E&P | NGI All News Access | NGI The Weekly Gas Market Report

Sparse Sand, Pressure Pumping to See Relief as Capacity Additions Readied

Pressure pumping horsepower and sand supply used in unconventional drilling are tight in some regions of the United States, especially in the Permian Basin, but significant additions are expected in the second half of the year.

The domestic pressure pumping market should see more than 2 million hp in net additions, with several refurbished units returning to the workforce, according to Rystad Energy.

“By the end of 2018, we project that pumping horsepower will exceed 23 million hp, from which the net new additions are expected to be more than 2 million hp,” said analysts.

Capacity is expected to be “particularly tight” in the Permian until the end of June before most of the equipment comes online in the latter half of the year. More than half of the total U.S. pumping capacity by year’s end is expected to be in the Permian.

In addition to newbuilds, Rystad expects cold-stacked equipment to be reactivated, “including equipment that may have been written off as attrited. Equipment manufacturers are focusing some capacity on refurbishing pumps cannibalized during the downturn.”

Rystad’s team discussed the tight onshore equipment market with operators.

“We have actually delayed our expansion plans this year just because we couldn’t get the new fleets delivered fast enough,” said one pressure pumping sales manager.

Another said replacement parts “are getting harder and harder to find. Companies just won’t keep large inventories like they used to; they don’t want to get burned again.”

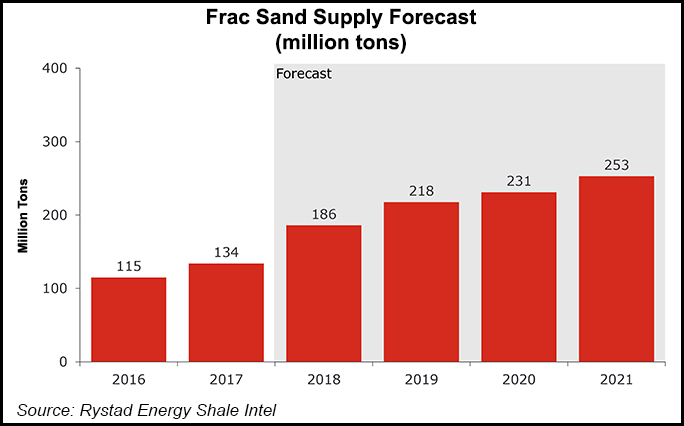

Rystad also expects 52 million tons of new fracture sand supply to hit the market in 2018 with a significant portion to come online before the second half of the year.

“In addition, we expect the majority of the 2018 additions to be concentrated in-basin in the Permian and foresee the local sand to be prominent in other basins in the next few years.”

As the industry awaits the supply increase, there are bottlenecks in the sand supply chain for a number of reasons, Rystad noted. For example, trucking continues to be a major bottleneck.

“Our primary intelligence results…also confirm that conclusion,” analysts said.

“It’s not just the quality of roads anymore, it’s the number of roads,” an oilfield services company executive told Rystad. “I just don’t think there are enough roads to service this kind of demand without traffic jams of semis all over the Permian.”

Tudor, Pickering, Holt & Co. Inc. (TPH) earlier this month updated its estimate for U.S. sand demand in 2018 and 2019. Analysts estimated about 112 million tons of sand would be used this year, with 133 million tons in 2019. Analysts agree with Rystad that the primary destination is the Permian.

“With 45 million tons of estimated Permian fracture sand demand in 2018 and 40 million tons of supply expected to come online throughout the year…we continue to see a substantial call on Northern White and other regional sand into the Permian,” said the TPH team. “The same goes for 2019, given the mesh-size supply/demand mismatch.”

Northern white sand demand is forecast to be 60 million tons/year-plus in both 2018 and 2019, versus 2014 demand of around 54 million tons.

“We realize this argument will fall on deaf ears given the specter of a self-supplied Permian Basin alongside the reality that more regional sand will likely emerge in other plays,” including the Eagle Ford and Haynesville shales, the Midcontinent and Denver-Julesburg Basin, the TPH team said.

TPH’s supply/demand model also suggested fracture tightness persisting through the rest of this year, “but continued spread additions from pressure pumpers threaten our conviction.”

Exploration and production companies ramped up completions activity late last year. While there were some disruptions, they should prove transitory, with a ramp up in onshore well completions extending beyond the second quarter, according to TPH.

The recent disruptions because of weather created some slack in the supply/demand system for completions “as spot crews were suddenly in search of work at the same time as new hydraulic horsepower (hhp) entered the market, thus spot fracture prices converged with dedicated fleet rates.”

However, completions should continue to increase for the rest of the year.

TPH noted that its 2018 hhp addition estimates, which are reactivations plus newbuilds, should climb to 5.1 million hhp from 4.6 million hhp a year ago based on a “pumper-by-pumper deep-dive…but demand remains quite robust and should reach 19-21 million hhp in 4Q2018,” or a gain of 4-6 million hhp versus 4Q2017.

Even if there is enough sand and enough pressure pumping, is the labor pool adequate in the Permian? Energent Group’s Todd Bush, vice president of commercial North American research, doesn’t think so.

“Companies of all sizes are finding it difficult to find and hire qualified people,” he said. “Qualified personnel are in scarce supply in the Permian. Experienced personnel are key to the last-mile logistics, which involves storing, trucking, and delivering frac sand from rail, transload, or mine to the well or pad site.”

Last-mile logistics accounts for 35-50% of the cost to deliver fracture sand, depending on the origin of the sand and the location of the well site, Bush said. For example, a four-well pad in the Permian’s Delaware sub-basin might use 35,000 tons of sand, which would require thousands of truckloads of sand to the wellsite.

There also is a huge demand for experienced drivers with commercial driver’s licenses. To operate a 24-hour/day, seven-day-a-week operation, trucking companies need two to three experienced drivers for each tractor trailer, Bush noted.

Logistics companies plan to hire more people and “incentivize employees for efficient driving,” allowing prices for delivering sand to be raised to retain drivers.

“Oil prices of above $60/bbl will continue to create demand for last-mile logistics, especially in sand hauling and fracture sand storage,” Bush said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |