Markets | E&P | LNG | NGI All News Access | NGI The Weekly Gas Market Report

For First Time Since 1958, U.S. Became Net Natural Gas Exporter Last Year, FERC Says

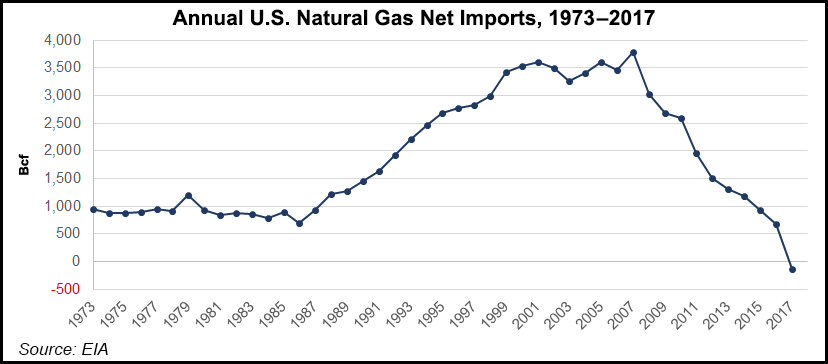

The United States became a net exporter of natural gas in 2017 for the first time since 1958, as increasing shipments of liquefied natural gas (LNG) to world markets and pipeline deliveries to Mexico exceeded imports, according to FERC.

“LNG exports more than tripled from 2016, making LNG the fastest-growing demand sector in 2017, as two additional trains at Cheniere’s Sabine Pass LNG in Louisiana came online,” according to the Federal Energy Regulatory Commission’s annual State of The Markets Report, which was issued Thursday. “Construction is currently underway at four other terminals on the Gulf Coast and Atlantic Seaboard, as well as a one-train expansion at Sabine Pass, wit most of that capacity expected to be online by 2020.

And more domestic natural gas will be in demand at LNG facilities this year, according to Adam Bennett of FERC’s Office of Enforcement.

“We see two projects coming on line this year — the Cove Point facility, which has already completed commissioning and went into commercial service earlier this year, as well as the Elba Island facility in Georgia. Together they add about 1 Bcf/d of new demand. That’s not going to triple the number like we saw in 2017, but it will add to gas demand.”

One recent study concluded that the cumulative economic benefits through 2050 from U.S. LNG exports could be as much as $3.26 trillion.

Natural gas trade with Mexico also grew in 2017, according to FERC’s report.

“Mexico was the most common destination for U.S.-sourced LNG shipments, with 40 cargoes totaling nearly 137 Bcf delivered to its regasification terminals. Pipeline exports to Mexico have steadily increased since 2010 and total exports to Mexico increased by about 0.5 Bcf/d from 2016, topping 4.2 Bcf/d on average in 2017 and setting a new single-day high of 4.5 Bcf/d in August.” Exports to Mexico were spurred by the opening of Energy Transfer Partners‘ Comanche Trail and Trans-Pecos pipelines in early 2017, which added a combined 2.4 Bcf/d of capacity in west Texas, FERC said.

U.S. natural gas spot prices last year increased 21% compared with 2016, but Henry Hub prices remained 7% below the previous five-year average and 33% below the 10-year average. Cold weather and high winter heating load at both the beginning and end of 2017 contributed to a 28% price increase in the East, and prices in the Marcellus Shale region jumped 19% as new pipeline capacity allowed producers to meet a larger share of demand in previously inaccessible market areas, according to the report. Pipeline and storage limitations in Southern California continued to constrain the Los Angeles market area and prices there increased 18% compared with 2016.

Nearly 12 Bcf/d and 773 miles of FERC-jurisdictional gas pipeline capacity entered service in 2017.

“Many of the new projects connect Marcellus and Utica shale natural gas fields to markets in the Midwest and Northeast regions,” FERC said. “However, only 20 miles of new pipeline and 0.3 Bcf/d of capacity was built in New England.”

Natural gas production was mostly flat in the first half of 2017 but rebounded in the second half, increasing 1% overall for the year. The largest production growth came in the Marcellus and Utica shale plays, which saw a 2.18 Bcf/d increase compared with 2016. In Texas, the Permian Basin saw a 1.38 Bcf/d production increase.

Overall U.S. demand for gas in 2017 was down slightly from 2016 levels, FERC said. Natural gas used for power generation fell 6% as cooling degree days in 2017 fell 3.5%, residential/commercial demand was flat, and industrial demand increased 1%. The largest demand increase came from LNG exports.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |