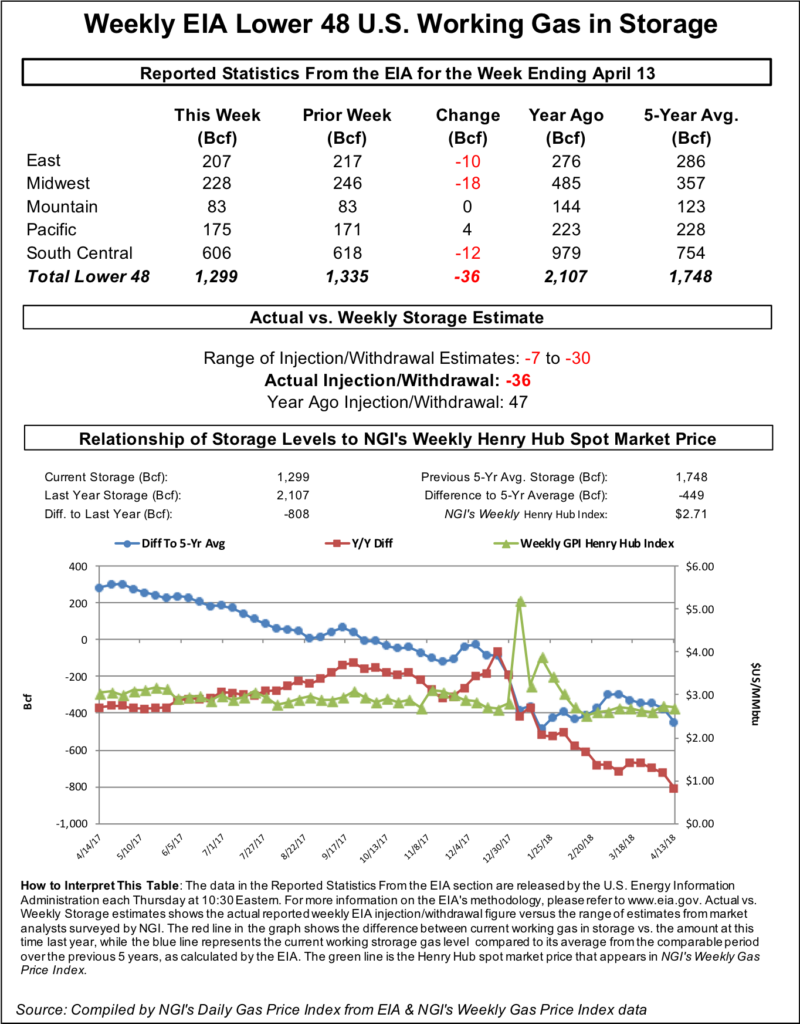

EIA reported a 36 Bcf withdrawal from Lower 48 gas stocks for the week ending April 13, an unusual pull from inventories during injection season thanks to uncharacteristically cold weather during the period. Last year, 47 Bcf was injected, and the five-year average is a build of 38 Bcf.

Prior to the report, the market had been looking for a withdrawal about 10 Bcf looser than the actual figure. A Reuters survey of traders and analysts had on average predicted a 23 Bcf withdrawal for the week, with responses ranging from minus 7 Bcf to minus 30 Bcf. A Bloomberg survey had produced a median withdrawal of 26 Bcf, with responses ranging from minus 11 Bcf to minus 30 Bcf.

OPIS By IHS Markit had called for EIA to report a 24 Bcf withdrawal for the period. IAF Advisors analyst Kyle Cooper had predicted a 27 Bcf withdrawal, while Intercontinental Exchange EIA storage futures settled Wednesday at a withdrawal of 26 Bcf. Bespoke Weather Services had called for a 23 Bcf pull and viewed the actual figure as “quite bullish.”

“This is the second consecutive bullish miss to our estimate, though this one was quite larger,” Bespoke said. “Shoulder season data is notoriously noisy, but this data does confirm that in the short-term the natural gas market is not quite as loose as some other data may have indicated.”

The price reaction immediately following the report was “muted, however, as expectations of further production coming online have smothered the impacts of shoulder season demand tightening,” the firm said. “Prices already tested our $2.65-2.68 range and may not have much interest in retesting after a bullish print.”

Total working gas in underground storage stood at 1,299 Bcf as of April 13, versus 2,107 Bcf last year and five-year average inventories of 1,748 Bcf. The year-on-year deficit widened week/week from 725 Bcf to 808 Bcf, while the year-on-five-year deficit increased from 375 Bcf to 449 Bcf, EIA data show.

By region, the Midwest saw the largest net withdrawal for the week at 18 Bcf, while 10 Bcf was pulled in the East. The Mountain region finished flat week/week, while 4 Bcf was injected in the Pacific. The South Central saw 12 Bcf pulled from storage for the week, including 11 Bcf from salt and 1 Bcf from nonsalt.

“Some natural gas storage operators have reported net withdrawals from base gas, beginning with the week ending April 6,” EIA noted in this week’s report. “The cumulative net withdrawals of base gas were treated as negative working gas stocks and are reflected in the working gas inventories. As a result, a small portion of this week’s reported net change includes flows from base gas.”

On a weather-adjusted basis the gas market “returned to less than 1 Bcf undersupplied, ending a two-week trend of oversupply,” analysts with Tudor, Pickering, Holt & Co. (TPH) said Friday. “Counter-seasonal draws are expected to continue one more week, with preliminary estimates around 12 heating degree days above five-year averages,” implying undersupply of more than 2 Bcf/d.

“Long-term, however, expect temperatures to be warmer as we transition into injection season,” the TPH analysts said. “Mexican exports remain below January/February levels” presenting “a red flag for those betting on Mexican demand to bail out the Permian.” Meanwhile, liquefied natural gas exports are “ramping, though somewhat volatile,” as Dominion Energy’s Cove Point export project “moves toward sustained operations.”

The EIA storage withdraw “was driven by the lingering cold, generating total degree days 47 greater than the five-year average, and marks the latest a withdraw has been reported since at least 2010,” Genscape Inc. analyst Eric Fell said Friday. “Power demand was much stronger this week versus the prior two weeks. That was not reflected in pipeline nomination data, but was apparent with our power plant monitors and” independent system operator “data. Also, net exports were stronger this week versus the prior two weeks.”

Despite the bullish report, forward initially on Thursday “went the other way on what we assume is related” to a delay for the liquefied natural gas (LNG) export project, Freeport LNG, according to Fell. The terminal’s delay in starting up could reduce LNG exports by an average of 600 MMcf/d for the upcoming winter and by 1.3 Bcf/d in the summer of 2019.

After the recent cold weather across the Midwest and Northeast, Societe Generale analyst Breanne Dougherty said she expects “the net storage injection pace this month to be under 2 Bcf/d. This is the lowest level in our history set — very low compared to the five-year average of 7 Bcf/d.”

According to Dougherty, Societe Generale expects 3Q2018 prices to average $3.00, with 1Q2019 presenting a potential “buy opportunity at the moment given our expectation that if bullish sentiment is to make its way into the market this summer, there will be a significant number of participants” flocking to those contracts, which could drive up prices “even if only for a few months time.”

Societe Generale’s forecast for end-of-October inventories has been coming in around 3.55-3.65 Tcf, versus 3.78 Tcf last year, she said.

On the supply side, the U.S. rig count continued to climb for the week ended Friday, adding five units thanks to oil drilling gains focused in the Permian Basin, according to data from oilfield services (OFS) giant Baker Hughes Inc.

The upward trajectory in the U.S. oil rig count comes as crude prices have been on the rise. The May Nymex West Texas Intermediate (WTI) contract settled 9 cents higher at $68.38/bbl Friday.

The recent strengthening in crude prices puts more downward pressure on gas forwards given the prospect for associated gas growth, according to Genscape analyst Rick Margolin.

The crude oil prompt month settlement at $68.29/bbl Thursday at the time marked “its highest level since November 2014,” Margolin said in a note to clients Friday.

“The rally is being driven by a variety of news and data points, including (but not limited to): a reported drawdown in U.S. storage inventories bringing levels below five-year averages, strong refinery and export demand, worries about geopolitical issues including strikes on Syria potentially pulling oil producing Russia and Iran into the mix, and reports this week that” the Organization of Petroleum Exporting Countries (OPEC) “has been very successful hitting its targets for production cuts.”

The near-term nature of a lot of these issues has made the curve “notably inverted through late 2023,” but “most longer-dated forwards have also risen and WTI futures never drop below the $50/bbl mark through 2026,” he said. Genscape’s breakeven analysis indicate producers in gassy, oil-focused plays would be “well in the money at or above $50/bbl, which is more or less confirmed” by analysis of hedging activity.

The strong crude oil prices are driving increases in the latest updates to Genscape’s Spring Rock gas production forecast. For the week ending April 13, “a $1.07/bbl gain in the 2019 crude price helped drive a 0.35 Bcf/d increase in the gas production forecast,” Margolin said. “And the latest $3-plus gain in crude looks to contribute to the addition of nearly 0.7 Bcf/d to our summer 2019 gas production forecast.”

In the spot market Friday, forecasts for moderating temperatures by Monday in key Midwest and East Coast markets curbed interest in three-day deals; the NGI National Spot Gas Average fell 19 cents to $2.42/MMBtu.

In its one- to seven-day outlook Friday, NatGasWeather called for to temperatures to “remain chilly with lows of 20s to 40s across the northern U.S., aided by a weather system with rain and snow tracking out of the Northeast, resulting in stronger than normal national demand.

“Temperatures will warm across the southern U.S. into the 70s and 80s, although cooling slightly late this weekend into early next week as a weather system brings showers,” the firm said. “Next week will bring a mix of mild and cool periods as weather systems track across the country every few days, averaging out to near seasonal national demand.”

Radiant Solutions was calling for temperatures in Chicago to remain colder than average over the weekend, with highs in the 50s and lows in the upper 30s, before warming to near normal by Monday. Further east, Radiant was calling for cooler-than-normal conditions to continue through the weekend in cities including New York and Boston, but milder versus Friday’s temperatures.

Meanwhile, Genscape’s forecasts Friday showed demand for the weekend and Monday coming in well below recent seven-day averages in the Midwest, New England, Appalachia and Southeast/Mid-Atlantic regions.

In the Midwest, Chicago Citygate fell 17 cents to $2.54, while in the Northeast, Algonquin Citygate tumbled $1.85 to $3.03. Further upstream, Dominion South shed 11 cents to $2.44 as Millennium East Pool tumbled 23 cents to $1.78.

In the West, SoCal Border Average gave up 13 cents to $1.87. Meanwhile, SoCal Citygate dropped 61 cents to average $2.25, ending a roughly two-week stretch of premium-pricing there amid ongoing import-constraints for Southern California Gas Co. (SoCalGas).

SoCalGas was forecasting weekend demand on its system to hover around 2 Bcf/d before climbing to around 2.3 Bcf/d Monday. That’s versus demand of close to 2.6 Bcf/d on Thursday, according to the utility. SoCalGas was forecasting system receipts of a little over 2.5 Bcf/d over the next several days.

Further upstream, points in the Rockies generally dropped by a dime or more, while West Texas prices were mixed. El Paso Permian dropped 5 cents to $1.52, while Waha gained 5 cents to $1.70.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |